What Is Included in Closing Costs for Homebuyers

- Justin McCurdy

- 3 days ago

- 14 min read

You've picked out the perfect flooring, countertops, and cabinets—the fun part is done! Now it's time to tackle the final hurdle in your homebuying journey: closing costs. These are essentially the service fees for all the professionals working behind the scenes to make your new home officially yours.

Your Friendly Guide to Home Closing Costs

Think of closing costs like the final, itemized bill at the end of a fantastic meal. You see charges for the food, the drinks, tax, and a well-deserved tip for the server. In the same way, your closing statement lists all the individual costs for services like loan processing, property appraisal, and title searches that were needed to finalize your home purchase. It might look like a long list, but trust me, every fee has a specific job to do.

The final total can definitely be a surprise if you're not ready for it. Typically, closing costs for buying a home run anywhere from 2% to 5% of the home's purchase price. So, for a $300,000 home—a common price point in many of the Maryland communities we build in, like White Marsh or Edgewood—you could be looking at costs between $6,000 and $15,000.

Getting a handle on what these fees actually cover is the first step toward walking into your closing with total confidence.

The Main Categories of Closing Costs

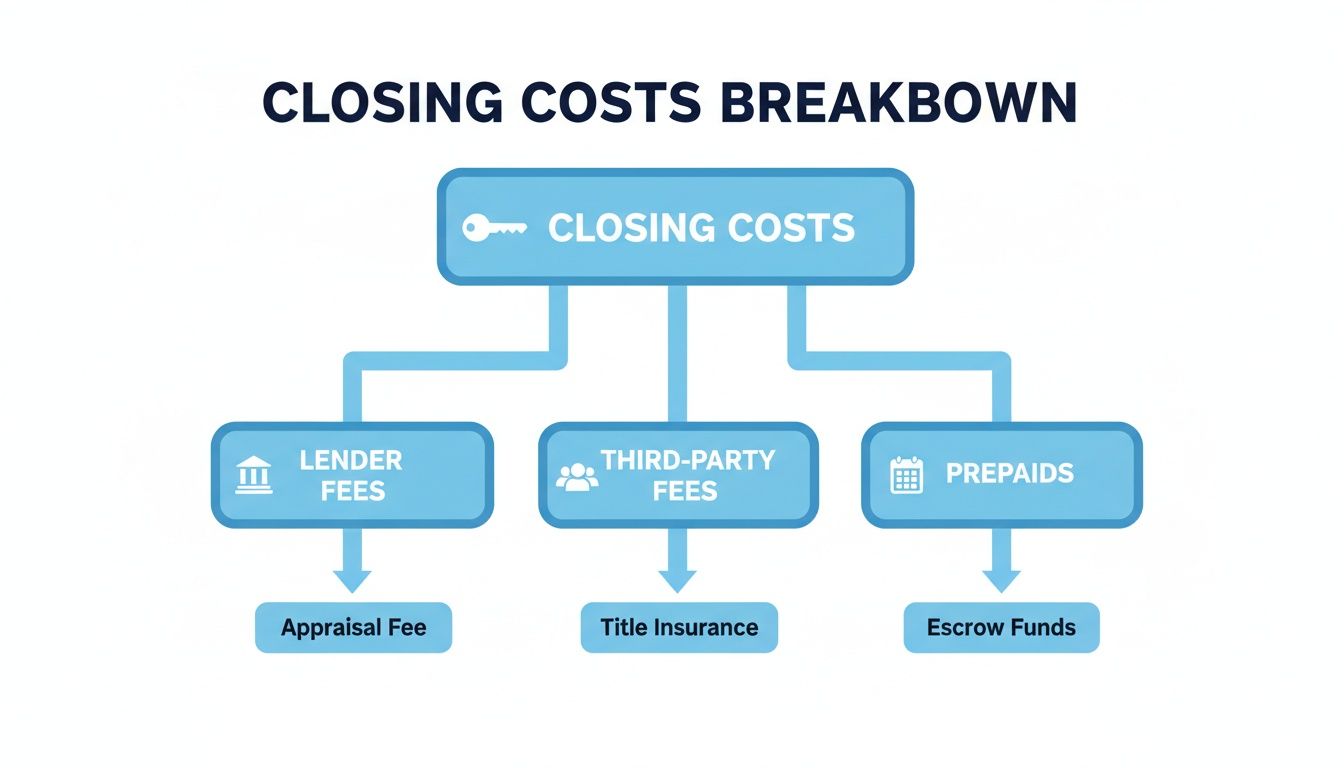

So, what exactly is included in closing costs? Let's break it down. The fees generally fall into three main buckets, which helps make sense of where all the money is going.

To give you a quick overview, here’s a simple table that sorts these costs into their main categories. It's a great cheat sheet for understanding who gets paid for what.

Quick Breakdown of Typical Closing Cost Categories

Cost Category | What It Covers | Typical Payer |

|---|---|---|

Lender Fees | Costs associated with creating and processing your home loan, like origination and underwriting. | Buyer |

Third-Party Fees | Payments to other companies for services like the appraisal, title search, and survey. | Buyer |

Prepaid Items & Escrow | Upfront payments for future expenses, mainly homeowner's insurance and property taxes. | Buyer |

This table gives you the 30,000-foot view. Now, let’s zoom in a little closer on what each of these categories actually means for your wallet.

Lender Fees

These are the charges from your mortgage provider for the work of creating and processing your loan. This bucket includes things like the loan origination fee, underwriting (which is just their process for assessing risk), and the cost of pulling your credit report.

Third-Party Fees

This is where you pay for all the other professionals who play a part in the transaction. These costs cover essential services like the home appraisal to confirm the property's value, the title search to make sure there are no ownership disputes, and sometimes attorney fees, depending on the situation.

Prepaid Items & Escrow

This part is a little different. These aren't fees for services you've already received, but rather funds you pay upfront for future expenses. You're basically pre-funding an account for your first year's homeowners insurance premium and a buffer of property taxes. This money goes into a special savings account called an escrow account.

To really get a grip on one of the major prepaid items, it helps to have a good understanding of home insurance explained simply.

But here’s the good news: you don't have to feel overwhelmed by these numbers. With our current promotions, many of our buyers can use builder incentives to pay for all of their closing costs and pre-paid items (that's one year of your homeowner's insurance premium and about 12 to 14 months of estimated property taxes).

That means you could move into your dream home in Baltimore County or Harford County for just your down payment. Even better, in communities like Trimble Meadows and potentially Vista Reserve, qualified buyers could move in for $0 out of pocket by using our exclusive 100% financing loan program. My mission is to make this process as smooth as possible, using hands-on service to help you navigate every single step.

Breaking Down Every Fee on Your Closing Disclosure

Alright, let's talk about the paperwork. After you’ve had the fun of picking out gorgeous countertops and flooring, seeing your Closing Disclosure for the first time can feel a little... overwhelming. It's a long list of terms you’ve probably never seen before, and it can look like a foreign language.

Don't sweat it. We're going to walk through it together, line by line, and I'll translate everything into plain English. Think of it this way: I promised you hands-on service from start to finish, and that includes making sure you know exactly where every dollar is going. My goal is for you to sign those final documents feeling confident and in control.

This chart is a great visual map that breaks down the three main buckets your closing costs fall into.

As you can see, the total is a mix of fees for your lender, payments to other professionals involved, and a few expenses you pay upfront for the home itself.

Lender Fees: The Cost of Getting Your Loan

This first batch of fees goes directly to your mortgage lender. It’s what they charge for the service of putting your loan together and managing all the behind-the-scenes work to get it approved.

Loan Origination Fee: This is the lender’s main fee for processing your application. It’s usually a percentage of the total loan, typically between 0.5% and 1%. For example, on a $400,000 loan, you can expect this to be anywhere from $2,000 to $4,000.

Underwriting Fee: Think of the underwriter as the lender's detective. They're the ones who meticulously verify your income, assets, and credit history to give your loan the final green light. This fee covers their time and expertise.

Credit Report Fee: This is a small but essential charge, usually around $30-$50, to pull your credit report from the major bureaus. It's a key piece of the puzzle that helps determine your interest rate.

Third-Party Fees: Paying the Other Pros

Next up are the costs for all the other independent professionals who have a hand in your home purchase. These services are crucial because they protect both you and the lender, making sure the whole transaction is airtight.

A perfect example is the appraisal fee. You're paying a licensed appraiser to give an unbiased, expert opinion on the home's fair market value. It's like having a trusted mechanic inspect a used car before you buy it—you want to know you're making a sound investment.

Here are a few other common third-party fees:

Title Search & Insurance: This one’s a big deal. A title company digs through public records to make sure there are no hidden ownership claims or liens on the property. Then, you buy a title insurance policy to protect yourself and the lender from any issues that might pop up down the road.

Home Inspection Fee: While your lender might not require it for new construction, a home inspection gives you incredible peace of mind. You hire an inspector to do a top-to-bottom check of the home's structure and systems.

Attorney Fees: In some states, an attorney is required to oversee the closing. They review all the documents to ensure the sale is legally sound and that your interests are protected.

Government Fees: Taxes and Recording Charges

The last category covers the fees required by your local and state government to make the property transfer official. This is where things can really vary depending on where your new home is.

Location is one of the biggest factors in total closing costs. We see dramatic differences across the U.S., from as low as $1,551 in South Dakota to $13,738 in New York and a staggering $17,545 in Washington D.C. Here in Maryland, where we build in fantastic communities like White Marsh and Edgewood, costs tend to be higher than the national average. You can often expect to see costs between $8,000 and $12,000 on a $400,000 home, thanks to state recordation taxes and escrow requirements.

The Good News: Don't let that $12,000 number scare you. Our buyers can use builder incentives to pay for all of these closing costs and your pre-paid items.

What does that mean for you? It means you can move into a stunning new home in Baltimore County or Harford County for just your down payment. And for our homes in Trimble Meadows and potentially Vista Reserve, qualified buyers could even move in for $0 out-of-pocket with our exclusive 100% financing program. My job is to make this journey as smooth as possible, and that includes finding every way to make your dream home a financial reality.

Let's Talk About Your Prepaid Items and Escrow Account

Alright, let's tackle a part of closing costs that often makes people's eyes glaze over: prepaid items and your escrow account. I know, it sounds a bit like financial jargon, but I promise it’s much more straightforward than it seems. These aren't really fees for services already rendered; think of them as you getting a head start on your homeownership bills.

It’s a bit like setting up your BGE or cable service before you move in. You pay a little something upfront to make sure the lights and internet are ready to go the moment you walk through the door. Prepaids are the exact same concept, just for your home's bigger annual expenses.

What Exactly Are Prepaid Items?

Prepaid items are just what they sound like—costs you pay in advance at the closing table for expenses you'll owe down the road. The two main ones you'll always see are homeowner's insurance and property taxes.

Homeowner's Insurance: Your lender will require you to pay the entire first year's insurance premium right at closing. This is non-negotiable for them because it guarantees the home (their investment) is protected from day one.

Property Taxes: You'll also prepay a few months of property taxes. How many months depends entirely on what time of year you close and when the county tax bills are due.

Getting a handle on home insurance is a big piece of the puzzle here, as it's a key reason why lenders put so much emphasis on creating these prepaid arrangements in the first place.

How Your Escrow Account Works

So, where does this prepaid money actually go? It gets deposited into an escrow account.

The easiest way to think of an escrow account is as a separate savings account for your home's big bills, which your lender manages for you. You put the initial "seed money" in at closing, and then every month, a small piece of your mortgage payment is automatically tucked away into that same account.

Think of your escrow account as a "bill-paying assistant" for your house. Your lender collects a little from you each month, holds it in this special account, and then pays your property taxes and homeowner's insurance for you when the bills come due.

This setup is a win-win. It protects you from getting hit with a huge tax bill once or twice a year, and it gives the lender peace of mind knowing those critical expenses are always paid on time.

How Maryland Taxes Affect Your Escrow

The amount of cash you'll need for these prepaids can swing quite a bit depending on your new home's location. Here in Maryland, every county sets its own property tax rates.

For example, a home in White Marsh (Baltimore County) has a completely different tax rate than one just down the road in Edgewood (Harford County). This directly impacts how much money you need to bring to closing to fund that escrow account. A higher tax rate simply means you need a bigger cushion to start with.

This might sound like just another big check to write, but this is exactly where my hands-on help and our builder promotions really shine.

Here's the incredible news: with our current incentives, you can often use them to cover ALL of your closing costs plus these prepaid items. We’re talking about your first full year of homeowner’s insurance and an estimated 12 to 14 months of property taxes. For many buyers, this means you can move into your brand-new, customized home for just your down payment.

And for our homes in Trimble Meadows and potentially Vista Reserve, it gets even better. We have an exclusive 100% financing loan program that could allow qualified buyers to move in with $0 out-of-pocket. This is a completely separate thing from your earnest money deposit, which is the good-faith deposit you make when your offer is accepted. My entire goal is to use every tool and program we have to get you into your dream home without the financial stress.

Smart Strategies to Lower Your Closing Costs

Alright, let's get to the good stuff—how you can keep more of your hard-earned cash in your pocket. Now that we've unpacked what goes into closing costs, let's talk about how to knock that final number down. A little know-how can save you thousands, making your dream home that much more attainable.

Think of it like shopping for a new car. You wouldn't just accept the sticker price, right? You’d compare dealerships, hunt for rebates, and negotiate. The same logic applies perfectly to your mortgage and all the fees that come with it. It all starts with being a smart, proactive buyer.

Compare Lenders and Loan Estimates

One of the most powerful moves you can make is simply to shop around. Don't feel obligated to go with the first lender that pre-approves you. I always advise clients to apply with at least three different lenders. This gives you multiple Loan Estimates to compare, which is the standardized document breaking down their proposed interest rates and fees.

When you lay these estimates side-by-side, it's easy to spot who has the better deal on things like origination and underwriting fees. Even a slightly lower interest rate or a few hundred bucks saved on fees adds up to a huge difference over the long haul.

Negotiate with the Seller or Builder

Here's another fantastic strategy: ask for concessions. A seller or builder concession is just a fancy term for getting the seller to pay for some of your closing costs. This is incredibly common in new construction, and it's an area where we really help our clients shine.

For instance, a builder might offer a $10,000 credit toward your closing costs instead of dropping the home's price by $10,000. It's often a win-win. The home’s appraised value stays strong, and you have to bring way less cash to the settlement table. You lose nothing by asking what incentives are on the table.

This is where my hands-on service and our unique promotions truly benefit you. With our current incentives, buyers can often use them to pay for all of the closing costs and pre-paid items—that includes your first year of homeowner's insurance and up to 14 months of property taxes.

What does that actually mean? It means you could move into a beautiful, customized home in White Marsh or Edgewood for just your down payment. Better yet, in our Trimble Meadows and possibly Vista Reserve communities, our exclusive 100% financing program could get qualified buyers into a new home with $0 out-of-pocket.

Other Smart Tips for Savings

Beyond those bigger moves, a few other savvy tricks can add up to real savings.

Schedule a Late-Month Closing: This is a classic tip for a reason. Closing near the end of the month shrinks the amount of prepaid interest you owe. You only pay for the days you own the home in that first month, so a closing on the 28th means just a few days of interest versus a whole month's worth if you close on the 2nd.

Review Your Closing Disclosure Carefully: Always, always compare your final Closing Disclosure with your initial Loan Estimate. Don't be shy about questioning any fees that shot up or new charges you don't recognize. Knowing what's what, like the purpose of a property survey, empowers you to catch any errors.

Closing Cost Savings Checklist

To help you stay on track, I've put together this simple checklist. Use it to map out where you can find savings as you go through the homebuying journey.

Savings Strategy | Potential Savings | Action Step |

|---|---|---|

Shop for Lenders | $500 - $1,500+ | Get Loan Estimates from at least 3 different lenders and compare fees. |

Seller/Builder Concessions | $2,000 - $10,000+ | Ask your agent to request concessions in your offer to cover some or all closing costs. |

Close at the End of the Month ifPossible | $50 - $1,000+ | Discuss scheduling with your lender and title company to minimize prepaid interest. |

Review Closing Disclosure for Errors | $100 - $500+ | Compare your final disclosure to the Loan Estimate and question any discrepancies. |

Ask About Incentive Programs | Varies Widely | Inquire about builder incentives or local/state homebuyer assistance programs. |

Every little bit helps, and being organized with a checklist ensures you don't leave any money on the table. Happy savings!

Move Into Your Home With Zero Closing Costs

After running through all those fees, I know what you’re probably thinking: “How on earth am I going to cover all of that?” It’s a valid concern, and I firmly believe that the stress of upfront costs shouldn’t get in the way of building your dream home.

That’s why I do more than just build beautiful homes; I work to create real solutions that make homeownership a reality for my clients.

My current promotions are designed to do just that—help you clear the closing cost hurdle completely. Imagine using builder incentives to cover ALL of your closing costs and prepaid items. I'm not just talking about the lender and title company fees. This can include your entire first year of homeowner's insurance and up to 12 to 14 months of property taxes.

What This Means For You

So, what does that actually look like for you? It means you could walk into settlement for your brand-new, customized home needing only your down payment.

You get to focus on the fun stuff—like picking out your perfect flooring, countertops, and cabinets—without the nagging worry of scraping together thousands of extra dollars just to get the keys.

My hands-on approach isn't just for the design studio. I’m here to help you navigate the financial side, too. Using our unique visualization tools and years of expertise, we can make your dream a reality with far less stress. This is about bringing your vision to life, both creatively and financially.

The Ultimate Opportunity: A $0 Move-In

Right now, in our Trimble Meadows community (and potentially Vista Reserve), we're offering an exclusive 100% financing loan program. For buyers who qualify, this is a true game-changer. It stacks our powerful closing cost incentives on top of a loan that requires no down payment whatsoever.

The result? You could genuinely move into your beautiful new home with $0 down and $0 in closing costs. It’s an incredible opportunity to start your homeownership journey without that heavy, upfront financial lift.

This isn’t just another sales pitch; it's my commitment to helping you achieve your goals. Ready to see if you qualify and how you can take advantage of these savings? Let’s connect and figure out how we can get you into the customized home you've always wanted.

Got Questions About Closing Costs? I've Got Answers.

As we wrap up, let's tackle a few of the most common questions I hear from homebuyers. Think of this as our final huddle before the big day—I want to make sure you feel totally clear and confident about what to expect at the closing table.

Are My Closing Costs Tax Deductible?

This is a smart question, and one I get all the time. While you can't deduct every single fee (like the appraisal or title insurance), a couple of key items often qualify. The big ones are usually any prepaid mortgage interest—you'll see this listed as "points"—and the property taxes you paid at closing.

Let's say you paid $2,500 in property taxes and another $1,500 in mortgage points when you signed your final papers. That $4,000 could potentially be a deduction. Of course, tax laws can get tricky, so I always tell my clients to have a quick chat with their tax advisor to see how it applies to their specific situation.

Can I Just Roll the Closing Costs Into My Loan?

You bet. This is a really popular strategy for buyers who want to keep more cash in their pockets upfront. Essentially, you just add the closing costs to your total loan amount.

For instance, if your loan is $350,000 and your closing costs are $10,000, you'd simply take out a mortgage for $360,000. The upside is obvious: you need less money on closing day. The trade-off is a slightly higher monthly payment because you're borrowing a bit more. It's a great option for many people, and we can definitely talk through if it's the right move for you.

Do Sellers Have to Pay for Anything?

They sure do! While buyers usually see a longer list of fees, sellers have their own responsibilities. They're almost always on the hook for the real estate agent commissions, their portion of the property taxes, and any unpaid HOA dues.

Here in Maryland, especially in places like Harford County or Baltimore County, it's also common for sellers to pay a transfer tax. And when the market is right, a seller might even agree to contribute to the buyer's closing costs to help seal the deal.

My job isn't just to build you a beautiful home. It's to guide you through every one of these financial steps, making sure you understand exactly where your money is going. And don't forget, our current promotions can often cover all of your closing costs and prepaids. For qualified buyers in our Trimble Meadows community, and possibly Vista Reserve, that could mean getting into your brand new home for just your down payment—or maybe even $0 with our exclusive 100% financing loan program.

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. Let’s start bringing your vision to life. Start customizing your dream home today.