Home Warranty vs Insurance Explained

- Justin McCurdy

- Oct 9, 2025

- 13 min read

So, you’re diving into homeownership—congratulations! It’s a huge step, and one of the first things you'll want to figure out is how to protect your investment. You’ve probably heard the terms "home warranty" and "homeowners insurance" thrown around, and it's easy to get them mixed up. They sound similar, but they do completely different jobs.

Think of it this way: homeowners insurance is for the big, unpredictable disasters—the stuff you hope never happens. For example, if a major storm hits your neighborhood and a tree falls on your house, that’s a job for insurance. A home warranty, on the other hand, handles the more predictable (and annoying) breakdowns that come from everyday use. Imagine your oven suddenly stops heating up right before a big family dinner—that's where a warranty comes in.

Your Guide to Home Protection Plans

Let’s get straight to the point. Homeowners insurance is your shield against catastrophe. If a nasty thunderstorm rolls through your Baltimore County neighborhood and takes half your roof with it, your insurance policy is what you’ll call to help cover those massive repair bills. It’s almost always required by your mortgage lender for this very reason.

A home warranty is your secret weapon for everyday household headaches. Your dishwasher suddenly gives up the ghost? The air conditioning conks out in the middle of a July heatwave? That's a job for your home warranty. It’s built to cover the repair or replacement of major appliances and systems that fail due to normal wear and tear.

Warranty vs. Insurance: The Core Differences

Breaking it down further, the key is understanding their separate roles and costs. A home warranty typically runs between $747 and $1,400 a year and is designed to keep your out-of-pocket repair costs low. Homeowners insurance has a much wider cost range, anywhere from $610 to over $6,000 annually, because it’s protecting against far more expensive, catastrophic events.

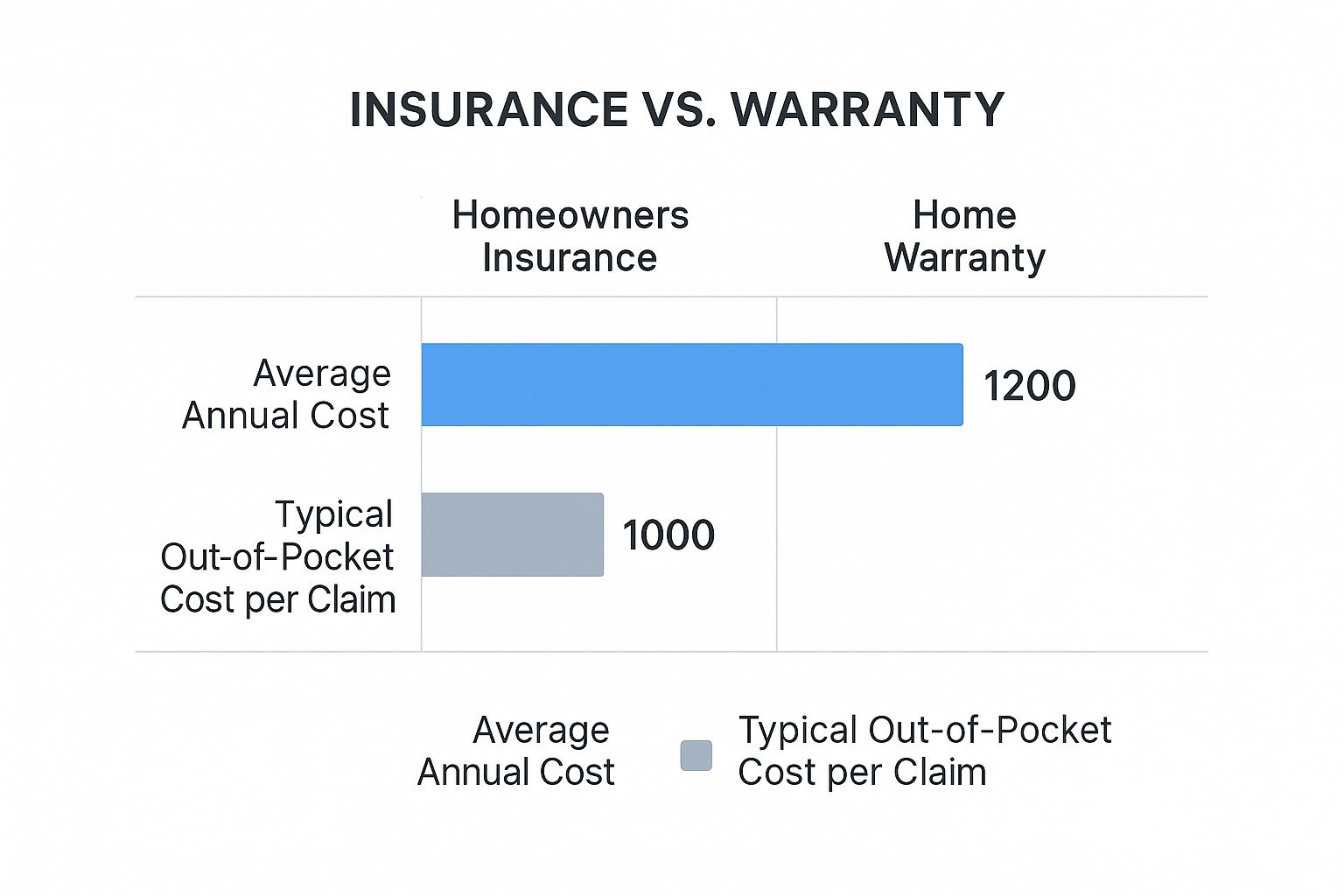

The infographic makes it clear: while your insurance premium might be higher, a warranty’s low service fee per incident is a lifesaver for budgeting against those smaller, but still costly, repairs.

Home Warranty vs. Insurance At a Glance

Here's a quick breakdown of what each plan covers so you can see the key differences side-by-side.

Coverage Focus | Home Warranty | Homeowners Insurance |

|---|---|---|

What's Covered? | Major home systems (HVAC, plumbing) and appliances (refrigerator, oven) that break down from normal use. | The structure of your home, personal belongings, and liability from accidents. |

Why It Fails | Everyday wear and tear. | Sudden, accidental events like fire, theft, or severe weather. |

Typical Cost | $747–$1,400 annually, plus a service call fee ($75–$125) per claim. | $610–$6,000+ annually, with a deductible ($500–$2,000+) per claim. |

Is it Required? | No, it's an optional service contract. | Yes, almost always required by your mortgage lender. |

Ultimately, these two policies work together to create a comprehensive safety net for you as a homeowner.

Building Your Perfect Protection Plan

As you get settled into a new home in a community like White Marsh or Edgewood, having both plans in place is a smart move. It gives you true peace of mind. Even in a brand-new build, this dual-layer approach means you're covered whether a storm damages your siding or your furnace decides to quit.

Having both a home warranty and homeowners insurance isn't redundant—it's smart. One covers the structure from disasters, while the other covers the systems that make your house a home.

Finding the right house is just the beginning. Knowing how to protect it is what makes it a secure, long-term investment. If you're currently exploring new construction homes in Maryland, your guide to a perfect fit can help you navigate the process with confidence. While the builder I represent provides high-quality homes, I go a step further—offering my clients unique customization tools, hands-on service, and access to visualizers that help you bring your dream space to life. You get to pick your own flooring, countertops, and cabinets. Let's work together to create a home that's not just beautiful, but protected from day one.

Decoding Your Homeowners Insurance Policy

Alright, let's talk about homeowners insurance. If you have a mortgage, your lender is going to insist on it. But don't just see it as another bill—think of it as a financial backstop for your biggest investment. This is what protects you from the big, catastrophic stuff that could otherwise sink you financially.

At its heart, homeowners insurance is all about sudden and accidental damage. It's there to help you recover when a disaster strikes, not when your dishwasher gives up the ghost from old age. For a practical example, picture a nasty storm ripping through your Harford County neighborhood and tearing up your roof; that’s exactly what your insurance policy is for.

What Your Policy Typically Covers

A standard policy, often called an HO-3, usually bundles a few different types of protection together. Getting a handle on these is key to knowing where your money is going.

Dwelling Coverage: This is the headline act. It protects the actual structure of your house—the foundation, walls, roof, and even things attached to it, like a deck.

Personal Property: This covers all the stuff inside your house. Think furniture, clothes, TVs, and computers. If a covered disaster hits or you're burglarized, this coverage helps you replace your belongings.

Liability Protection: This one is huge. As a practical example, if a friend slips on your icy porch or a delivery person trips on a loose step, liability helps pay for their medical bills and your legal fees if they sue.

Additional Living Expenses (ALE): If a fire or major storm damage makes your home unlivable, ALE coverage is a lifesaver. It helps pay for hotel stays, rent, and other living costs while your house is being repaired.

One of the biggest mistakes people make is assuming homeowners insurance covers absolutely everything. It doesn't. It's built to cover specific events, or "perils," like fire, theft, and wind. Normal wear and tear or problems from poor maintenance are on you.

Exclusions and Limits to Keep in Mind

Every policy has its limits. Standard plans almost always exclude damage from floods and earthquakes—you’ll need separate policies for those. And it's not a blank check; you need to pay close attention to the fine print, which includes understanding insurance policy limits. This is the absolute maximum your insurer will pay out for a specific claim.

Everyone's needs are different, so it's smart to find a policy that really fits your life. And when you’re ready to look for that perfect home in Maryland, remember that I offer a truly hands-on service. I have unique tools that let you customize everything from flooring to countertops, so you can see your dream home come to life.

How a Home Warranty Really Works

Okay, let's switch from thinking about major disasters to the smaller, everyday headaches of owning a home. This is where a home warranty comes into play. Think of it as a service contract for the stuff you use every single day—the appliances and systems that keep your house running. It’s built to cover the cost of repairs or replacements when things just give out from normal, everyday use.

For a practical example, picture this: you're a year into your new place, and your dishwasher just quits halfway through a load. Instead of panicking, frantically searching for a trustworthy repair person, and bracing for a bill that could be hundreds of dollars, you just make one call to your warranty company. That’s the whole point—managing and budgeting for those common, and always frustrating, household breakdowns.

What a Standard Plan Covers

Most home warranty plans focus on protecting the real workhorses of your home. The exact details will always differ between companies, but a basic policy is designed to cover the major systems and appliances you can't live without.

Here’s what you can generally expect to find in a standard plan:

Major Kitchen Appliances: We're talking about your refrigerator, oven, range, dishwasher, and that built-in microwave.

Plumbing Systems: This takes care of things like annoying leaks, clogs, and other typical plumbing failures.

Electrical Systems: Got a problem with your wiring, outlets, or breaker panel? This has you covered.

Heating and Cooling (HVAC): This is a huge one. It covers your furnace and air conditioning, which are crucial for staying comfortable.

Water Heater: A lifesaver when it fails, ensuring you aren't stuck taking ice-cold showers.

On top of the standard stuff, many companies let you add optional coverage for extras like a pool, spa, well pump, or septic system. This lets you build a plan that truly matches what your property has. If you want to dive deeper into the nitty-gritty, our simple guide on [what is home warranty coverage](https://www.customizeyourhome.com/post/what-is-home-warranty-coverage-a-simple-guide) breaks it all down.

The Claim Process Demystified

So, what happens when something actually breaks? The process is surprisingly simple.

When a covered item dies on you, you just contact your warranty provider to file a claim. They’ll then send one of their pre-screened, approved technicians to your house to figure out what's wrong.

When the tech shows up, you'll pay a set service fee—this is usually somewhere between $75 and $125—directly to them. That fee is pretty much your only out-of-pocket cost for the entire repair, no matter how big the final bill is. From there, the warranty company handles the rest, covering the repair or replacement up to the limits spelled out in your contract.

It’s a system that’s clearly catching on. The home warranty market has ballooned into a $3.6 billion industry, which tells you a lot about how many homeowners are looking for this kind of predictability. It's all about buying peace of mind and protecting your budget from those sudden, expensive surprises.

A Look at the Costs and Claims Process

When you get down to it, the biggest difference between a home warranty and homeowners insurance is the money—what you pay to have the policy and what you pay when you actually need it. They both protect your bank account, just from very different kinds of threats.

Let's talk about homeowners insurance first. The two main numbers you need to know are your annual premium and your deductible. Your premium is what you pay every year to keep the policy active, and it can be all over the map depending on your home's age, where it's located, and what it's made of. For example, a home in a flood-prone part of Baltimore County is going to have a different premium than one in a quieter part of Prince George's County.

Your deductible is the amount you have to pay out of your own pocket before the insurance company steps in. When something big happens, like a tree falling on your roof, you’ll pay that deductible—often $1,000 or more—and the insurance handles the rest.

A home warranty works on a totally different financial scale. You’ll pay a monthly or annual fee for the plan, and when a covered item like your dishwasher suddenly gives up, you just make a claim and pay a flat service call fee. This is usually a much more manageable $75 to $125.

What a Claim Looks Like in Real Life

To make this crystal clear, here are a few practical examples. Imagine you're a homeowner in a place like White Marsh, Maryland, and one of these two things happens:

Insurance Claim: A nasty hailstorm rolls through and wrecks your siding. The quote to fix everything comes in at $8,000. If your policy has a $1,500 deductible, you pay that, and your insurance covers the remaining $6,500.

Warranty Claim: You wake up one morning and your refrigerator is warm. You call the warranty company, they send a technician, and you pay your $100 service fee. That’s it. The warranty covers the cost of the repair or replacement.

The core financial difference is scale. Insurance protects you from catastrophic, budget-breaking events, while a warranty smooths out the smaller, more frequent costs of homeownership.

Which one makes more sense financially really depends on your specific home. The cost of homeowners insurance is tied directly to your home's value—for every $100,000 your home is worth, your premium can jump by $400 to $500 a year. To get a better handle on these ongoing expenses, check out our guide on creating your ultimate monthly home maintenance list for 2025. You can also find some great breakdowns on how these costs are calculated by looking at statistics from Guardian Service.

At the end of the day, an insurance claim is a bigger deal. There's more paperwork and it takes longer because the financial stakes are so much higher. A warranty claim, on the other hand, is built for speed—it's all about getting a pro to your house to fix the immediate problem. When you choose a new home with me, I provide access to unique customization tools and visualizers to help you design your space from the start, ensuring you love every detail, from the countertops to the flooring.

Choosing the Right Protection for Your Home

Alright, we’ve broken down the nitty-gritty of home warranties versus homeowners insurance. So which one do you actually need? For just about every homeowner out there, the answer is refreshingly simple: you need both. But the real key is understanding why that combination is so crucial for your wallet and your sanity.

Think about it like this: your homeowners insurance is the absolute, must-have foundation. It's the huge safety net that catches you when a major disaster—like a fire or a tree falling through your roof—threatens to wipe out your biggest financial investment. Going without it just isn't an option.

A home warranty, on the other hand, is all about managing the everyday headaches of owning a home. It's your strategy for dealing with the smaller, yet still expensive, breakdowns that are bound to happen. This is especially true during your first year when you're still learning the quirks of every appliance and system.

Assessing Your Needs

Even if you’ve just moved into a brand-new, top-quality home in a community like White Marsh or Edgewood, a home warranty can add a serious layer of security. The builder’s warranty is great for the structure itself, but it won't help you when the dishwasher suddenly decides to quit.

Here are a few things to consider when you're weighing a home warranty plan:

Your Budget: Could you easily stomach a surprise $800 bill to fix the fridge or a $1,500 HVAC repair? A warranty transforms that potential budget-buster into a predictable service fee.

Your Risk Tolerance: Are you someone who prefers knowing exactly what you'll pay each month, or are you comfortable building up a big emergency fund and hoping for the best?

Convenience: Let's be honest, finding a reliable technician when you're in a panic is a pain. With a warranty, one quick call gets a pre-screened pro on their way to your door.

The bottom line is that pairing insurance with a warranty gives you a complete protection strategy. Insurance is there for the catastrophes, while the warranty handles the day-to-day repair bills that can sneak up on you.

Of course, making a house feel like home is about more than just protecting it—it’s about making it yours. While the builder I represent provides high-quality homes, I go a step further—offering my clients unique customization tools, hands-on service, and access to visualizers that help you bring your dream space to life. You get to pick out your flooring, countertops, and cabinets to make your vision a reality. If you're looking for that kind of personalized home-buying experience in Baltimore County or Harford County, let’s connect and build a home you'll love for years to come.

Create a Home That Is Uniquely Yours

Figuring out the difference between a home warranty and homeowners insurance is a big step toward becoming a savvy homeowner. But let's be honest, before you can worry about protecting your home, you have to create a space that actually feels like you. That journey starts way before you get the keys—it starts with a vision.

While the builder I represent provides high-quality homes in some of the best communities across Maryland, I go a step further—offering my clients unique customization tools, hands-on service, and access to visualizers that help you bring your dream space to life. I don't just hand over a set of floor plans. I offer a hands-on, personalized experience from the very beginning. This isn't just about buying a house; it's about creating your home.

Design Your Dream Space

I give my clients exclusive access to some really cool customization tools and visualizers that let you be the designer. We're not talking about picking from a few pre-set packages here. This is about seeing your dream kitchen or master bath take shape right on the screen as you mix and match:

Flooring: Think warm hardwoods or sleek, modern tiles.

Countertops: Play around with stunning granite, quartz, and other finishes.

Cabinets: Find the exact style and color that fits your vibe.

Tile: Design the perfect backsplash or shower surround.

Your home should be a direct reflection of your personality. My job is to give you the tools and guidance to make that a reality, making sure every little detail is just how you pictured it.

If you’re looking for a new home in great spots like White Marsh, Edgewood, Baltimore County, Harford County, or Prince George's County, let's talk. I'd love to show you around our communities and walk you through just how fun and easy it can be to design a home that is completely, uniquely yours.

Your Top Home Protection Questions, Answered

Getting a handle on home protection can feel a bit like learning a new language. You've got warranties, you've got insurance... what's the difference? Let's break down some of the most common questions I hear from homebuyers to clear up the confusion for good.

Will My Mortgage Lender Force Me to Buy a Home Warranty?

Nope, that's one thing you don't have to worry about. Lenders are focused on protecting their investment—the house itself. That's why they will always require homeowners insurance. As a practical example, insurance is what safeguards the physical structure against big-league disasters like fires, hail, or a tree falling on your roof.

A home warranty, on the other hand, is completely optional. It’s a service contract you buy for your own peace of mind, helping you manage the costs of those inevitable appliance and system breakdowns.

Is There Any Overlap Between a Home Warranty and Homeowners Insurance?

It's incredibly rare for them to overlap because they're designed for two totally different jobs. Think of them as teammates, not competitors.

Here’s a practical, real-world scenario: Imagine your water heater gives out and the resulting leak ruins that beautiful new hardwood floor in your Edgewood home.

Your home warranty would step in to cover the repair or replacement of the water heater itself, since it failed from normal wear and tear.

Your homeowners insurance would then handle the claim for the water-damaged floor, because that damage was caused by a sudden, accidental event.

See how they work in tandem? One fixes the source of the problem, the other fixes the resulting mess.

I'm Buying a Brand New Home. Do I Really Need a Home Warranty?

It's actually a pretty smart move, even with a new build. While our homes across Baltimore County and Harford County are built with top-notch systems and appliances, a home warranty gives you an extra layer of financial protection.

Your builder's warranty is great for covering major structural items. But what happens when your fancy new dishwasher decides to quit a month after the manufacturer's warranty expires? That’s exactly where a home warranty saves the day. It’s a budget-friendly safety net for those surprise repair bills that can pop up when you least expect them.

For a deeper dive into home protection, these general insurance FAQs offer some great insights.

I go beyond just finding you a great house. I provide a hands-on service with unique customization tools and visualizers that let you bring your dream space to life. If you’re ready to design a home that is uniquely yours, visit https://www.customizeyourhome.com to get started.

Comments