How to Buy Your First Home in Maryland

- Justin McCurdy

- Sep 15, 2025

- 16 min read

Buying your first home is a huge milestone, and it all starts with getting your financial house in order. We’re talking about three main things: saving for a down payment, getting a handle on your debt-to-income ratio, and making sure your credit score is looking sharp. Nail these, and you'll turn that dream of owning a home into a reality.

Building Your Financial Foundation

Before you even start scrolling through listings in beautiful Maryland communities like White Marsh or Edgewood, we need to talk money. This isn’t just about number-crunching; it’s about building the confidence you need for what is likely the biggest purchase of your life. Trust me, a solid financial foundation makes the whole process so much smoother.

It’s interesting to see how things have changed. The median age for first-time home buyers has jumped to 38, a big leap from just 30 a decade ago. This is mostly due to things like rising home prices making it tougher to save up. But with a good plan, you can get ahead of the curve. You can see some cool data on this trend over at Visual Capitalist.

Understanding Your Debt-to-Income Ratio

Okay, let's get into the nitty-gritty. One of the very first things a lender will look at is your debt-to-income (DTI) ratio. It’s just a fancy way of comparing how much you owe each month to how much you make. Lenders use it to see if you can comfortably handle a mortgage payment on top of your other bills.

Let’s use a real-world example. Say your gross monthly income is $6,000. Your monthly debts are a $400 car payment and $300 in student loans, which adds up to $700. To get your DTI, you just divide your total monthly debt ($700) by your gross income ($6,000).

$700 (Total Debts) ÷ $6,000 (Gross Income) = 0.116

That gives you a DTI of about 12%. Since most lenders want to see a DTI below 43%, you're in an amazing position in this scenario. If your DTI is a little high, no sweat—now you know to focus on paying down some debt before you apply for a loan. If you're curious how these numbers translate into a home price, we've got you covered in our guide on how much house you can actually afford.

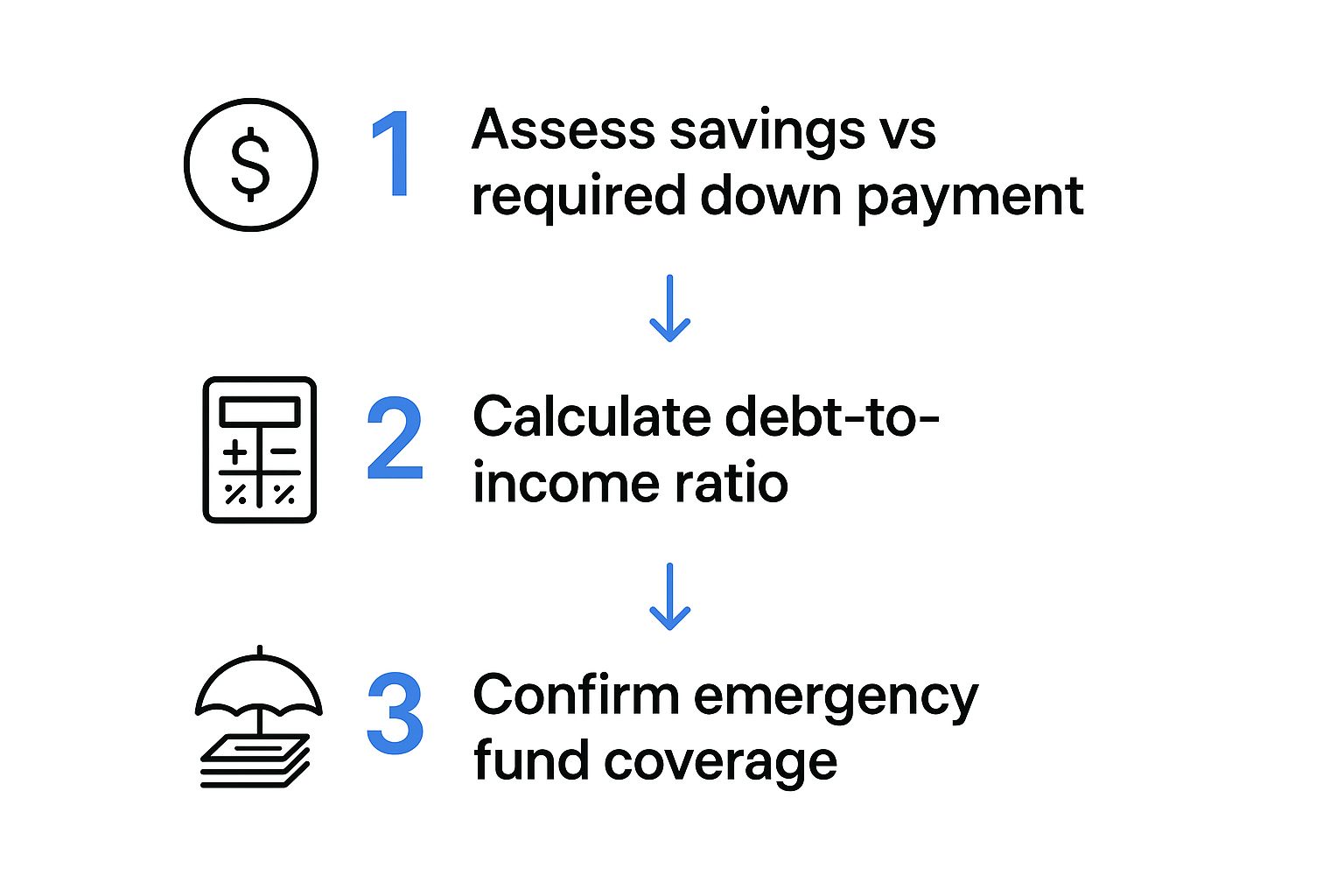

This visual breaks down the key financial steps you’ll take before your search even begins.

It really shows how everything, from your savings to your emergency fund, is connected when you're getting ready to buy a home.

Your Credit Score is Your Superpower

When it comes to buying a home, think of your credit score as your superpower. A high score shows lenders you’re a safe bet, which means they'll offer you better interest rates. That can save you tens of thousands of dollars over the life of your loan. A score of 740 or higher is what you're aiming for—that’s the sweet spot.

If your score isn’t quite there yet, don’t panic. Here are a few simple things you can do to give it a boost:

Pay on time, every time: Late payments are a score-killer. Set up automatic payments so you never miss a due date.

Lower your credit card balances: Try to keep your balance below 30% of your total credit limit on each card. For example, if you have a card with a $5,000 limit, aim to keep the balance under $1,500.

Be a detective: Pull your free credit reports from all three major bureaus and check for errors. Finding and fixing a mistake can give your score a quick lift.

Before you start looking for a house, it's a great idea to run through a quick financial checklist to make sure you're truly ready.

First-Time Home Buyer Financial Checklist

This table lays out the essential financial groundwork. Getting these things squared away puts you in the driver's seat.

Tackling this checklist isn't just about qualifying for a loan; it's about making sure you’re truly prepared for homeownership.

Building this solid financial base is the most empowering thing you can do. When I work with first-time buyers, my goal isn't just to find them a house. It's to make sure they walk into their new home feeling completely confident and in control.

Getting Your Mortgage Pre-Approval

Think of a mortgage pre-approval as your golden ticket when you're house hunting. It’s an official letter from a lender that says, "Yes, we're ready to lend you this much money." Suddenly, you’re not just a window shopper anymore. You’re a serious buyer, and sellers will take you seriously.

This is a huge step up from a pre-qualification, which is really just a quick, unverified guess of what you might be able to borrow. A pre-approval means the lender has actually gone through your financials with a fine-tooth comb. They've seen your income, your debts, and your credit, and they're ready to put their money where their mouth is.

Time to Round Up Your Paperwork

To get that pre-approval, you’re going to have to open up your financial life to the lender. My advice? Get all your documents in order before you even start the conversation. It makes the whole thing feel so much less chaotic.

Here’s the usual list of what you'll need to pull together:

Proof of Income: Your last two pay stubs and W-2s from the past two years usually do the trick.

Bank Statements: Grab the last two months' statements for both your checking and savings accounts.

Tax Returns: You'll need your federal tax returns for the last two years.

Identification: A clear copy of your driver’s license or another government-issued ID.

My Favorite Pro Tip: I always tell my clients to create a "Mortgage Docs" folder on their computer. Every time a new pay stub or bank statement comes in, save it as a PDF right to that folder. When your lender asks for something, you’ll have it ready to go in seconds.

The housing market is always shifting. We're seeing more people moving locally—moves within the same city are up 11% year-over-year—but the total cost of owning a home is also creeping up. A solid pre-approval gives you a real-time, no-nonsense budget to work with, so you know exactly what you can afford right now.

Finding the Right Lender and Loan

Not all mortgages are the same, and honestly, the lender you choose can make or break your homebuying experience. You don't have to go with the first one you talk to. In fact, you shouldn't! Shop around and compare offers from at least three different places—think banks, credit unions, and dedicated mortgage brokers.

As a builder's representative, I pride myself on providing hands-on service, and that includes connecting my clients with the best people for the job. To make things simpler for buyers here in Maryland, we’ve put together a list of lender partners who specialize in new construction homes. These folks know the market in places like Baltimore County and Harford County inside and out.

When you start comparing, you’ll run into a few different loan types. For most first-time buyers, it comes down to these two:

FHA Loans: These are backed by the government and are a lifesaver if your credit isn't perfect or you have a smaller down payment. You can get in the door with as little as 3.5% down.

Conventional Loans: These aren't government-insured, so they usually want to see a higher credit score. You'll need at least 3-5% down, but the goal is 20% to avoid paying private mortgage insurance (PMI).

Let's put that into perspective. Say you fall in love with a $350,000 home in Edgewood. With an FHA loan, your down payment could be as low as $12,250. To avoid PMI with a conventional loan, you'd need to bring $70,000 to the table. Seeing those numbers side-by-side makes it clear how important it is to find the right fit for your finances. My job is to give you the info you need to make that choice with total confidence.

So, How Do You Actually Find The Perfect Home?

Alright, this is the fun part. With your mortgage pre-approval squared away, you can finally start looking at houses with a real sense of purpose. It's no longer just window shopping on Zillow; it's a mission. It’s incredibly easy to fall in love with a stunning kitchen or a perfectly staged living room, but a smart approach is what separates a happy homeowner from someone with buyer's remorse.

Before you even step foot in an open house, you need to get brutally honest about what you need versus what you just want. Trust me, this little exercise will save you a world of headaches and wasted weekends.

Must-Haves vs. Nice-to-Haves

Seriously, sit down with your partner (or just yourself!) and make two columns on a piece of paper. This becomes your North Star during the hunt, keeping you grounded when a beautiful-but-impractical house tries to sway you.

A must-have is a deal-breaker. If a home doesn't check this box, you walk away. No exceptions. A nice-to-have is exactly that—a bonus. It's the cherry on top, but you can live without it or maybe add it down the road.

Here’s what that might look like in the real world:

Must-Haves: - Minimum of three bedrooms for our growing family. - Commute to the office needs to be under 45 minutes. - A fenced yard for the dog is non-negotiable. - We need a two-car garage; street parking is a nightmare.

Nice-to-Haves: - A finished basement would be awesome for a playroom. - I'd love granite countertops. - A big primary bathroom with a soaking tub would be a dream. - Hardwood floors on the main level.

Having this list in hand as you search communities across Baltimore, Harford, and Prince George's County will keep you laser-focused on properties that actually fit your life.

The New Construction Advantage

As you browse, you'll see a mix of older homes and brand-new construction. While there's a certain charm to existing homes, going new offers some huge perks, especially if you're a first-time buyer nervous about hidden costs.

With a new home, you're getting a modern, open layout built for how we live today. Even better, everything is brand new—the roof, the HVAC, the appliances. This practically eliminates the risk of a surprise five-figure repair bill popping up right after you move in.

The current market is tough, no doubt. In fact, first-time home buyers recently made up only 24% of all home sales, a big dip from 32% just two years prior, mostly due to inventory and affordability issues. But here's the good news: overall homeownership has actually climbed to 65.2%. It shows that with the right game plan, owning a home is still totally possible. You can get more context on these 2025 home buying trends to see the bigger picture.

And if you're eager to move without a long construction timeline, checking out our quick move-in homes in Maryland is a fantastic starting point.

What to Look for Beyond the Fresh Paint

You found a place that looks great online and you've booked a tour. Now it’s time to be a detective. Your job is to look past the stylish furniture and fresh paint to investigate the nitty-gritty details that affect everyday living.

Don't be shy! When you're in the home, really check things out. Here are a few things I always encourage my clients to do:

Check the Water Pressure: Go into the main bathroom and turn on the shower. Then, turn on the sink faucet at the same time. Is the pressure still strong, or does it drop to a sad dribble?

Test Your Cell Signal: Walk from room to room, and don't forget the basement and garage. Can you get a decent signal everywhere? Nothing is more frustrating than a dead zone in your own home.

Scope Out the Neighborhood: This is a big one. Drive through at different times of day—rush hour on a Tuesday, mid-afternoon on a Thursday, and on a Saturday evening. What’s the noise level? Do you see kids playing? Get a feel for the community's rhythm.

Open *All* the Closets: Is there enough real, usable storage for your stuff? Or is it all tiny, impractical closets?

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique customization tools, hands-on service, and access to visualizers that help you bring your dream space to life. We empower you to select your own flooring, countertops, and cabinets, making sure your new house feels like your home from the moment you get the keys.

Making an Offer and Closing the Deal on a Resale

You found it. That one house that just feels right. After all the searching, this is a huge moment. Take a deep breath—this next part, making the offer, isn't nearly as scary as it sounds. Once you put your offer in, it's really just a series of final steps that stand between you and a new set of keys.

Crafting a Winning Offer

Putting in an offer is more than just throwing out a number. Think of it as a complete package designed to show the seller you're not just interested—you're a serious, reliable buyer who can get this done.

A strong, competitive offer usually has these key ingredients:

The Offer Price: This is the big one, of course. Your agent will help you land on a number based on what similar homes in the area have actually sold for, not just the list price.

Your Pre-Approval Letter: This is your golden ticket. It proves to the seller that a lender has already vetted your finances and you're ready to secure a mortgage.

Contingencies: These are your safety nets. They’re basically conditions that need to be met for the sale to move forward, protecting you if something unexpected pops up.

Earnest Money Deposit: This is a "good faith" deposit that shows you’re committed. It’s typically 1-3% of the sale price and gets held in a neutral account.

Those contingencies are incredibly important. The two most common are the home inspection contingency, which lets you walk away (or renegotiate) if the inspection uncovers major problems, and the financing contingency, which protects you in the off-chance your loan doesn't get final approval. Neither of these contingencies are done on new construction homes.

Handling Negotiations Like a Pro with a Resale

It’s completely normal for a seller to come back with a counter-offer. Don't let it discourage you! This is just the beginning of the conversation. They might ask for a higher price, a different closing date, or maybe ask you to drop a contingency.

This is where you lean hard on your real estate agent's expertise. Let’s say you offer $370,000 and the seller counters at $380,000. Your agent might advise meeting in the middle at $375,000. Or, if the seller is firm on their price, you could ask them to chip in for some of your closing costs to offset the difference.

The goal of negotiation isn’t to "win." It's about finding a solution where both you and the seller feel good about the outcome. A little bit of flexibility can make all the difference.

From Accepted Offer to Closing Day

Once your offer is accepted (pop the champagne!), a new clock starts ticking. This is the "under contract" or "in escrow" phase, and it usually lasts about 30 to 60 days. During this time, a flurry of activity happens behind the scenes to get the sale finalized.

Here’s a quick look at the major milestones you can expect:

Home Inspection: You'll hire a pro to give the house a top-to-bottom physical. A typical inspection runs about $350, but it can save you thousands by spotting hidden issues with the roof, foundation, or plumbing.

Appraisal: Your lender will order an appraisal to make sure the home is actually worth what you’ve agreed to pay. It’s a crucial step that protects their investment—and yours.

Final Loan Underwriting: The lender’s underwriting team does one last, deep dive into your financial profile to give the final, official green light for your mortgage.

Final Walkthrough: Right before you sign the papers, you get one last chance to walk through the house and make sure everything is in the same condition as when you first made your offer.

My goal is to make sure my clients feel supported through every one of these steps. I offer a level of hands-on service that goes further. I help you access unique customization tools and visualizers, so even as you're closing, you can already be dreaming up how you'll pick out your perfect countertops, flooring, and cabinets to truly make the space your own in our communities across Baltimore County and Harford County.

Making Your New House a Home

So, you did it. Congratulations! You've navigated the maze of finances, the property hunt, and the mountain of paperwork at the closing table. Now the real fun begins—turning this brand-new structure of walls and floors into a place that feels completely, undeniably you.

This is the moment when all those daydreams finally come to life. It's time to stop thinking about mortgage rates and start thinking about where the comfy couch will go.

This Is Where Your Style Comes In

I firmly believe that personalization is what truly turns a house into a home. It's why I go the extra mile for my clients, offering a hands-on service with access to some incredible visualizer tools that let you see your design choices in real-time.

Imagine being able to experiment with different design combinations right from your laptop. No guesswork, no crossing your fingers and hoping for the best. You get to mix and match finishes until you find the look that perfectly fits your vision.

For instance, you could virtually try out:

Warm, wide-plank hardwood floors paired with classic white shaker cabinets for a timeless kitchen.

A sleek quartz countertop with subtle veining to set off those bold, navy blue vanities you've been eyeing for the bathroom.

Modern, geometric tile for a kitchen backsplash that really makes a statement.

This isn't just about picking out materials; it’s about pouring a bit of your personality into your home from the very start.

Honestly, my favorite part of the whole process is watching clients play with these tools. There's always an "aha!" moment when they find the perfect flooring and countertop combo. You can just see it click—that’s when the vision for their new life in that home really starts to take shape.

Customization Options at a Glance

To get your creative juices flowing, here’s a quick rundown of some key areas where you can really make your mark.

This table breaks down some popular choices and my personal tips to help guide you.

See? The possibilities are endless, and you get to call the shots on what feels right for you and your family.

Settling In and Making It Yours

Once your choices are locked in and you’ve got the keys in hand, the fun just keeps rolling. Remember, settling into a new home is a marathon, not a sprint. Don’t pressure yourself to have everything perfect on day one.

Here are a few simple things I always tell my clients to do first:

Unpack the kitchen. Seriously. Being able to make a cup of coffee and a simple meal will make you feel instantly more at home.

Set up your bedroom. After a long day of unpacking, having a comfortable place to crash is non-negotiable.

Bring in familiar scents. Light your favorite candle or plug in a diffuser. Smell is a powerful sense tied to memory and comfort.

Beyond getting the boxes unpacked, think about how technology can make your new life a little easier. Smart home devices aren't just for tech gurus anymore; they're practical tools for everyday living. From smart thermostats that trim your energy bills to lighting you can control from your phone, these little additions make a huge difference. For more ideas, check out your guide to home smart tech in a new build.

Finally, put together a basic home maintenance checklist. Even in a brand-new home, knowing where your main water shut-off valve is and remembering to change your air filters are small habits that will protect your investment for years to come.

My goal is to make your home-buying journey feel seamless and supportive, from our very first chat to the moment you step into your beautifully personalized home in White Marsh, Edgewood, or anywhere in Baltimore, Harford, or Prince George's County. Let’s create a space that’s a perfect reflection of you.

Got More Questions? Let's Talk It Out.

Even with a roadmap in hand, it's totally normal to have some questions buzzing around your head. Honestly, it's part of the process! Let's clear up a few of the most common things first-time buyers ask. Getting straight answers here can really boost your confidence as you move forward.

So, How Much Do I Really Need for a Down Payment?

This is the big one, isn't it? The question on every first-timer's mind. The short answer is: it really depends.

You’ve probably heard the old "you need 20% down" rule. Think of that more as a gold standard than a strict requirement. Hitting that 20% mark is awesome because it means you get to skip paying for Private Mortgage Insurance (PMI), which saves you money every month. But for most first-time buyers, that's a huge pile of cash.

Luckily, there are other paths to homeownership. Many people I work with use loan programs designed to make that first purchase more accessible.

FHA Loans: These are a go-to for a reason. You can often get into a home with as little as 3.5% down. On a $350,000 house, that's the difference between saving $12,250 and a much more daunting $70,000.

Conventional Loans: Don't count these out! Some programs now let first-time buyers put down as little as 3%. We even have a 100% Conventional loan that require no down payment with a lower than market interest rate.

The trick is to talk with a great lender who can walk you through the options and find the one that fits your savings and financial goals.

What’s the Deal with Closing Costs? And How Much Are We Talking?

Great question. Closing costs are essentially the fees for all the services needed to finalize the sale. They're totally separate from your down payment, and you absolutely need to budget for them. It’s a mix of charges from your lender, the title company, and other professionals who get the deal across the finish line.

A good rule of thumb is to budget between 2% and 5% of the home's purchase price for closing costs. For that same $350,000 home, you'd want to have somewhere between $7,000 and $17,500 set aside.

This bucket of money covers a lot of important stuff, like:

Loan origination fees

The home appraisal and inspection fees

Title insurance (to protect your ownership)

Prepaid property taxes and your first year of homeowners insurance

Knowing about this expense from the start saves you from a nasty surprise right when you're about to get the keys.

How Long Is This Whole Thing Going to Take?

Patience is your best friend in real estate! While every home purchase is a little different, there's a general timeline you can expect.

Once a seller accepts your offer, the clock starts on the closing process. This part usually takes about 30 to 60 days. This is the "under contract" or "in escrow" phase where all the important behind-the-scenes work happens—the inspection, the appraisal, and the final loan underwriting.

The house hunting part, though? That’s the real wild card. It could take a weekend or it could take a few months. It all comes down to the local market and how quickly you find a place that feels like the one.

I've been lucky enough to guide countless clients through this exact journey, making sure they feel supported from their first question to the moment they're standing in their brand-new, personalized home in amazing Maryland communities like White Marsh, Edgewood, and across Baltimore, Harford, and Prince George's Counties. My entire focus is on giving you hands-on service and unique tools to help bring your vision for a dream home to life.

At Customize Your Home, we think your first home should be a true reflection of you. While the builder I represent provides high-quality homes, I go a step further—offering my clients unique customization tools, hands-on service, and access to visualizers that help you bring your dream space to life. Let's build a home together that is uniquely yours from day one.

Start exploring the possibilities and get your journey started at https://www.customizeyourhome.com.

Comments