Home Construction Loan Requirements Made Simple

- Justin McCurdy

- Sep 14, 2025

- 10 min read

Dreaming about building your new home is the fun part. Figuring out how to pay for it? That can feel a little overwhelming. Let's cut through the noise with a friendly guide.

The short answer is that most lenders are looking for a credit score of 680 or higher, a down payment of at least 20%, and a super-detailed construction plan. These are the non-negotiables that get your foot in the door.

This article covers the typical process of building a custom home. Don't have 20% for a down payment or a 680 credit score? Not to worry! When you buy a home with me, you only need a 580 to 620 middle FICO score and 3% to 3.5% for your down payment and in a few communities, you can even move-in for $0 with a lower than market rate if qualified. While these are not custom homes, we build these like we build our custom homes and we let you customize your home. You will also get to use my exclusive visualizer tool to see your vision come to life even before we build it! I do everything possible to make your dream of home ownership as simple and enjoyable as possible.

Your First Step to Building a Dream Home

It's one thing to stand on an empty piece of land and imagine your future home, but it's another to actually make it happen. Before you get lost in paint swatches and kitchen layouts, you need to lock down the financing. This is your no-nonsense guide to understanding what it really takes to get a construction loan.

Getting your financing sorted out early makes the entire building process—from pouring the foundation to final walkthrough—a whole lot less stressful. It all boils down to preparation. Lenders need to feel confident that you’re a good bet and that your project is realistic.

They're essentially looking for proof of three things:

A Solid Financial Profile: Can you handle the loan? They’ll want to see a history of you managing your money well.

A Detailed Building Plan: Do you have a real plan? This shows them you’ve thought through every single detail.

A Clear Budget: Do you know the costs? A line-by-line budget proves your project is financially sound.

Securing your loan is the official starting line for your home-building journey. It transforms your dream from a simple idea into a tangible project with a real timeline and budget.

To give you a clearer picture, here's a quick summary of what you'll typically need to have in order.

Quick Glance at Typical Construction Loan Requirements

This table breaks down the baseline requirements most lenders will ask for when you're applying for a home construction loan.

Keep in mind, these are just starting points, and every lender has slightly different criteria.

Finding a lender who gets the ins and outs of new construction is just as crucial as having your ducks in a row. I always make sure my clients are connected with seasoned pros who make the process smooth. You can check out some of the best new home construction lenders in Maryland that we partner with to help build dream homes in communities across White Marsh, Edgewood, and Baltimore County.

What Lenders See When They Look at Your Finances

Before any lender signs off on a construction loan, they need to get a clear picture of your financial health. Think of it like a three-legged stool—if one leg is weak, the whole thing gets pretty wobbly. For lenders, those three legs are your credit score, your debt-to-income (DTI) ratio, and the cash you have for a down payment.

These loans are a different beast than a standard mortgage. They’re short-term, usually lasting just 6 to 18 months, and you only pay interest while your home is being built. This makes them a higher risk for the lender, so they’re a bit stricter on who qualifies. Our friends at Trident Home Loans have some great insights into what makes these loans unique.

Your Credit Score: The First Hurdle

The very first thing a lender will pull is your credit score. It’s their at-a-glance report card on how you’ve handled debt in the past. To even get in the game for most construction loans, you'll need a score of 680 or higher.

Honestly, the higher, the better. A score above 720 puts you in a much stronger position, often unlocking better interest rates and more favorable terms. For example, a higher score might mean the lender requires a slightly lower down payment, which can save you a ton of money upfront.

Debt-to-Income (DTI) Ratio: Can You Handle the Payments?

Next up is your DTI. It sounds technical, but it’s just a simple comparison of how much you owe each month versus how much you earn.

Think of your monthly income as a pizza. Lenders want to see that your existing debts—car payments, student loans, credit cards—aren't eating up more than 43% of that pizza. A lower DTI shows them you have plenty of room in your budget to comfortably take on the new loan payment without being stretched too thin. For instance, if you make $8,000 a month, your total monthly debt payments should be under $3,440.

The Down Payment: Your Skin in the Game

This is where construction loans often surprise people. Unlike some traditional mortgages, you can’t just scrape by with a tiny down payment. Lenders will expect you to put down 20% to 25% of the total project cost in cash.

Why so much? This substantial investment lowers their risk and proves you're fully committed to seeing the project through. It’s your skin in the game.

Coming up with that chunk of change can feel like a massive hurdle, but it's totally doable with the right strategy. If you need some ideas, we've got a great guide on down payment tips for first-time buyers that can help.

Getting Your Paperwork Dialed In

Want to know the secret to a smooth, stress-free loan process? Get all your documents in order before you even talk to a lender. I like to think of it as building a "loan application toolkit." The more complete your kit is, the faster and easier everything will be.

For a standard mortgage, you know the drill: pay stubs, W-2s for the last couple of years, bank statements. But a construction loan is a different beast entirely. Your lender isn't just betting on you; they're investing in a project that doesn't exist yet, so they need to see the whole blueprint.

What Your Lender Really Wants to See

On top of your personal financial info, your application needs to paint a crystal-clear picture of the project itself. This is where the home construction loan requirements go much deeper than a typical home loan.

Here's what you'll need to have ready:

Builder Details: The lender needs to vet and approve your builder. This means you'll need to provide their license, insurance, and a resume of past projects. They want to see a track record of success.

The Full Plans: We're talking architectural blueprints and a detailed spec sheet that lists out all the materials and finishes. Seriously, get specific—right down to the doorknobs and faucets you plan to customize.

A Rock-Solid Budget: Your lender will want a line-item budget that breaks down every single anticipated cost, from digging the foundation to planting the last shrub. It proves you've thought this through.

Construction Schedule: A realistic timeline is key. It should map out each phase of the build and when you expect it to be done. This is what the lender uses to structure the loan's payment draws.

Think of the builder contract and budget as your project's business plan. It’s not just red tape; it shows the lender you’ve got a professional, well-thought-out strategy for every dollar they’re about to invest.

Once you apply, the lender will provide a document called a Loan Estimate. It’s a standardized form that clearly breaks down all the costs involved. The Consumer Financial Protection Bureau provides great resources on this, including an example of what to expect.

This document is your best friend for comparing offers. It lays out all the key features, potential risks, and total costs in the same format for every lender, making it much easier to shop around and find the best deal.

How Construction Loan Payments Actually Work

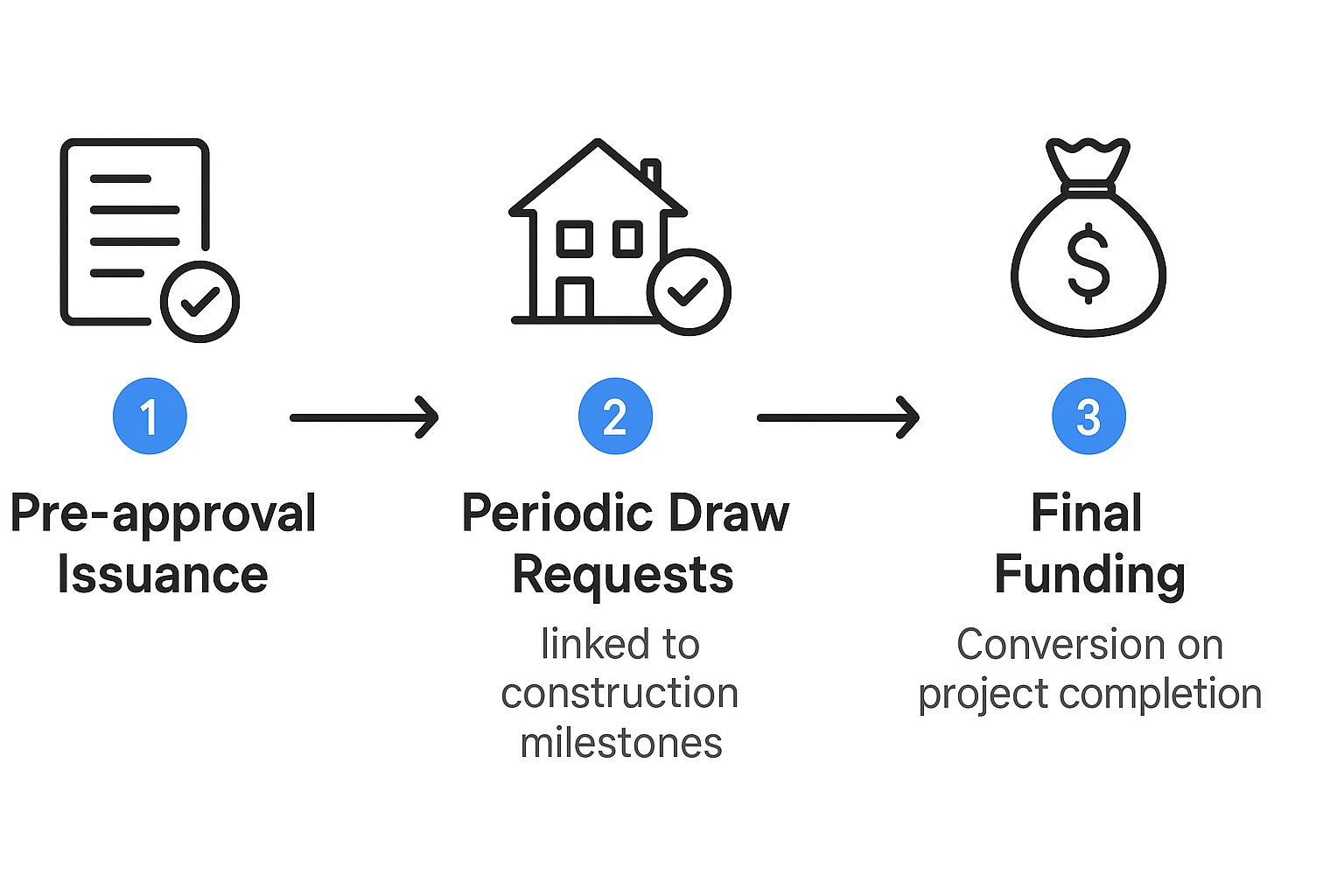

So, how does the money actually flow when you get a construction loan? It's a common question, and it's quite different from a standard mortgage. Instead of getting one big check at closing, a construction loan works more like a line of credit that's paid out in stages.

These stages are called draws, and they’re tied directly to specific milestones in your build. It's a system designed to protect everyone involved—you, the builder, and the lender.

Think of it this way: your builder can't just take the full loan amount and disappear. They have to prove the work is getting done. First, they pour the foundation. Once it passes inspection, they can "draw" the funds allocated for that phase. This pay-as-you-go model continues for every major step, from framing and roofing all the way to installing the final fixtures.

The Draw Schedule Process

This structured payment plan, or draw schedule, is the roadmap for your project's funding. The builder requests a draw, the lender sends an inspector to verify the work is done to code, and then the money for that stage is released. Simple as that.

The infographic below gives you a great visual of how this whole process unfolds, from getting pre-approved to finally converting the loan.

As you can see, each step builds on the last, unlocking the funds needed to move the project forward. It keeps everyone accountable and ensures the money is being spent exactly as planned.

Understanding this sequence is a huge part of feeling confident in the process. If you want to see how these draws line up with the actual building timeline, check out our guide on the new home construction timeline explained. It really connects the dots between the money and the work happening on-site.

My job, whether you're building in White Marsh, Edgewood, or anywhere in Baltimore County, is to make sure this whole process is smooth and transparent. I’m right there with you and the builder, making sure every draw request matches the quality work being done. It’s a hands-on approach that keeps you in the driver’s seat.

So, What's the Deal with Construction Loan Interest Rates?

Talking about construction loan interest rates can feel like trying to hit a moving target, but it's not as complicated as it sounds. Most of these loans come with a variable rate, which simply means the interest rate can fluctuate while your home is being built.

This is pretty standard stuff. Since a construction loan is a shorter-term, higher-risk product for the bank, they bake in that flexibility. After all, nobody has a crystal ball to know where rates will be in 12 or 18 months when the project wraps up.

Right now, you'll find that most residential construction loans are landing somewhere between 6.25% and 9.75% APR. These numbers are definitely a shift from what we saw a few years ago, and it's largely a ripple effect from Federal Reserve policies that guide what lenders charge. If you want to dive deeper into the "why," this article explains what's driving up rates.

Lock in Your Rate and Get Some Peace of Mind

Here's the good news: you don't have to spend your entire build worrying about where rates will end up. There’s a fantastic solution called a construction-to-permanent loan, and it’s the go-to option for good reason.

This type of loan lets you lock in a fixed interest rate for your permanent mortgage before the first shovel even hits the ground.

Think of it like this: you're setting your home's long-term mortgage rate in stone today, protecting yourself from any potential rate hikes down the road. It offers incredible peace of mind.

The best part? It’s a "one-time close" loan. That means you avoid the hassle of having to re-qualify for a separate mortgage and paying a whole second set of closing costs once the house is done. It’s the path I guide my clients toward because it provides financial stability, letting them focus on the fun stuff—like customizing their dream home in communities across Harford County and Prince George's County.

Designing a Home That Is Uniquely Yours

Alright, you've got your financing lined up. Now for the really fun part—making this house your home. This is where your vision and personality truly come to life. While we provide a high-quality home, you’re the one who infuses it with character by choosing your own finishes.

Think of me as your personal guide through this creative process. We'll use our visualization tools so you can play around with different styles and finishes without any of the commitment. You can see exactly how that flooring will look next to your cabinets or find the perfect countertops to serve as the heart of your kitchen. From cabinets to tile, every choice is yours.

My job goes beyond just building a house. I'm here to help you pull together a cohesive, beautiful space. I stick with you through the selection process to make sure every single element works together perfectly—something you don't always get with other builders.

We’re ready to bring your dream home to life in incredible communities across White Marsh, Edgewood, Baltimore County, Harford County, and Prince George's County.

If you want to get a head start on understanding the core of your home's design, check out our guide on how to read house blueprints. Let's connect and start designing!

Got Questions About Construction Loans? We've Got Answers.

Jumping into the world of construction financing can feel like learning a new language. Let's break down a few of the most common questions that pop up, so you can feel confident about meeting your home construction loan requirements.

Can I Get A Construction Loan With A Lower Credit Score?

This is a big one. While most lenders really like to see a credit score of 680 or higher, a lower score isn't necessarily a showstopper. There are some government-backed programs out there, like FHA or VA construction loans, that can be a bit more flexible.

Just keep in mind, a lower score usually means you'll be looking at a higher interest rate. Lenders might also ask for a larger down payment to offset their risk. Your best bet is always to work on bumping up that score before you apply—it’ll save you money in the long run.

What's The Real Difference Between A Construction Loan And A Mortgage?

Think of it this way: a construction loan is like a short-term tab you run at the hardware store while you're building. It's temporary, usually lasting 6-18 months, and it pays your builder in stages as work gets done. During this phase, you're typically just paying the interest.

A mortgage is the long-term loan you get for a finished house. Once the last nail is hammered in and you're ready to move in, the construction loan gets paid off and rolls into a normal mortgage that you'll pay off over the next 15 or 30 years.

Lots of people opt for a "construction-to-permanent" loan. It's a popular option that bundles both phases together with just one closing, which really simplifies the paperwork.

Do I Have To Own The Land Before I Apply?

Nope, you don't have to! Many construction loans are designed to wrap the cost of the land purchase right into the total loan amount. It’s all handled in one package.

But if you do already own your lot, you've got a great head start. You can often use your land's equity as part of your down payment, which can seriously lower the amount of cash you need to bring to the table.

I do more than just build your house—I help you make it yours. With hands-on service and unique customization tools, we'll create the perfect home for you in one of Maryland's beautiful communities in White Marsh, Edgewood, Baltimore County, Harford County, and Prince George's County. Ready to get started? Let's talk. You can learn more about our process at https://www.customizeyourhome.com.

Comments