When Is the Best Time to Buy a House? A Guide

- Justin McCurdy

- Aug 30, 2025

- 16 min read

Updated: Sep 12, 2025

Trying to figure out the best time to buy a house can feel like you're trying to solve a complex puzzle. But honestly, the answer is usually much simpler than you'd think. The "right time" happens when everything lines up: your finances, your personal goals, and the current market.

If you're a bargain hunter at heart, the fall and winter months often bring the best deals and way less competition. On the other hand, if having a ton of options is your top priority, you'll find the most homes for sale in the spring and summer—just be prepared to share the market with a lot more buyers.

Timing Your Purchase for the Best Outcome

Think of timing the real estate market like planning a beach vacation. If you book your trip for the middle of summer, you’re guaranteed great weather and plenty of things to do. But you'll also pay a premium and have to navigate huge crowds. Go in the off-season, and you might score an incredible deal and enjoy some peace and quiet, but you risk some of the best attractions being closed.

The housing market works in a very similar rhythm. Each season has its own unique vibe, with distinct pros and cons. Getting a feel for this annual flow is the first step toward making a savvy decision that truly fits what you’re looking for.

Seasonal Market Shifts

So, what can you actually expect as the seasons change? Let's take a look.

Spring (March - May): Welcome to peak season! This is when the market is flooded with new listings, giving you the widest selection. The downside? It's also when competition is fiercest. For example, a great house might get ten offers in a single weekend, pushing the price well above asking.

Summer (June - August): The market is still buzzing, but that initial spring craziness has started to die down a bit. This is a popular window for families who want to get settled before the new school year kicks off.

Fall (September - November): As the weather starts to cool, so does the real estate market. You'll see fewer homes for sale, but the buyers who are still looking are typically very serious. Sellers often become more willing to negotiate as the holidays approach.

Winter (December - February): This is by far the slowest time of year. Inventory hits its lowest point, but so does the competition. If you can find a home you love during these months, you have a great chance of getting a fantastic price from a seller who just wants to make a deal.

To make it even clearer, here's a quick cheat sheet on the home buying seasons.

Home Buying Seasons at a Glance

Season | Pros for Buyers | Cons for Buyers |

|---|---|---|

Spring | Largest selection of homes, properties look their best. | Highest prices, most competition, potential for bidding wars. |

Summer | Still a lot of inventory, more time for house hunting with longer days. | High prices persist, competition remains strong, especially in family areas. |

Fall | Less competition from other buyers, sellers are more motivated to negotiate. | Fewer homes to choose from, approaching holiday season can add pressure. |

Winter | Lowest prices of the year, very little competition, motivated sellers. | Very limited inventory, bad weather can make house hunting difficult. |

At the end of the day, the calendar is just one piece of the puzzle. The goal is to find a home that's absolutely perfect for you, and that's about more than just the season.

Ready to take the next step? You can find more expert advice by exploring our other articles on home buying and selling to help you feel confident on your journey.

Timing the Market: Understanding Real Estate's Seasons

Just like the weather, the real estate market has predictable seasons. Think about a popular vacation spot. In the middle of summer, it’s absolutely swamped. Everyone wants a piece of the action, and prices for everything—from hotels to boardwalk pizza—are at an all-time high. You have plenty of choices, but you’ll pay top dollar for them.

Now, picture that same town in the dead of winter. The crowds are gone, local restaurants are running specials, and you can enjoy the peace and quiet. The housing market works in a very similar way, with its own distinct peak and off-seasons. Getting a feel for this rhythm is the first step to timing your purchase perfectly.

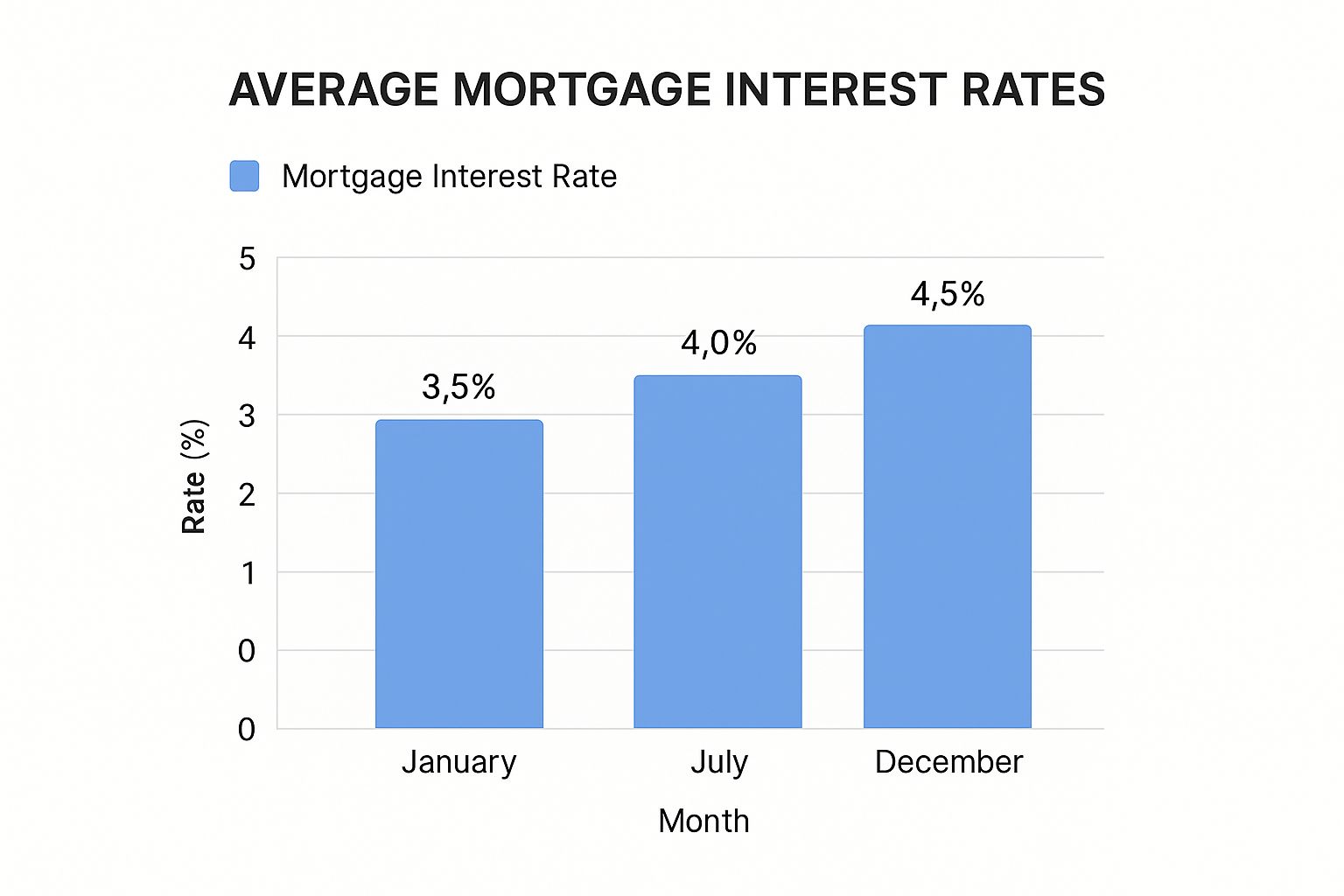

This isn’t just a gut feeling; the data backs it up. The chart below gives you a glimpse into how mortgage rates can ebb and flow throughout the year, which directly impacts how much house you can afford.

As you can see, even a small shift in interest rates can make a big difference in your monthly payment.

Spring: The Busiest Buying Season

Traditionally, spring is when the real estate market explodes. The snow melts, the flowers bloom, and "For Sale" signs pop up everywhere. This is when you'll find the biggest selection of homes all year, which is fantastic if you're looking for options.

But there's a catch. This is also when competition is absolutely fierce. It's basically the Black Friday of real estate. With so many buyers out there, bidding wars are common, homes often sell for well over the asking price, and there's very little room to negotiate. If you're jumping into the spring market, you've got to be ready to move fast and come in with a strong offer.

Summer: The Hot Streak Continues

The high energy of spring usually rolls right into the summer months. The initial frenzy might die down a little, but it’s still very much a seller's market. Many families are trying to lock down a new home and get settled before the school year starts, which keeps demand strong.

You’ll still find a good number of homes to look at, but don't expect any bargains—prices are typically at their peak. It’s a great time to see a property in its best light with green grass and sunny skies, but you're definitely paying a premium for that perfect curb appeal.

Fall and Winter: The Savvy Buyer's Season

Okay, this is where it gets interesting for buyers who are more focused on value. As the holidays get closer and the weather gets colder, the market takes a big, collective breath. A lot of potential buyers decide to pause their search, which means way less competition for those who stick it out.

Pro Tip: Historically, the best time to buy a house in the United States is in the fall and winter. The market slows way down, giving buyers more negotiating power and a much better shot at a great price.

Sellers listing their homes during this time are often really motivated. They might be moving for a new job, dealing with a life change, or just eager to close the deal before year-end. This is where you, the buyer, gain the upper hand.

For instance, data often shows that homes can be around 5% less expensive in November than they were back in June. Properties also tend to sit on the market longer, jumping from the high 20s to around 41 days in November. This less frantic pace can lead to price drops and better terms for buyers who care more about the deal than a massive selection. If you want to see the numbers yourself, you can dig into the seasonal perspective of the housing market.

Sure, there might be fewer homes to choose from in the fall and winter, but the buyers and sellers who are active are dead serious. This usually makes for a much smoother transaction. Braving the "off-season" could be your ticket to landing a fantastic home without the headache of a bidding war.

The Hidden Costs of Buying in a Hot Market

Jumping into the busy spring real estate market feels exciting, doesn't it? The weather’s getting nice, "For Sale" signs are popping up everywhere, and there’s a real buzz in the air. But that peak season energy can come with some serious hidden costs that go way beyond the list price.

Think of it like trying to snag the hottest new gaming console on launch day. The demand is through the roof, and sellers know they can charge a premium.

This isn't just a gut feeling—the data backs it up. A long-term look at the U.S. housing market found that sellers listing their homes between February and June consistently pocketed premiums of 12.2% to 13.1% over the estimated market value. May is often the peak, with sellers getting an average premium of 13.1%.

So while you might have more homes to look at, the fierce competition can inflate prices and completely kill your negotiating power.

The Financial Squeeze of a Seller's Market

In a hot market, that list price is really just the opening bid. It's the starting line for a race that often ends in a full-blown bidding war. Multiple buyers all vying for the same house can drive the final sale price tens of thousands of dollars higher than what the home is actually worth. For first-time buyers, that can be a really tough pill to swallow.

But the pressure goes beyond just the final price tag.

Waiving Contingencies: To make their offer stand out, buyers often feel forced to waive critical protections, like home inspection or financing contingencies. This is a massive gamble. You could be on the hook for thousands in surprise repairs or lose your earnest money if your loan doesn't come through.

Appraisal Gaps: When you offer more than the asking price, the home might not appraise for that amount. If that happens, you’re usually expected to cover the "appraisal gap"—the difference between the bank's valuation and your offer—out of your own pocket. For example, if you offer $415,000 but the home appraises at $400,000, you have to bring an extra $15,000 in cash to closing.

No Room to Negotiate: Thinking about asking for seller credits to help with closing costs? Or maybe asking them to fix that leaky faucet? Forget about it. In a seller's market, they hold all the cards, leaving little to no room for you to negotiate.

The Emotional Toll of High-Stakes Decisions

The financial strain is only one side of the coin. The frantic pace of a competitive market can also take a huge emotional toll. When houses are getting snapped up in just a few days, it’s easy to feel rushed into making one of the biggest financial decisions of your life.

This pressure-cooker environment is a perfect recipe for buyer's remorse. You might start overlooking red flags or compromising on your non-negotiables just to win, only to regret it down the line. It's so important to stay grounded and not let the fear of missing out (FOMO) cloud your judgment.

A lot of myths about home buying can pile on the pressure, making you feel like you have to do what everyone else is doing. We actually put together a guide to debunk some of the biggest myths to help you separate fact from fiction.

At the end of the day, while spring and summer give you more houses to choose from, you have to weigh that against the very real possibility of overpaying and making a rushed, high-stress decision. For many people, a calmer, less competitive market is a much smarter and saner path to finding the right home.

Figuring Out Your Personal Home Buying Timeline

We’ve talked a lot about calendars and seasons, but let's get real for a second. Trying to perfectly "time the market" is only half the story. The best time to buy a house isn't about what month it is; it’s about where you are in life.

The true sweet spot happens when your personal and financial worlds align, regardless of what the market is doing.

Think about it like deciding to start a family. You wouldn't make that call based on the time of year, right? You'd look at your career, your relationship, and whether you're genuinely ready for that kind of commitment. Buying a home is that exact same kind of milestone decision.

Are Your Finances in Order?

Before you even dream about scrolling through listings, you need to give your finances a quick, honest check-up. This isn’t about having a perfect bank account; it’s about being prepared. When you feel confident about your money, the whole process shifts from stressful to exciting.

Here are a few key things to get squared away:

A Stable and Reliable Income: Lenders really like to see consistency. Having a steady job history, usually for the last two years, shows them you can handle the monthly mortgage payments without breaking a sweat.

A Healthy Credit Score: Your credit score is a huge deal. It's one of the biggest factors that determines your mortgage interest rate, and a better score can literally save you tens of thousands of dollars over the life of the loan.

A Solid Down Payment Saved: You don't always need that classic 20%, but putting down a good chunk of cash is a massive advantage. It helps lower your monthly payment and lets you dodge Private Mortgage Insurance (PMI).

Extra Funds for Closing Costs: This is the one people always forget! Closing costs usually land somewhere between 2% and 5% of the home's price. Budgeting for this early on saves you from any nasty financial surprises at the finish line.

For example, on a $400,000 home, your closing costs could be anywhere from $8,000 to $20,000. Having that cash ready to go is just as critical as your down payment.

Is Your Life Ready for Homeownership?

Money is a big piece of the puzzle, but it’s not the whole thing. Your lifestyle and what you see for your future are just as important when you're deciding if now is the right time to buy. A house is a commitment that goes way beyond just a mortgage payment.

Ask yourself a few tough questions to see if you're really ready:

Are you planning to stay put? If there's a chance you might relocate for a new job or just want a change of scenery in the next couple of years, buying might not make sense. It usually takes a few years to build up enough equity to make selling worth it.

Are you prepared for maintenance? When you own the home, you're the landlord. That means when the water heater gives out or the roof springs a leak, that repair bill has your name on it. An emergency fund just for home stuff isn't a "nice-to-have"—it's a must. For example, tucking away 1% of your home's value each year ($4,000 for a $400,000 home) is a great way to prepare.

Do you want more control and stability? Let's be honest, this is one of the best parts of owning. If you're tired of asking a landlord for permission to paint a wall and you're craving the security of a fixed mortgage payment (unlike rent that seems to go up every year), then you're probably ready.

At the end of the day, market trends are just a guide. The only timeline that truly matters is your own.

When you feel solid in your finances and your life plans, that's your green light. And when you get there, I'm here to help you take that next step. While the builder I represent provides high-quality homes, I go a step further—offering my clients unique customization tools, hands-on service, and access to visualizers that help you bring your dream space to life. We don't just build a house; we let you personalize it by picking your own flooring, countertops, cabinets, and tile to create a home that truly feels like you. Let's connect and start making it happen.

Exploring New Construction and Personalization

What if you could skip the bidding wars and compromises of the resale market entirely? Going with a new construction home is a completely different ballgame, with its own unique timeline. Instead of fighting over existing houses, you get the chance to create a space that’s brand new and a perfect fit for your life.

This route really changes the whole conversation around the best time to buy a house. You're no longer reacting to whatever happens to be for sale in spring or fall; you’re creating your own supply. One of the biggest perks? You lock in your price and design choices months ahead of time, which can be a huge relief if the market suddenly gets volatile.

Understanding the New Build Timeline

Building a new home is a journey, not a sprint. It’s all about watching your vision go from a patch of dirt to your front door. While every project is a little different, the process usually follows a pretty reliable schedule.

Here’s a rough sketch of what you can expect:

Month 1 (Contract and Design): This is where the fun begins. You'll sign the paperwork and start picking out all the details—the flooring, cabinets, countertops, and tile that will make the house yours.

Months 2-3 (Construction): The foundation gets poured, the frame goes up, and your home starts to take shape. It’s pretty amazing to see it transform from a blueprint into a real structure.

Months 3-4 (Finishing Touches): Now for the inside. Drywall, paint, and all your interior selections are installed. This is when your design choices really come together and the space starts to feel like a home.

Months 5-6 (Final Walk-Through and Closing): Before you get the keys, you'll do one last inspection to make sure everything is just right. Then it’s official—you’re a homeowner!

This built-in schedule gives you a level of predictability you just don’t get with the resale market.

By choosing new construction, you swap the stress of competition for the excitement of creation. You're not just buying a house; you're personalizing a home tailored specifically to your tastes and lifestyle.

Bringing Your Vision to Life

This is where I step in to make sure the process is as smooth and enjoyable as possible. The builder I represent already constructs incredible homes, but I like to take things a step further. My goal is to give you a truly hands-on experience that brings your dream space to life.

I provide my clients with access to some pretty cool visualizer tools that let you see your design choices in real time. Can't decide if those quartz countertops will work with the dark wood cabinets? Wondering which backsplash tile best complements the flooring? We can play around with every combination until you find the perfect one. This personalized guidance means you can customize your home with confidence, creating a place you'll absolutely love for years to come.

If the idea of skipping the market madness and personalizing a home that’s a true reflection of your style sounds good to you, I'd love to chat. Let’s explore the possibilities and start designing a home that is uniquely yours.

Creating Your Home Buying Action Plan

You’ve explored the market trends and have a good handle on your personal timeline. Now, let’s put it all together and build a real-deal action plan. Knowing when to buy is one thing, but having a clear roadmap makes the entire process so much smoother.

This isn't just about making a to-do list; it's about creating your personal playbook. Follow these steps, and you'll be in the driver's seat, ready to make a smart, confident move when the right house comes along.

Your Step-by-Step Home Buying Checklist

Think of this as your mission control. Every step builds on the one before it, getting you that much closer to closing day.

Get Pre-Approved for a Mortgage: Seriously, do this first. A pre-approval letter tells you exactly what you can afford, and it shows sellers you’re a serious contender. For example, getting the green light for $450,000 means you can stop dreaming about million-dollar listings and start focusing on homes that are actually within reach.

Define Your Must-Haves vs. Nice-to-Haves: Grab a pen and paper. On one side, list your non-negotiables (like three bedrooms or a fenced yard). On the other, jot down the “would-be-nice” features (like a gourmet kitchen or a finished basement). This simple exercise is a lifesaver for staying focused during house tours.

Start Saving Aggressively: Your down payment is just the beginning. You’ll also need cash for closing costs, moving expenses, and a little buffer for unexpected repairs. A good rule of thumb is to have an extra 2% to 5% of the home's price tucked away for these extras. Unless you are buying a new home with us, you can potentially move in for as low as $0 as long as you don't currently own a home and with all of the incentives we give you for using our lender partners and preferred title company you will have next to $0 in closing costs too.

A solid action plan turns the chaos of home buying into a series of manageable, achievable goals. It’s the best tool you have for staying organized, focused, and in control of the journey.

Let’s Make Your Dream Home a Reality

If the idea of a brand-new home—one that’s personalized just for you—sounds like the perfect fit, you're in the right place. Imagine skipping the bidding wars and jumping straight to the fun part: picking out finishes that match your personal style.

While I represent a builder known for incredible quality, my real passion is the hands-on service I bring to the table. I give my clients access to amazing visualization tools that let you see your design ideas come to life before the foundation is even poured. We can play with different combinations of flooring, countertops, and cabinets until everything feels just right.

My goal is simple: to help you create a home that's not just well-constructed, but is a true reflection of you. When you're ready to create your roadmap, let’s talk. I can show you how fun and rewarding personalizing your new home can be.

Got Questions? We’ve Got Answers.

The home-buying journey is exciting, but let's be honest—it can also bring up a ton of questions. As you map out the best time to make your move, you're probably wondering about interest rates, down payments, and whether a new build or an existing home is the right fit.

Let's break down some of the most common questions we hear from buyers just like you.

Should I Wait for Mortgage Rates to Drop Before Buying?

Trying to time the mortgage market perfectly is a bit like trying to catch a falling knife. It’s a risky game. While a lower rate sounds amazing, waiting for that "perfect" moment could mean you're up against higher home prices and a flood of other buyers when rates finally do dip.

Here's something to chew on: a 1% jump in interest rates can shrink your buying power by roughly 10%. But a hot market with rising home prices can erase any potential savings from a lower rate just as quickly.

A much better strategy? Buy when you are ready. If you can comfortably afford the monthly payment on a home that fits your life right now, that's your green light. If rates take a nosedive later on, you can almost always look into refinancing. The goal is to focus on a budget that works for you today, not to gamble on what the market might do tomorrow.

Is It Better to Buy a New Construction or an Existing Home?

This is a classic head-scratcher, and the right answer really boils down to what you value most. Both paths have some incredible perks.

Existing Homes: These homes often have a certain charm you can't replicate, usually nestled in established neighborhoods with big, mature trees. The flip side? They can come with a few surprises, like unexpected repairs or the immediate need for a kitchen overhaul.

New Construction Homes: Think modern floor plans, top-notch energy efficiency, and that incredible feeling of being the very first person to live there. You get a completely fresh start without having to worry about fixing the last owner's DIY disasters.

With a new build, you also get the joy of making it truly yours from day one. You pick the floors, the countertops, the paint colors—everything. This way, you avoid the cost and chaos of renovating right after you’ve unpacked all your boxes.

How Much Money Do I Really Need for a Down Payment?

Forget the old myth that you absolutely must have 20% down. That rule just isn't the reality for many people anymore.

Plenty of loan programs are out there to help buyers get into a home with a lot less upfront. FHA loans, for instance, can require as little as 3.5% down, and you can find conventional loans that ask for just 3-5% down if you qualify.

The key thing to know is that if your down payment is less than 20%, you'll almost certainly have to pay for Private Mortgage Insurance (PMI). It's an extra fee that gets rolled into your monthly mortgage payment. However, two of our communities have 100% conventional financing with no PMI if you don't currently own a home (if qualified).

The best first step is to sit down with a lender and explore all your options. They can crunch the numbers and help you figure out the smartest financial path for you. For a deeper dive into these topics, feel free to check out our complete home buying FAQs.

At Customize Your Home, we believe building a new home should be a creative, fun, and personal adventure. The builder I represent delivers incredible, high-quality homes, and I take it a step further. I provide my clients with unique customization tools, dedicated hands-on service, and access to visualizers that let you see your dream home come to life before the foundation is even poured.

Ready to build a home that’s a perfect reflection of you? Let's connect at https://www.customizeyourhome.com.

Comments