What is a deed of trust? A Quick Guide to Home Financing

- Justin McCurdy

- Oct 29, 2025

- 10 min read

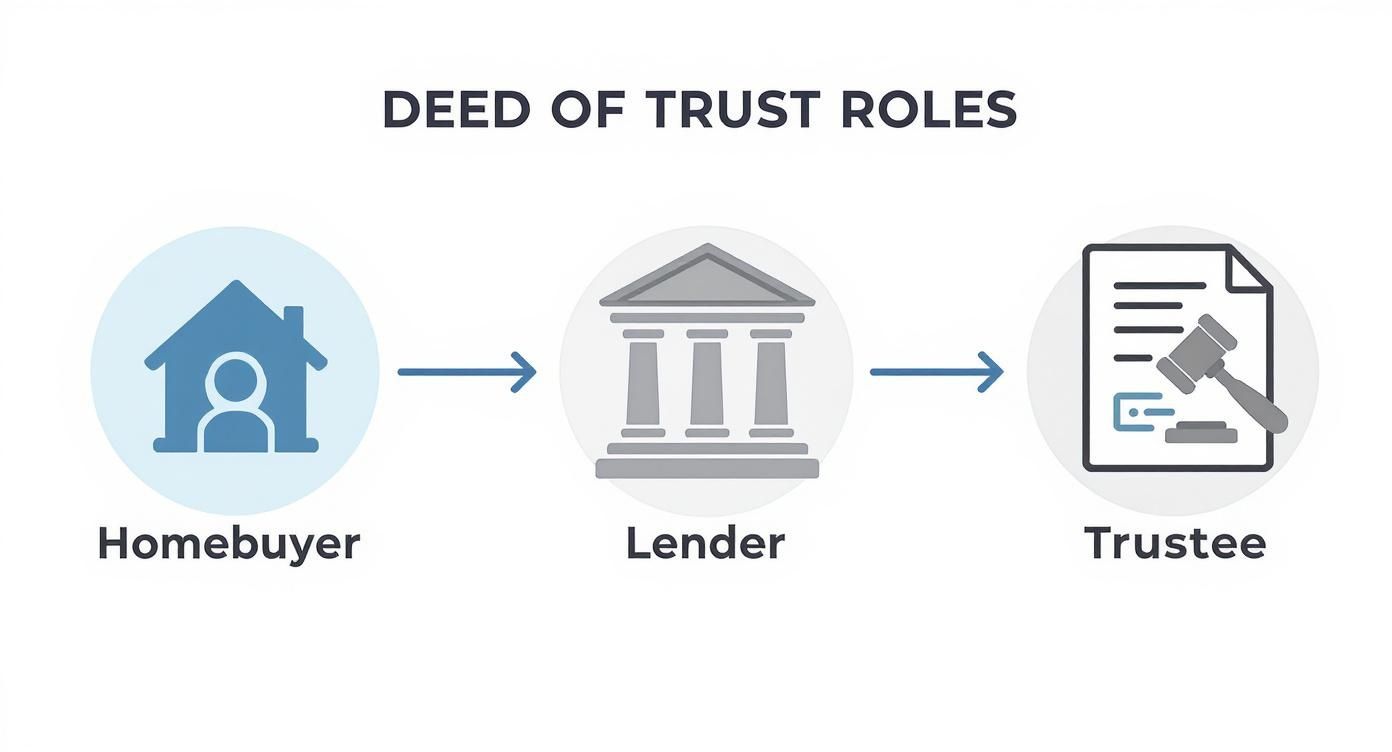

Let's cut through the jargon. At its core, a deed of trust is a legal document used in real estate deals that brings three parties to the table: you (the borrower), the lender who's fronting the cash, and a neutral third party known as a trustee.

Think of the trustee as a referee. They hold onto the property's legal title on behalf of the lender, just to make sure the loan is secure. You still get the keys, get to live in the house, and have what's called "equitable title," which means all the rights and responsibilities of ownership are yours.

Understanding a Deed of trust

Diving into home financing can feel overwhelming, but the idea behind a deed of trust is actually pretty friendly and simple. While a classic mortgage is a straightforward two-way deal between you and the bank, a deed of trust adds that third player, the trustee, into the mix.

The whole point of this setup is to give the lender an extra layer of security. You’re essentially giving the legal title of your property to an impartial entity—usually a title company or an attorney. They just hold it in trust until you’ve paid off your loan in full.

Don't worry, this doesn't mean the lender owns your home. It’s all yours to paint, renovate, and enjoy. Once that final mortgage payment is made, the trustee signs the title back over to you, and the deal is done. It’s a common and standard practice in many states, and you can read up on the nitty-gritty legal details) if you're curious.

The 3 Key Players in a Deed of Trust

To really get a handle on how this works, it helps to know who's who. Here’s a quick breakdown of the three parties involved and what they do.

Party | Role | Main Responsibility |

|---|---|---|

Trustor | Borrower | You! The person buying the property and repaying the loan. |

Beneficiary | Lender | The bank or financial institution that provides the loan. |

Trustee | Neutral Third Party | An impartial entity (like a title company) that holds the legal title until the loan is paid off. |

Basically, the Trustor (you) gets the loan from the Beneficiary (the lender) and entrusts the title to the Trustee for safekeeping. It's a system designed to protect everyone involved.

My goal is to make this whole process crystal clear for you. I offer hands-on service and even have proprietary visualization tools to help you picture your dream space becoming a reality.

Meet the Team: The 3 Key Players in a Deed of Trust

Now that you've got the general idea, let's pull back the curtain and meet the cast of characters. A deed of trust isn't a simple handshake between two people; it's more like a three-person team working together to make sure the home loan is secure for everyone.

Getting a handle on who does what is the best way to feel in control of your home financing. Each party has a specific job, and understanding their role makes the whole process, from closing day to that final mortgage payment, a lot less mysterious.

The Trustor (That's You!)

First up is the trustor. If you're the one buying the house and taking out the loan, congratulations—that's you!

When you sign a deed of trust, you're agreeing to temporarily hand over the "legal title" of your property to a neutral third party (the trustee) as a security deposit for the loan. But don't let the legal jargon scare you. You still hold what's called "equitable title," which gives you all the rights of a homeowner. You can live in it, renovate it, and make it completely yours—from the kitchen cabinets to the backyard patio.

The Beneficiary (The Lender)

Next, we have the beneficiary. This is simply your lender—the bank or mortgage company that's providing the cash for your home. They "benefit" from this setup because the deed of trust protects their money.

Think of it as their insurance policy. If everything goes smoothly and you make your payments, their role is pretty hands-off. But if the loan goes into default, the beneficiary is the one who can authorize the trustee to start the foreclosure process.

The Trustee (The Neutral Referee)

Last but not least is the trustee. The easiest way to think of the trustee is as an impartial referee. This role is almost always handled by a neutral third party, like a title company, escrow agency, or a real estate attorney.

The trustee holds that legal title we talked about, but they don't have any skin in the game. They're just there to enforce the rules of the agreement.

They have two primary jobs:

When you pay off the loan: The trustee signs a document called a Deed of Reconveyance, which officially transfers the legal title back into your name. Hooray!

If you default on the loan: The trustee is responsible for managing the foreclosure sale, but only at the direction of the lender.

Their neutrality is the glue that holds the whole thing together, ensuring the property title is handled fairly and exactly as laid out in the loan agreement.

How a Deed of Trust Works in Real Life

Theory is one thing, but seeing how a deed of trust actually works during a home purchase makes it all click. Let's walk through a practical example with a fictional homebuyer, Alex, who's buying a place in Harford County, Maryland.

This little story really highlights how the three parties—the buyer, the lender, and the trustee—each play their part from the moment the loan starts until it's finally paid off.

You can see from this breakdown that the trustee really is just a neutral third party. They're not on the buyer's or the lender's side; their only job is to hold onto the title until the loan is settled.

From Loan Approval to Moving Day

So, Alex finds a home they love and gets a loan approved by a local bank. (If you're at that stage, it helps to know the mortgage pre-approval requirements for a smooth process). At the closing table, Alex signs a bunch of documents, and one of the most important is the deed of trust.

This document hands the "legal title" of the property over to a neutral trustee, which is almost always the title company handling the closing.

Now, even though the trustee is holding the official paper title, Alex gets the keys! They have all the rights of an owner—they can live in it, renovate it, and make it their own. This is the fun part. Maybe Alex uses my proprietary visualization tools to pick out some gorgeous new flooring for the living room or find the perfect quartz countertops for the kitchen.

For years, Alex lives in the home, makes memories, and faithfully sends in those monthly mortgage payments. The whole time, the deed of trust is just sitting there in the background, with the trustee holding the title as security for the lender.

The Final Payment and Full Ownership

Fast forward a few years, and Alex makes that final mortgage payment. What a feeling! Once the lender gets that last dollar, they shoot a message over to the trustee confirming the loan is paid in full.

This kicks off the final step, a process called reconveyance. The trustee drafts a new document called a Deed of Reconveyance. This document officially transfers the property title from the trustee directly to Alex.

Once that new deed is recorded with the county, the lender's lien is wiped clean. Alex is now the 100%, undisputed owner. It’s a clean and simple end to the journey. For folks in the industry, there are great resources for title and real estate professionals that dive even deeper into this framework.

Deed of Trust vs. Mortgage: What's the Real Difference?

Alright, so you’ve heard the terms "deed of trust" and "mortgage" thrown around, and they sound pretty much the same, right? They both help you buy a house. But the way they work behind the scenes is actually quite different, and those differences can have a big impact on you as a homeowner.

The easiest way to think about it is counting the players. A mortgage is a simple two-party deal: it’s just you (the borrower) and the bank (the lender). A deed of trust, on the other hand, is a three-party arrangement. It involves you, the lender, and a neutral third party called a trustee.

Let's break down how this small change in the cast of characters creates some major plot twists, especially when things go wrong.

How Foreclosure Works

The single biggest difference—and the one you really need to understand—is what happens during a foreclosure. This is where that third-party trustee really steps into the spotlight.

With a mortgage, if you stop making payments, the lender usually has to take you to court to foreclose on the property. This is called a judicial foreclosure. As you can imagine, anything involving courts can be a long, drawn-out, and expensive process for the lender.

With a deed of trust, things move much faster. The lender can simply instruct the trustee to sell the property to recoup their money. This process, known as a non-judicial foreclosure, completely bypasses the court system.

This power of sale clause is precisely why lenders in many states, including Maryland, prefer using deeds of trust. It gives them a faster, more direct way to handle a default.

Deed of Trust vs Mortgage At a Glance

To make it even clearer, let's put these two side-by-side.

Feature | Deed of Trust | Mortgage |

|---|---|---|

Parties Involved | 3 (Borrower, Lender, Trustee) | 2 (Borrower, Lender) |

Title Holder | The trustee holds the legal title until the loan is paid. | The borrower holds the title. |

Foreclosure Type | Usually non-judicial (no court needed). | Typically judicial (requires court action). |

Foreclosure Speed | Can be very fast (weeks or months). | Generally a slow process. |

Seeing them compared like this really highlights why the distinction matters. It all comes down to the foreclosure process and who holds the power if the loan isn't paid.

Knowing these details is a huge part of being an informed homebuyer. When you understand the legal nuts and bolts of your loan and maintain a strong credit history, you're in the driver's seat. Speaking of which, understanding your credit score's impact on a home loan is just as critical.

Whether your loan is secured by a deed of trust or a mortgage, my job is to help you confidently find your way home in communities like White Marsh, Edgewood, Baltimore County, Harford County, or Prince George's County. I’m all about hands-on service and using unique proprietary visualization tools to help you find a house you can truly customize with flooring and countertops you’ll love for years to come.

Let's Make Your Dream Home a Reality

Getting a handle on the financing is the first hurdle, but let's be honest—the real fun starts when you can finally make a house your own. While legal documents like a deed of trust might feel a bit intimidating, they're just the key that unlocks the door to a home you'll love for years.

I go a step further than just helping you through the home buying process—I offer my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. It all starts with mastering the pre-approval process to lock in your budget. Once that’s sorted, we can get to the exciting stuff.

Think about it: you can see exactly how your choices for flooring, cabinets, and countertops will look in a virtual model of your home before a single thing is installed. This process takes all the guesswork out of customizing and ensures the final result is 100% you.

Navigating the money side of things is a big step. If you need some pointers on finding the right financial partner, check out our friendly guide on choosing a mortgage lender.

If you’re looking for a home in White Marsh, Edgewood, Baltimore County, Harford County, or Prince George's County, I'd love to chat. Let's work together to get you from financing all the way to designing a space that’s uniquely yours.

Common Questions About Deeds of Trust

Let's be honest, the world of home financing can feel like a maze of unfamiliar terms. To help you find your way, I've broken down some of the most common questions people have about deeds of trust.

Getting a handle on these basics will make you feel a whole lot more confident as you navigate the home-buying process.

What Happens When I Finish Paying My Loan?

This is the best part! It's the moment you've been working toward for years. Once you send in that final payment, your lender gives the trustee the green light.

The trustee then drafts up a Deed of Reconveyance. Think of this as the official document that transfers the "legal title" from their name into yours, once and for all. It gets recorded, the lender's claim on your property vanishes, and you become the outright owner. It’s a huge milestone and a fantastic feeling.

Is a Deed of Trust Public Record?

Yep, it sure is. A deed of trust is recorded with the county government where your property is, making it a public document. It's the same deal with a traditional mortgage.

This step is all about transparency. It puts everyone on notice that there’s a loan tied to the property, which protects the lender’s investment until you've paid it all back.

Key Takeaway: As the homeowner, you hold what's called "equitable title." This gives you all the rights to live in, enjoy, and paint the walls whatever color you want. The trustee just holds the "legal title" on paper as a safety net for the lender. As long as you’re making your payments, your home is your castle.

Can I Sell My House with a Deed of Trust?

Absolutely! You can sell your home anytime, even if you still owe money on it. When you close the sale, the buyer's money first goes to pay off the remaining balance of your loan.

The title company managing the sale makes sure your lender is paid in full. After that, the trustee issues that deed of reconveyance to wipe the slate clean for the new owner. Any cash left over after paying off the loan and other closing costs is all yours. Getting your finances in order is the first big step, and our guide on getting prequalified for a mortgage loan is a great place to start.

I do more than just help you find a great house in a community like White Marsh, Edgewood, Baltimore County, Harford County, or Prince George's County. I offer a hands-on service with unique proprietary visualization tools that let you see your dream space come to life. You get to pick out the perfect flooring, countertops, and cabinets before you even move in. Ready to find a home that's 100% you? Let's connect today!

Comments