First Time Buyer Mortgage Options to Secure Your Dream Home

- Justin McCurdy

- Nov 19, 2025

- 14 min read

First-time buyer mortgage options stretch from conventional loans to government-backed FHA, VA, and USDA programs. You can lock in a fixed rate and know your monthly payment up front, or choose an adjustable rate that starts lower but may shift down the road. Your credit score, income and even the home’s location come into play.

Read on to map out which loan lines up best with your goals.

While the builder I represent provides high-quality homes, I go a step further—offering unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life.

Overview Of First Time Buyer Mortgage Options

Picking a mortgage is a lot like choosing wheels for a cross-country trip: you want something reliable, affordable and flexible when the unexpected pops up. Laying out the options side by side brings everything into focus.

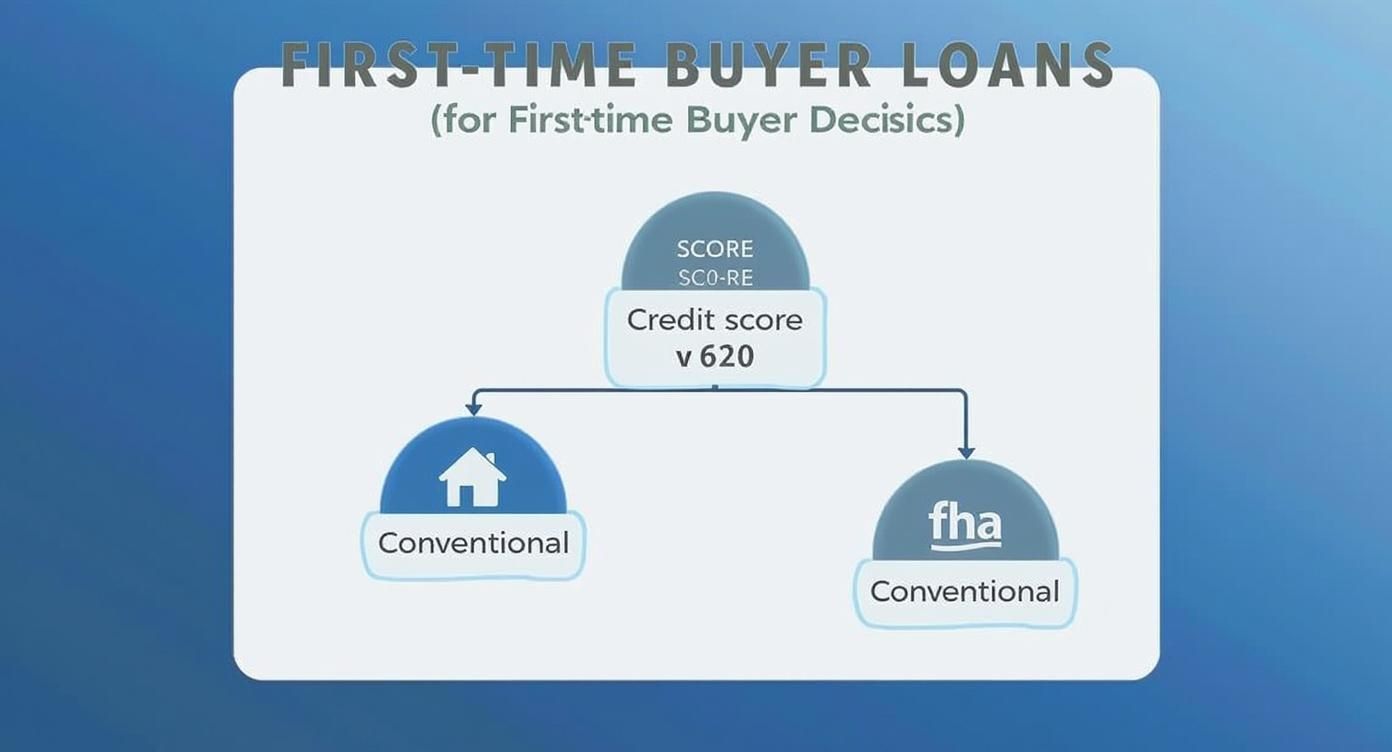

Credit Score Criteria: Minimum 620 for conventional, 580 for FHA in most cases

Down Payment Levels: FHA from 3.5%, conventional from 5%

Rate Types: Fixed stays steady, adjustable can move

Local Perks: Programs vary in White Marsh, Edgewood, Baltimore County, Harford County and Prince George’s County

Key Mortgage Factors

These are the building blocks that determine your monthly payment and overall costs:

Loan Type (FHA, VA, USDA, Conventional)

Interest Rate (Fixed vs. Adjustable)

Loan Term (15, 20, 30 years)

PMI (Private Mortgage Insurance requirements)

Assistance (State or local first-time buyer programs)

Understanding each piece makes conversations with lenders feel more like friendly advice than a quiz.

Interestingly, the median age of first-time buyers has climbed to 40, a record high. That tells you younger folks are facing steeper hurdles. Meanwhile, FHA loans are back in favor—one in four first-time buyers now picks FHA, thanks to its lower down payments and looser credit checks. CoastOne Mortgage Insights on First-Time Buyer Trends

FHA loans operate like training wheels, reducing upfront costs while you build equity.

Example Borrower Scenarios

Let’s meet a few buyers in our area:

Sarah in White Marsh: Credit score 610, opts for FHA with 3.5% down and enjoys flexible underwriting.

James in Edgewood: Goes conventional with 0% down and has no PMI. He didn't own a home and had a middle FICO score of 620 or higher.

Maria in Harford County: Qualifies for a VA loan and puts 0% down, keeping cash on hand.

Comparing Payment Structures

Here’s a quick glance at how the main three loan types stack up:

Loan Type | Down Payment | Insurance |

|---|---|---|

Conventional | 5%, 0% in Trimble Meadows if a home is not owned and a middle FICO score of 620 or higher | PMI Required, no PMI on the 100% loan in Trimble Meadows |

FHA | 3.5% | Mortgage Insurance |

VA | 0% | No PMI |

Fixed rates feel like cruising on a smooth highway—predictable. Adjustable rates start low but can climb, more like tackling rolling hills. Early savings versus long-term peace of mind: that’s your trade-off.

Remember to weigh credit, income, and local assistance.

Questions To Ask Your Lender

Before you sit down with a lender, have these questions ready:

What rate and APR can I lock in today?

How much will I need for a down payment?

Can closing costs be rolled into the loan?

When—and how—does PMI drop off?

Are there any state or local first-time buyer programs I qualify for?

Covering these will turn a nerve-wracking meeting into a productive chat.

Ready to explore mortgage solutions? Contact Customize Your Home for a free consultation in White Marsh, Edgewood, Baltimore County, Harford County or Prince George’s County.

Decoding The Main Mortgage Types

Buying your first home can feel like staring at a toolbox full of gadgets. You need a mortgage that fits your finances and your future plans. Let’s break down the main loan options so you can pick the one that feels right.

Conventional Loan: credit score 620+, down payment from 0% (in Trimble Meadows, can't own a home), 3% (for first time buyers), to 5%, PMI until 80% loan-to-value

FHA Loan: credit score as low as 580, 3.5% down, mortgage insurance premium applies

VA Loan: 0% down for qualified veterans and service members, no PMI

USDA Loan: 0% down in eligible rural areas, income limits apply, location must qualify

The chart above shows that if your credit score sits at 620 or higher, conventional loans are within reach. Below that, FHA tends to be the safety net for many buyers.

FHA Loans And Training Wheels

Think of an FHA loan as a gentle introduction to homeownership. Backed by the federal government, it eases the lender’s risk and lowers the bar for borrowers.

Credit score starting at 580

Minimum 3.5% down payment

Mortgage Insurance Premium: 1.75% upfront + about 0.85% annually

For example, Sarah in White Marsh had a 610 credit score and used the 3.5% down option. She also tapped into the Baltimore County down payment assistance to cover closing costs, then used our visualization tool to pick wood-look flooring.

VA Loans And Zero-Down Rocket Fuel

VA loans are the powerhouse choice for veterans and active service members. With 100% financing, they eliminate the need for a down payment—plus there’s no PMI.

0% down for eligible users

Up to $155,000 in Maryland funding bonus

Funding fee can roll into the loan

Maria in Harford County leveraged her VA benefit for zero down. She dove into our home designer tool to plan her kitchen layout, later choosing shaker-style cabinets and a marble countertop.

Conventional Loans For Steady Riders

Conventional loans reward strong credit and solid savings. They’re straightforward, with options for fixed or adjustable rates.

Credit score 620+

Down payment starting at 0% in Trimble Meadows (can't own a home currently), 3% for first time buyers, 5%

PMI drops off once you hit 80% loan-to-value

James in Edgewood went with a conventional mortgage, put down 0%, and avoided PMI at the start of his loan. He worked with Customize Your Home to lock in quartz countertops and porcelain tile flooring before closing.

USDA Loans For Rural Explorers

Eyeing a spot outside the city? USDA loans offer 100% financing for homes in qualifying rural zones. Income limits apply, so you’ll want to check the map.

0% down for eligible properties

Income cap near $100,000 in Maryland

Must meet USDA’s location criteria

Quick Guide to First Time Buyer Mortgage Options

Loan Type | Typical Down Payment | Best For | Key Feature |

|---|---|---|---|

Conventional | 0%, 3%, 5% | Strong credit histories | PMI removal at 80% LTV, and on the 100% loan in Trimble Meadows if qualified |

FHA | 3.5% | Lower credit scores | Easier approval with flexible terms |

VA | 0% | Eligible veterans | No PMI requirement |

USDA | 0% | Rural buyers | Income-qualified financing |

This quick guide should help you pinpoint the loan that fits your goals and budget.

Balancing Features And Costs

Finding the right mortgage means weighing upfront expenses against monthly payments and long-term savings. Compare interest rates, insurance requirements, and eligibility perks before you make a choice.

Key Takeaway Match your credit profile and down payment capacity to the loan that maximizes value and comfort.

Learn more about detailed home loan types in Maryland in our guide on home loan types explained for Maryland buyers.

Always check local requirements in White Marsh, Edgewood, Baltimore County, Harford County and Prince George’s County to leverage available government assistance, homebuyer incentives and rate discounts.

Tackling Down Payments And Closing Costs

Saving up for a down payment can feel like climbing a mountain—but it doesn’t have to be that daunting. Let’s walk through the options so you know exactly where your money goes and how to keep more of it in your pocket.

Breaking The 20 Percent Myth

You’ve probably heard you need 20% down. The truth? There are plenty of paths that let you step onto the property ladder with far less.

Popular low-down alternatives include:

FHA Loan: Starts at 3.5% down

VA Mortgage: 0% down for eligible veterans

USDA Loan: 0% down if you qualify in rural areas

Conventional Loan: From 5% down

Each option has its own quirks, but none require a full fifth of the home price upfront. That can be a game-changer.

Understanding PMI And How To Drop It

When your down payment is under 20%, lenders want extra protection. Enter Private Mortgage Insurance (PMI).

FHA borrowers juggle an upfront fee plus annual mortgage insurance

Conventional loans tack on PMI until you hit 20% equity

Think of PMI as a rental insurance policy you don’t really need for your own home. Once you build enough equity—either by paying down principal or refinancing—you can say goodbye to those extra dollars.

Funding Your Down Payment

Most first-timers tap personal savings (78.4%), while some lean on family gifts (17.7%), side gigs (11.8%), or retirement rollovers (9.8%). It’s like putting together a potluck dinner: everyone brings something.

Creative ways to gather your chunk of change:

Automate a weekly or monthly transfer into a dedicated savings account

Accept a gift from family in Baltimore County or Prince George’s County

Pick up freelance work or a weekend gig

Look into Maryland’s down payment assistance programs

Check your company’s benefits—some offer home-buying grants

Cutting Closing Expenses

Closing costs can tack on 3%–5% of your home price. These fees cover:

Appraisal and inspection bills

Title search and attorney services

Prepaid taxes and homeowner’s insurance

Loan origination and underwriting

You can shave off dollars by:

Negotiating seller concessions

Requesting lender credits in exchange for a slightly higher interest rate

Bundling title and escrow services

Tapping into local grants that cover closing fees

Maryland’s first-time buyer programs sometimes pick up the tab or offer credits. One Edgewood buyer combined a state grant with seller assistance and halved their closing bill.

Cutting fees early means more cash leftover for those fun design touches—think quartz countertops or subway-tile backsplashes.

Funding Examples And Next Steps

Sarah in White Marsh set aside $200 each month for two years.

Thomas in Edgewood received a family gift covering 5% of his home’s cost.

Maria in Harford County topped up her pot with weekend freelancing.

You can also qualify for Maryland-specific aid through local programs.

Check out our guide on saving strategies in our article How To Save For A Down Payment Tips For Your New Home

Small, consistent deposits add up faster than you think.

And don’t forget to budget for moving day extras—make sure to uncover hidden costs in moving house so nothing catches you off guard.

Comparing Down Payment Scenarios

Loan Type | Down Payment | PMI Impact |

|---|---|---|

FHA | 3.5% | MIP until term end |

VA | 0% | No PMI |

USDA | 0% | No PMI |

Conventional | 0%, 3%, 5% | PMI drops at 20% LTV, No PMI on the 100% conventional loan in Trimble Meadows |

For homeowners customizing their space, every dollar saved on the down payment can stretch your budget for finishes.

At Customize Your Home, we offer proprietary visualization tools, hands-on service, and custom options for flooring, countertops, cabinets, and tile.

Schedule a free consultation in White Marsh, Edgewood, Baltimore County, Harford County or Prince George’s County to see how we can personalize your home. Our team will guide you through financing, design selections, and everything in between—so you can move in faster and start living in a space you love.

Start your journey today.

Maryland Programs To Boost Your Buying Power

If you’re stepping into homeownership in Maryland, you’ve hit the jackpot. Our state boasts some of the most generous down-payment help and special-rate deals around. You could shave thousands off your upfront costs and lock in a lower interest rate for the life of your loan. Mix state aid with an FHA or conventional mortgage, and you’ll stretch each dollar further than you thought possible.

Maryland Mortgage Program Overview

The Maryland Mortgage Program (MMP) is all about fixed interest rates and extra cash in your pocket. You get up to $5,000 toward closing costs, plus a 3% down-payment grant that never comes back to bite you in repayment. Best of all, it teams up with FHA, VA, USDA or conventional loans—your choice.

0.5%–1.0% rate reductions below market averages

Up to $5,000 in closing-cost assistance

No repayment ever on the down-payment grant

Available in White Marsh, Edgewood, Baltimore County, Harford County, and Prince George’s County

Who Qualifies For Extra Funding

Teachers, nurses, and first responders have bonus options through the Teacher Next Door and Maryland Army National Guard programs. Take Jessica, a Baltimore County teacher: she stacked the Teacher Next Door grant with MMP to cover $4,000 of her closing costs. All she did was fill out Form 100A and drop in a copy of her teaching contract.

“Maryland’s public service programs turned my dream into an affordable reality,” says Jessica.

Steps to lock in your extra funds:

Gather proof of your job title and employer

Pull together service or contract documentation

Complete the state grant application (Form 100A)

Submit everything at least 30 days before your closing date

Check out our guide on buying your first home in Maryland for more local insights: Buying Your First Home In Maryland

How To Apply And Track Deadlines

Think of applying for Maryland assistance like a relay race—timing is everything. Miss a handoff and you could find yourself at the back of the line.

Get pre-approved with an MMP-approved lender

Download and fill out the MMP Assistance Application

Attach W-2s, recent pay stubs, and proof of your down-payment source

Watch the Maryland Housing Finance website for grant openings

Hit the closing table within 60 days of approval

Key Insight: Applications fund on a first-come, first-served basis—early birds get the best chances.

Maximizing Your Assistance

Many savvy buyers stack state and federal programs to wipe out out-of-pocket costs. The Millers from Edgewood used an FHA loan with 3.5% down, tapped the MMP 3% grant, and even snagged a $2,000 local city grant for educators in Harford County.

Program | Benefit | Best For |

|---|---|---|

Maryland Mortgage Program | 3% down-payment grant, low rates | Most first-time buyers |

Teacher Next Door Grant | Up to $2,000 for closing costs | Educators in public schools |

First Responder Home Grant | Up to $3,500 in down-payment assistance | Police, EMTs, firefighters |

Baltimore County DPA | Varies by jurisdiction | Local residents |

Tips To Stretch Your Grant

Time your purchase date with state funding calendars

Ask your lender to apply grants against your biggest fees

Combine family gift funds in Prince George’s County with state DPA

Every program has unique forms and deadlines. Keep a shared calendar with your lender and builder to dodge last-minute rushes. Those little steps can free up cash for flooring, countertops, cabinets—and more—when you work with Customize Your Home.

Connect with Customize Your Home’s experts for a free consultation on mortgage options and design finishes. We cover White Marsh, Edgewood, Baltimore County, Harford County, and Prince George’s County—and we’re here to make your dream home a reality.

Navigating the Mortgage Application Process

Think of pre-approval as flashing a VIP backstage pass—it commands attention from sellers. In contrast, pre-qualification is more like a friendly chat: you share basic numbers and get a rough idea of what you might borrow.

With pre-approval, though, your lender digs into pay stubs, bank statements and credit scores, then hands you an official purchasing limit. That extra verification gives you real bargaining power.

Essential Documents Checklist

Your documentation is the roadmap lenders follow to understand your financial picture. Keep these items handy:

Pay Stubs (last 30 days) to prove steady income

Bank Statements (2–3 months) showing savings or emergency funds

Tax Returns (two years) for any freelance or side gig earnings

Photo ID and Social Security Number for identity checks

Proof of Assets like 401(k) statements or gift letters

Each document adds a brushstroke to the full portrait of your finances. For example, consistent pay stubs reassure lenders you’re not living paycheck to paycheck.

Comparing Loan Estimates

Within three business days of applying, each lender must send you a Loan Estimate—a standardized snapshot of costs. This lets you compare apples to apples:

Interest Rate vs APR

Origination Fees & Discount Points

Prepaid Items (taxes, homeowner’s insurance)

Title Insurance & Escrow Charges

Total Cash Needed at Closing

Sometimes a slightly higher interest rate with lower fees ends up saving you more in the long run.

Learn more about specific pre-approval requirements in our article Mortgage Pre-Approval Requirements Your Quick Guide.

Key TakeawayComparing Loan Estimates beyond the rate reveals the true cost of each mortgage.

Rate Lock Strategies

Locking your interest rate for 30–60 days protects you if rates climb. If the market dips, a float-down option lets you snag a lower rate—often for a small fee. Think of it like choosing when to hop on your favorite roller coaster: timing is everything.

From Application to Approval

Once you lock in, underwriting double-checks every detail. They might ask for updated bank statements or explanations for large deposits—treat these as simple checkpoints. Responding quickly keeps the process moving.

When all conditions are satisfied, your “golden ticket” pre-approval becomes a firm loan commitment.

Mastering your credit score is a vital step in preparing for a mortgage application, directly influencing your eligibility and interest rates. Strategic Credit Score Mastery

Whether you’re weighing first time buyer mortgage options or customizing your new home finishes, this roadmap keeps you on track.

When you work with Customize Your Home, our team reviews your Loan Estimate alongside your design selections—flooring, countertops, cabinets, tile—to forecast your total project costs.

At Customize Your Home, we guide first-time buyers through each step in White Marsh, Edgewood, Baltimore County, Harford County, and Prince George’s County. Contact our team today to start your mortgage journey with confidence.

Making The Most Of Your New Home

Your financing is locked in with the right first-time buyer mortgage. Now comes the fun part—turning that blank canvas into a place you love.

Begin by budgeting for routine upkeep. Swapping out air filters every three months might seem small, but it can save hundreds of dollars over time.

Seasonal checklists keep you ahead of surprises. Clean gutters in fall, service your HVAC in spring, tackle plumbing in summer and boost insulation in winter.

For instance, Sarah in Edgewood cut her fall cleanup time by 50% after installing gutter guards.

Seasonal Maintenance Tips

Divide your to-do list by quarter and stick to it. This approach led to 10% fewer repair calls in homeowner surveys.

Quarter | Key Tasks |

|---|---|

Q1 | Furnace tune-up, Check smoke alarms |

Q2 | Power wash siding, Inspect roof shingles |

Q3 | Clean decks, Oil door hinges |

Q4 | Seal drafts, Winterize plumbing |

Decorating On A Homeowner Budget

Secondhand treasures can pack a punch without draining your wallet. Scout Baltimore County flea markets for one-of-a-kind rugs or lamps.

Rearrange what you already own to give a room a fresh feel. Toss in a few bold throw pillows for an instant mood boost.

Emily in Harford County swapped her curtains and spent just $60 to transform her living room’s vibe.

Quick Makeover Steps

Pick one room to refresh

Choose an accent color

Source three budget finds (pillows, art, plants)

Play with placement until it clicks

Planning ahead helps smooth out costs. Jot tasks into a shared calendar or use a home-management app to stay on track.

Leveraging Proprietary Visualization Tools

Our team in White Marsh, Edgewood, Baltimore County, Harford County and Prince George’s County offers a sneak peek at your future space.

With our visualization tools, you can drag and drop flooring, countertops, cabinets and tile into a 2D model of your home. It’s like trying before you buy—no surprises.

“Seeing my kitchen choices in 2D helped me avoid costly swaps,” says James, a new homeowner in Prince George’s County.

Ready to make your dream home a reality? Schedule a free consultation with Customize Your Home for friendly, hands-on guidance at every turn.

FAQ Your First Time Homebuyer Questions Answered

Still have questions? We pulled together the top four queries first-time buyers tend to ask about mortgage options, from credit myths to rate timing, eligibility, and surprise fees.

Each answer comes with real-life scenarios from White Marsh, Edgewood, Baltimore County, Harford County, and Prince George’s County. By the end of this, you’ll feel confident moving forward.

What Credit Score Do I Really Need

Your credit score might feel like an exclusive club bouncer—but it doesn’t have to kick you out. For a conventional mortgage, you usually need at least 620. If you’re eyeing an FHA loan, you can often start as low as 580.

Common myths include:

You must have 750+ to get in

Any score below 600 is an automatic no

In reality, take Sarah from White Marsh. She walked in with a 610 credit score and landed an FHA loan with just 3.5% down and thoughtful underwriting flex.

How Do I Time My Rate Lock

Locking your rate is like grabbing an umbrella before a forecasted storm—it costs a bit upfront, but you’ll thank yourself if rates climb before closing. Rate locks usually span 30–60 days, depending on your lender’s playbook.

Float-down options let you snag a lower rate if the market dips. For example, Maria in Harford County locked her rate for 45 days, then paid a $350 float-down fee to shave 0.125% off her rate.

“Rate locks are like umbrellas; you hope you don’t need them, but you’ll be glad you had one if it rains.” — Loan Officer Alex

Can I Use A VA Loan If I Qualify

If you’re a veteran or active service member, a VA loan can be a game-changer. It offers 0% down financing, no private mortgage insurance, and you just need a valid Certificate of Eligibility.

James in Edgewood tapped into his VA benefit. He skipped the down payment, kept cash in his pocket, and funneled it into picking out cabinets and tile with our visualization tool before closing day.

What Happens On Closing Day

Closing day often feels like the final puzzle piece snapping into place. Here’s the play-by-play:

Verify every figure on your Closing Disclosure

Sign mortgage and title documents

Transfer your funds via certified check or wire

Once the ink dries, those keys are yours. Congratulations—you’re a homeowner! Then the real fun begins: planning all the finishing touches.

Ready to see your options in action? Contact Customize Your Home for a free consultation in White Marsh, Edgewood, Baltimore County, Harford County, and Prince George’s County.

Comments