Credit Score for Home Loan: Boost Your Mortgage Chances

- Justin McCurdy

- Oct 16, 2025

- 11 min read

When you're dreaming of a new home, your credit score for a home loan is one of the most critical numbers you'll encounter. For most conventional loans, you'll generally need a score of at least 620 just to get in the door. One of my lender partners can go as low as a 540 credit score but you will have to put more money for your down payment.

But the real magic happens when your score hits 740 or higher. In some of my communities, one of my lender partners has an exclusive program to these communities that you will only need a 620 credit score and are treated like you have a 850 credit score. There are special requirements for this loan, such as you can't currently own a home or have your name on a deed or title and no late payments. That’s the friendly sweet spot where lenders roll out the red carpet with their best interest rates, saving you a small fortune over the life of your loan.

Your Credit Score and Why It Matters for a Home Loan

Think of your credit score as your financial reputation boiled down to a single number. This three-digit score, which runs from 300 to 850, is a lender’s quick-glance guide to how you’ve handled debt in the past. A great score tells them you’re a reliable borrower, which makes them feel a lot more comfortable handing you a big check.

This number isn't just about getting a "yes" or "no" on your mortgage application. It directly impacts your wallet. A higher score usually means a lower interest rate, which translates to a smaller monthly payment. For example, boosting your score could mean hundreds of dollars back in your pocket each month—that's money for new furniture, a weekend getaway, or just a little less stress.

Who Calculates Your Score?

You don't just have one credit score. In the U.S., there are three major credit bureaus keeping track of your financial activity, and each one calculates its own score for you.

Experian: A huge player in the credit world, providing reports to both people and businesses.

Equifax: Another major bureau that gathers and crunches credit data from all sorts of places.

TransUnion: The third key agency, offering credit services across the globe.

When you apply for a mortgage, lenders usually pull your scores from all three and use the middle one to make their decision. So don't panic if the numbers aren't identical—that's totally normal since not every creditor reports to all three bureaus.

To help you see where you stand, here’s a quick breakdown of the typical credit score ranges and what they mean to a mortgage lender.

Credit Score Ranges and What They Mean for a Mortgage

As you can see, a few points can make a big difference in how lenders view your application.

The Building Blocks of Your Score

Your score is a mix of a few key ingredients, but some are way more important than others. Payment history is the undisputed champion, making up the biggest slice of the pie. The single best thing you can do for your credit is to simply pay all your bills on time, every time.

Your credit score is more than just a number—it's a key that unlocks better financial opportunities. Understanding how it works is the first step toward securing the keys to your dream home.

This powerful number plays a huge role right from the start. To learn more about those crucial first steps, check out our guide on **getting prequalified for a mortgage loan**.

The Magic Numbers: What Score Do You Actually Need?

Let's get straight to the point: you don't need a perfect 850 score to buy a home. The credit score for a home loan you'll need really boils down to the type of mortgage you're shooting for. Each one has its own playbook and minimums.

Take a Conventional loan, for instance. It's the most common type out there, and you'll typically need a minimum credit score of 620 to even get in the game. But here's the kicker: to snag the best interest rates, lenders really want to see a score of 740 or higher. A score like that tells them you're a low-risk borrower, and they'll reward you for it with better terms.

Different Loans, Different Scores

Everyone's financial picture is a little different, which is why there are so many loan options on the table. The requirements can be worlds apart, so it’s smart to know where you stand.

FHA Loans: Backed by the government, these loans are a big hit with first-time homebuyers. They often have a much lower bar for entry, sometimes letting you in with a score as low as 580. It’s a great way to make homeownership a reality for more people.

VA Loans: If you're an eligible veteran or service member, VA loans are an incredible benefit. The VA itself doesn't set a hard-and-fast minimum score, but you'll find that most lenders prefer to see a score of 620 or better.

You can see just how much these scores matter when you look at the big picture. As of mid-2025, total mortgage debt in the U.S. ballooned to $12.94 trillion, and the average credit score was a solid 715. You can dig deeper into these trends in the Federal Reserve Bank of New York's recent report.

While a 620 score might get your foot in the door in communities like White Marsh, Edgewood, or others in Baltimore County, aiming for a 740+ can unlock significantly better terms, saving you thousands over the life of your loan.

This score isn't just some random number—it’s a major piece of your financial puzzle. Getting a handle on these requirements is a huge part of being prepared. You can learn more about what lenders are looking for by checking out our quick guide to mortgage pre-approval requirements.

How a Better Credit Score Lowers Your House Payment

Your credit score is way more than just a number that gets you approved for a loan—it's a dial that controls how much you'll actually pay. A higher score tells lenders you're a safe bet, and they reward you with a lower interest rate. Over the life of a mortgage, that little difference adds up to a lot of money.

Honestly, the savings can be massive. We're talking about tens of thousands of dollars. A strong credit score for a home loan doesn't just get you the keys; it gives you more breathing room in your budget every single month.

A Tale of Two Homebuyers

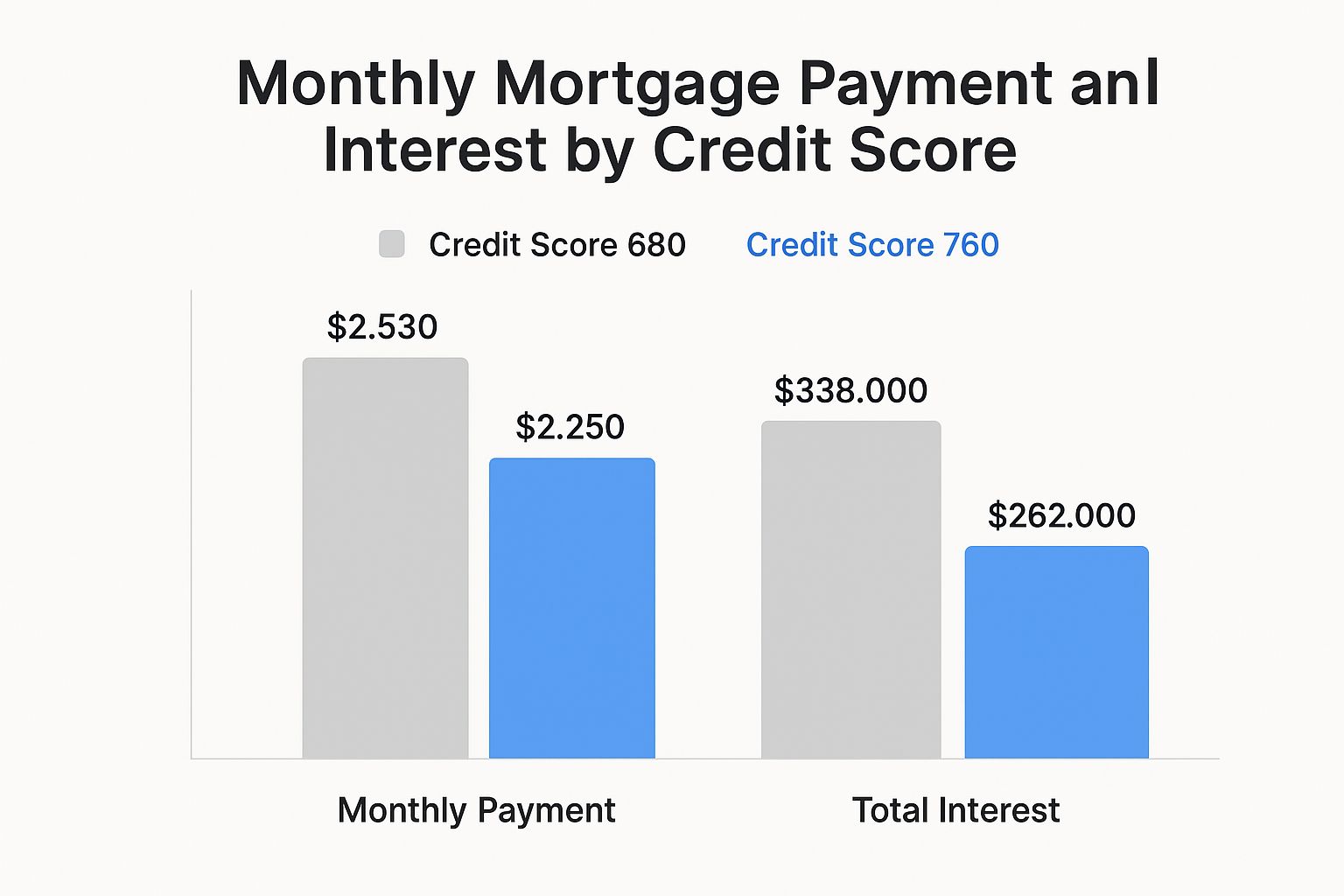

Let's make this real. Imagine two people, Sarah and Tom, are both eyeing the same beautiful $400,000 home in Harford County, Maryland. Everything is identical—their income, their down payment—except for one thing: their credit scores.

Sarah has a ‘good’ credit score of 680.

Tom has an ‘excellent’ credit score of 760.

You might not think that 80-point difference is a huge deal, but watch what happens to their mortgage. It completely changes the game for their monthly payments and the total interest they'll pay over 30 years.

This infographic lays it out perfectly. It shows just how much cash Tom keeps in his pocket compared to Sarah, all thanks to his higher score.

The numbers don't lie. Tom's excellent credit saves him a chunk of change every month, which snowballs into a staggering amount over the long haul.

By boosting his score by just 80 points, Tom saves over $85,000 in interest over the 30-year loan. That’s enough to furnish the whole house, go on some epic vacations, or seriously pad a retirement fund.

This is exactly why putting in the effort to improve your credit is one of the smartest things you can do before you start house hunting. It's just as important as figuring out your budget, which is why our guide on **how much house you can afford** is the perfect next step. We're here to walk you through it all, making sure you find a home that truly works for you and your wallet.

Practical Steps to Boost Your Credit Score

If your credit score isn’t quite where you want it to be for a home loan, don’t panic. Think of your score as a living number, not a permanent grade. With a little focus on the right financial habits, you can absolutely build a stronger score and put yourself in a fantastic position for a mortgage.

Let's dig into some friendly, straightforward ways you can nudge your score in the right direction.

Master Your Payment History

This is the big one. Seriously. Lenders need to see a reliable track record of you paying your bills on time, every time. A history littered with late payments is one of the quickest ways to scare them off.

Set It and Forget It: The easiest win is to set up automatic payments for all your regular bills—car loans, credit cards, you name it. This virtually guarantees you'll never miss a due date by accident.

Create Reminders: If you're not a fan of autopay, use your phone! Set calendar alerts a few days before each bill is due to give yourself a nudge. This is a simple but super effective home living hack.

Manage How Much You Owe

This piece of the puzzle is called your credit utilization. In plain English, it’s the percentage of your available credit you're currently using. A great rule of thumb is to keep your balances below 30% of your total credit limit.

For instance, if you have a credit card with a $10,000 limit, your goal should be to keep the balance under $3,000. Maxing out your cards sends a signal that you might be stretched too thin financially, which can drag your score down. For a deeper dive, you can learn how to improve your credit score with some more advanced strategies.

Other Key Factors to Watch

While payment history and utilization are the heavy hitters, a few other elements play an important supporting role in your overall score.

Pro tip: Avoid applying for a bunch of new credit cards or loans right before you start house hunting. Each application can trigger a 'hard inquiry' on your report, which can cause a temporary dip in your score.

Finally, resist the temptation to close old credit card accounts you no longer use. A longer credit history is a good thing, and closing an old account can shorten that history. It also reduces your total available credit, which can make your utilization ratio jump up—and not in a good way.

Building these healthy habits is your ticket to a better credit score for a home loan and getting the keys to a new place you can call your own in great Maryland communities like White Marsh or Edgewood.

Common Credit Myths That Can Hurt Your Home Loan Chances

When you're trying to get a great credit score for a home loan, you'll hear a ton of advice. Unfortunately, a lot of it is just plain wrong. Let's tackle some of the biggest myths I see that could sabotage your chances of getting that dream home in a community like White Marsh, Edgewood, or even Prince George's County.

One of the worst offenders is the idea that you should close old credit cards to boost your score. It feels like cleaning up, right? In reality, it can backfire badly. Closing an old account actually shortens your credit history and shrinks your total available credit—two things that can make your score drop.

Fact vs Fiction in Credit Management

Another piece of bad advice I hear all the time is that you have to carry a balance on your credit cards to build your score. This one is completely false, and it's an expensive mistake to make.

Myth: You have to carry a balance month-to-month to prove you’re using credit.

Fact: Lenders want to see that you pay your bills on time, every time. Paying your balance in full each month is the gold standard for responsible credit use and saves you from paying a single cent in interest. You do, however, need to keep your paid off credit cards open which usually entails you using it from time to time, even for a small purchase like a pack of gum.

The real goal isn't to show lenders you're constantly in debt; it's to prove you can handle it responsibly. A zero balance paid on time is a massive green flag.

Building good credit habits early is more important than ever, especially with younger buyers getting into the market. We've already seen a 20% jump in mortgage inquiries from the 18-25 age group in 2025 compared to last year. If you want to dig deeper into the numbers, check out the latest global consumer credit trends on Equifax.com.

Steering clear of these common mistakes will put you in a much stronger position. Once you feel confident about your credit, I'm here to help you take the next step—from getting that pre-approval to customizing a beautiful new home with our unique design tools and hands-on service.

From Credit-Ready to Your Dream Home

Alright, so you've got a handle on your credit score. That's the first big step, but now for the fun part: finding a home you can actually see yourself in. This isn't just about crunching numbers; it's about creating a space that feels like you in a community you'll love calling home.

That’s where I come in. I specialize in helping people find their perfect spot in amazing communities across White Marsh, Edgewood, Baltimore County, Harford County, and Prince George's County. What makes my service different is the hands-on approach. I offer unique customization tools and visualizers that let you pick out your own finishes—we're talking everything from the floors and countertops to the cabinets and tile. You get to personalize your new home and bring your dream space to life.

Making Your Vision a Reality

Getting the keys to your new place involves a bit more than just getting approved for a mortgage. You'll also need to think about the down payment and the day-to-day costs of owning a home. To get a head start, you should check out our guide on **how to save for a down payment for your new home**.

It's easy to focus on the mortgage, but remember that owning a home comes with ongoing expenses. To get a clearer picture of the long-term financial side of things, it’s smart to understand **holding costs in real estate**.

I’m here to help you connect the dots between your financial prep work and the home you’ve always wanted. Let's make it happen.

Got Questions? We've Got Answers

When you're diving into the world of home loans, a few questions always seem to pop up. People often ask me how long it takes to bump up their score or what happens if their partner's credit isn't as strong as theirs. These are smart questions, and getting them sorted out can make a world of difference.

Will Shopping for a Mortgage Wreck My Credit Score?

I get this one all the time, and the good news is, you can relax. The short answer is no, as long as you're smart about it.

Lenders and credit bureaus know you need to shop around to find the best rate. Because of this, scoring models are designed to treat multiple mortgage applications within a short window—usually 14 to 45 days—as just one single inquiry.

So go ahead and compare those rates. You won't tank your score for being a savvy shopper.

Pro Tip: Try to get all your mortgage applications submitted within a two-week period. This signals to the credit bureaus that you're just looking for a single loan, not trying to open a bunch of new credit cards.

How Do Lenders Look at Joint Applications?

When you apply with a spouse or partner, lenders will pull both of your credit reports. Here's the catch: they typically use the lower or middle score of the two of you to make their decision. This is a huge reason why it’s a great idea for both partners to work on building a solid credit history before applying.

A strong credit score tells lenders you're a reliable borrower. It's a big deal, especially when you consider that first mortgage delinquencies crept up to 1.27% in mid-2025. You can see the full story in the latest consumer credit report from TransUnion.

Navigating the home loan process is a massive step, and having the right person in your corner can change everything. I do more than just help you find a house; I offer a hands-on service with unique customization tools that let you truly personalize your space.

Whether you're picking out countertops in White Marsh or choosing the perfect flooring in Edgewood, I'm here to help you create a home that's 100% you. Ready to bring your dream space to life? Swing by https://www.customizeyourhome.com and see what we can create together.

Comments