How Do I Get a House? A Practical Guide to Homeownership

- Justin McCurdy

- Dec 17, 2025

- 16 min read

Okay, let's be real. The absolute first step in getting a house isn't scrolling through Zillow—it's figuring out what you can actually afford. It’s so easy to get carried away by beautiful listings, but starting with a firm grasp on your finances is what separates a smooth homebuying journey from a stressful one.

Figuring Out What Home You Can Actually Afford

Before you even think about open houses or paint colors, you need a reality check. Falling in love with a home that’s out of your league only leads to frustration. Instead, let's get a crystal-clear picture of your money situation so you can hunt for a home with total confidence.

This isn't just about your salary. It means taking an honest look at everything—what comes in, what goes out, and what you’ve got tucked away. This simple exercise empowers you and makes the whole process way more fun.

Creating Your Personal Financial Map

Time to get forensic with your finances. Grab your bank statements and start by adding up all your monthly income. Easy enough.

Now for the tricky part: list out every single monthly expense. And I mean everything, from your car payment to that streaming service you forgot you had. Those little things add up fast.

Break it down to make it easier:

Fixed Costs: These are the predictable bills that hit your account each month—think rent, car loans, insurance, and student loans.

Variable Costs: This is the stuff that changes, like groceries, gas for your car, utility bills, and weekend fun. Look back at the last three months to get a solid average.

Subtract your total monthly expenses from your total monthly income. Whatever is left over is your magic number. This is what you have to work with for a mortgage payment and to continue saving for that down payment.

For example, say you bring in $6,000 a month after taxes and your expenses total $4,500. That leaves you with $1,500. That’s your starting point for what a lender will see as your capacity for a housing payment.

Pro Tip: Lenders often use the 28/36 rule. The idea is that your total housing costs shouldn't be more than 28% of your gross monthly income, and all your debt combined (car, student loans, etc.) shouldn't top 36%.

Dream Home vs. Right-Now Home

Here’s something every first-time buyer needs to hear: your first home probably won't be your "forever home," and that's completely okay. Think of it as a smart stepping stone. It gets you out of the rent race and starts building your personal wealth through equity.

Maybe your long-term dream is a huge single-family home with a sprawling yard. But for now? A brand-new townhome in a vibrant community like those in White Marsh, Maryland or Edgewood, Maryland might be the perfect fit. You get modern features, great amenities, and a strong community vibe in fantastic areas of Baltimore County and Harford County, Maryland—all at a price that works for your current budget.

If you want to get into the nitty-gritty of the numbers, check out our complete guide on how much house you can afford.

Don't forget to think about long-term ownership costs, too. Things like making your house more energy efficient to save money can have a huge impact on your monthly budget down the road. This is a big reason new construction is so appealing—modern building standards mean lower utility bills right from day one.

When you lay this financial groundwork first, you can start your house hunt with excitement instead of anxiety, knowing you're looking for a home you'll not only love but can truly afford.

Getting Your Finances in Shape for a Mortgage

Alright, you've got a budget in mind. Now it's time to switch gears and start thinking like a mortgage lender. This part can feel a little intimidating, but trust me, it’s all about getting your financial ducks in a row so you can walk in with confidence.

Lenders aren't trying to make your life difficult; they just need to be sure you can handle the loan. Think of it as opening up your financial playbook for them to see.

What Lenders Are Really Looking For

When a lender reviews your application, they're essentially trying to answer one big question: "Is this person a reliable borrower?" To do that, they zoom in on three main things:

Your Credit Score: This is your financial report card. It gives them a quick look at how you've managed debt in the past.

Your Debt-to-Income (DTI) Ratio: A fancy term for a simple calculation—how much of your monthly income is already spoken for by debt payments.

Your Assets: This is your cash on hand for the down payment and closing costs, plus any savings or investments you have.

Let's break down what each of these means for you.

Your Credit Score Is a Big Deal

Your credit score plays a huge role in this process. A higher score tells lenders you're a lower risk, which usually translates to a lower interest rate for you. Over the life of a 30-year mortgage, a better rate can literally save you tens of thousands of dollars.

Most lenders want to see a score of at least 620 to even consider you for a conventional loan. The real sweet spot, though, is 740 or higher—that’s where you’ll get the most competitive rates. If your score isn't there yet, don't sweat it. You can nudge it in the right direction by simply paying bills on time and keeping your credit card balances down.

Pro Tip: A quick way to boost your score is to keep your credit utilization below 30%. For a practical example, if your credit card has a $10,000 limit, try to keep the balance under $3,000. It shows you aren't maxing out your available credit.

Getting a Handle on Your DTI Ratio

Next up is your debt-to-income ratio, or DTI. This is the number lenders use to make sure a new mortgage payment won't stretch you too thin. To figure out your DTI, just add up all your monthly debt payments (think car loan, student loans, credit card minimums) and divide it by your gross monthly income (your income before taxes).

Let's say your total monthly debts are $1,500 and you earn $6,000 a month. Your DTI would be 25% ($1,500 ÷ $6,000).

Lenders generally want to see a DTI of 43% or less, and that includes your estimated new mortgage payment. This is their way of making sure you’ll still have money left over for, you know, everything else in life. It's also why having a down payment is so important. While putting 20% down helps you avoid private mortgage insurance (PMI), a lot of first-time buyers put down closer to 7%.

Pre-Qualification vs. Pre-Approval: What’s the Difference?

You're going to hear these two terms thrown around a lot. They sound almost the same, but they are worlds apart in the eyes of a home seller.

A pre-qualification is basically a ballpark estimate. You tell a lender your income and debts, and they give you a rough idea of what you might be able to borrow. It’s a good starting point, but it's not a guarantee. You can learn more about this first step in our post on getting prequalified for a mortgage loan.

A pre-approval is the real deal. For this, you’ll submit actual documents—pay stubs, tax returns, bank statements—and the lender will do a deep dive into your finances. If all looks good, they'll give you a letter stating they've conditionally committed to lending you a specific amount.

Having that pre-approval letter in hand is like having a golden ticket. It shows sellers you're serious and have the financial backing to make a solid offer, giving you a major leg up, especially in hot markets like those in Baltimore County, Maryland and Harford County, Maryland.

4. New Build or Resale? Deciding What's Right for You

Okay, you’ve got your financial ducks in a row. Now comes the exciting part—choosing the actual house! This is a major fork in the road for any homebuyer, and it really boils down to one big question: Do you want a brand-new home or one that’s already been lived in?

Each path offers a totally different journey, with its own set of pros and cons. Let's break it down.

The Case for Character: Resale Homes

There’s no denying the charm of an older home. They often sit in established neighborhoods with big, beautiful trees and a sense of history that you just can't build from scratch.

The trade-off, of course, is that you might inherit some… quirks. Think drafty windows, a surprise leaky faucet, or a furnace that’s seen better days. You could also find yourself in a stressful bidding war, especially in a hot market. It's a classic battle between character and convenience.

The Appeal of a Fresh Start: New Construction

A new construction home is a completely different world. Imagine being the very first person to cook in your kitchen, use your shower, or walk on your floors. It's a powerful feeling.

Everything is pristine, under warranty, and built to today's energy-efficiency standards—which means lower utility bills from day one. There are no mysterious pet smells or questionable 1980s wallpaper to contend with. Plus, you get to skip the bidding wars and unpredictable repair costs that can plague resale buyers.

The process is much more straightforward. You agree on a price and then move on to the fun stuff.

How Today's Market Shapes Your Choice

The current housing market can also push you in one direction or another. There's a well-documented housing supply gap, which means fewer existing homes are available. That scarcity often drives up competition and prices for resale properties. Recent global housing market trends on hines.com show this shortage is a major factor for buyers everywhere.

In high-demand areas, this can make the home search feel like a battle.

This is where new construction communities, like the ones we build in White Marsh, Maryland and Edgewood, Maryland, really offer a lifeline. You can sidestep all that resale frenzy and secure a home in a fantastic, growing area without the fight.

New Construction vs Resale Homes: A Quick Comparison

Before we dive into customization, let's put these two options side-by-side. This table gives a quick snapshot to help you see which path might be a better fit for your family and lifestyle.

Feature | New Construction Home | Resale (Existing) Home |

|---|---|---|

Customization | High level of personalization (floors, paint, fixtures) | What you see is what you get; changes require renovation |

Maintenance | Low initial maintenance; everything is new and under warranty | Potential for immediate repairs and ongoing upkeep costs |

Energy Efficiency | Built to modern standards, resulting in lower utility bills | Often less efficient; may need updates like new windows or insulation |

Timeline | Longer wait time while the home is being built | Faster move-in, typically 30-60 days after an offer is accepted |

Neighborhood | New and developing communities | Established neighborhoods with mature landscaping |

Price | Base price with potential added costs for upgrades | Final price is negotiated; risk of bidding wars |

Ultimately, there's no single "right" answer. It's about weighing what matters most to you—a quick move-in and established charm, or a blank slate and modern convenience.

Customization: This is Where the Magic Happens

Here’s where a new build truly pulls ahead: personalization. This is your chance to create a home that is 100% you from the very beginning.

Instead of living with someone else’s outdated kitchen until you can afford a renovation, you get to design your dream space right from the start.

Flooring: Do you love the durability of wood laminate? Prefer plush, cozy carpet in the bedrooms? Or maybe you need durable luxury waterproof vinyl plank for kids and pets?

Countertops: Are you picturing sleek quartz, timeless granite, or a modern solid surface? The choice is yours.

Cabinets: Pick the style, the color, and the hardware you’ve been pinning for years.

Tile: Design a spa-like bathroom with floor and shower tiles you selected yourself.

This is what transforms a house into your home. You get to move into a space that’s already perfectly tailored to your life, skipping years of messy weekend projects and saving for future remodels.

For a deeper dive, I highly recommend our article comparing a new construction vs. an existing home in Maryland. While I obviously love what we do as a builder, I take it a step further for my clients. I provide unique visualization tools that let you see exactly how your finish selections will look together, bringing your vision to life before we even break ground. It's a hands-on service to make sure you absolutely love every single detail.

Making a New House Your Home with Personalization

This is where the real magic happens, and frankly, it's my favorite part of the process. When you decide to go with a new construction home, especially with my team, you’re not just buying a property—you're stepping into the role of a designer. This section is all about that incredible journey of making a house truly yours from the ground up.

Unlike buying a resale home where you inherit someone else’s design choices (and maybe some questionable 90s wallpaper), a new build is a blank canvas. It's your opportunity to infuse your personality into every corner, ensuring the space reflects your taste and lifestyle from the day you get the keys.

Beyond the Floor Plan

The foundation of any great home is its layout, but the finishes are what bring it to life. This is where you get to move past the blueprints and start making the selections that turn a structure into a sanctuary. My role is to guide you through these exciting choices, making sure the process is fun, not overwhelming.

We let our buyers customize their homes by getting to pick their flooring, countertops, cabinets, tile, and more.

Flooring That Fits Your Life: Will it be warm, wood laminate in the living areas? Maybe you prefer plush, cozy carpeting for the bedrooms where your kids will play. For high-traffic zones like the kitchen and entryway, durable and stylish luxury vinyl tile might be the perfect, worry-free solution.

Kitchens That Inspire: This is the heart of the home, so let's make it special. You get to select the perfect combination of countertops, cabinets, and hardware. For example, you could pair sleek quartz countertops with modern shaker cabinets in a deep navy blue you've always dreamed of.

Bathrooms Built for Relaxation: Create your own personal spa. You'll choose everything from the floor tiles and the shower surround to the vanity that creates a tranquil escape after a long day.

This hands-on approach is how we make sure your home is a direct reflection of your vision.

See Your Vision Before We Build

Here's where I go a step further for my clients. One of the biggest anxieties for buyers is wondering, "Will it all look good together?" It's tough to imagine how a tiny square of flooring, a swatch of tile, and a paint chip will combine in a real, finished space. That’s why I offer access to unique, proprietary visualization tools.

Think of it as a virtual test drive for your design choices. These visualizers let you mix and match your selections in a digital model of your exact floor plan.

Want to see if that bold bathroom tile clashes with your vanity choice? Curious how light versus dark kitchen cabinets will affect the feel of the room? Our tools let you see it all in real-time, taking the guesswork and stress out of the equation.

This hands-on service is a complete game-changer. It gives you the confidence to make creative choices because you’ve already seen how beautiful the final result will be. For example, a client recently used our visualizer to compare three different backsplash tiles for their kitchen. Seeing them in the virtual space made the decision instant and exciting, rather than nerve-wracking.

The True Value of Personalization

Building a new home in a community in White Marsh, Maryland or Edgewood, Maryland isn't just about getting a modern, energy-efficient house. It's about creating a space that is perfectly tailored to your family's needs from day one. You won't spend your first few years as a homeowner saving up for a kitchen remodel or living with a bathroom you can't stand.

Instead, you move into a home that feels complete and personal. The cabinets, countertops, and flooring are exactly what you wanted. It's a level of satisfaction that is incredibly hard to find in the resale market.

If you’re ready to stop just looking for a house and start designing your home, let’s talk. I can walk you through the process and show you just how powerful these visualization tools are. This is how we turn the dream of getting a house into the reality of creating a home you’ll love for years to come.

From Offer Accepted to Keys in Hand: Navigating the Final Stretch

You got the house! Take a deep breath and celebrate—that’s a huge win. Now, the real fun begins. You're officially "under contract," which kicks off the final sprint to the closing table.

This phase is a flurry of activity with a lot of moving parts and important deadlines. It can feel a little intimidating, but think of it as a series of critical checkpoints. Each one is there to protect you and your lender, making sure the home is a solid investment before you sign your name on that final stack of papers.

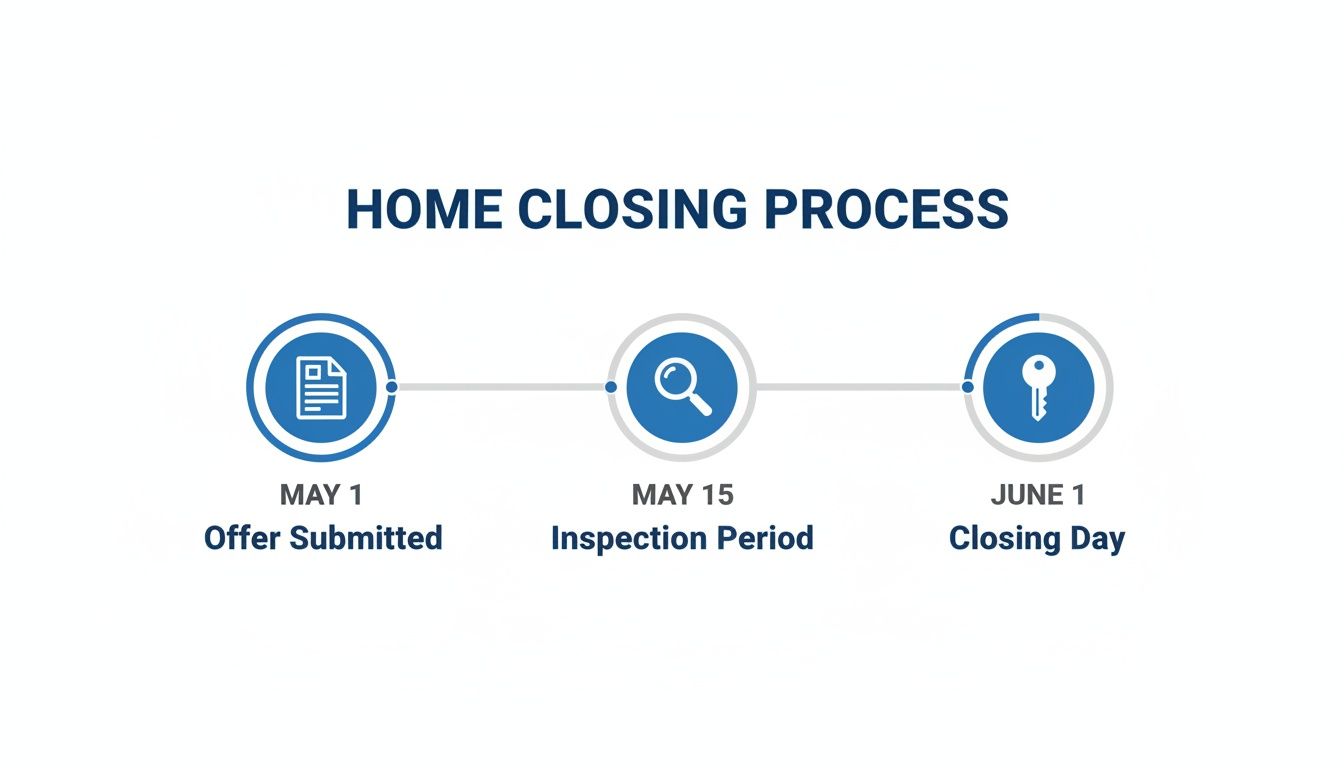

Here’s a simple visual to help you see how it all comes together.

Breaking it down like this helps make the whole process feel less overwhelming and a lot more manageable.

What Happens After Your Offer Is Accepted

Once that purchase agreement is signed by everyone, the clock starts on your "contingency period." This is typically a 30 to 60-day window where all the important due diligence happens. You'll be coordinating with your lender, a home inspector, and a title company to tick off the final boxes.

Here’s who you’ll be working with and what they’ll be doing:

The Home Pre-close Walkthrough: You'll meet in your new home with the construction superintendent to go through the home, checking everything from the roof to the foundation. Their job is to uncover any hidden issues you couldn't possibly see during a showing.

The Appraisal: Your mortgage lender will order an appraisal to confirm the house is actually worth what you're paying. An independent appraiser evaluates the home's condition and compares it to similar properties that recently sold nearby to determine its fair market value.

The Title Search: A title company dives deep into the property's public records. They're looking for any old liens, ownership disputes, or other legal entanglements that could cause problems down the road. The goal is to ensure you get a "clear title" to your new home.

Getting Ready for Closing Day

While all of that is happening, your lender is busy with the final loan approval process, known as underwriting. This is a critical time, and my best advice is to avoid any big financial moves. Seriously. Don’t go finance a new car, open a new credit card, or quit your job. Any sudden change to your financial picture could put your loan in jeopardy at the last minute.

The goal here is a smooth, predictable path to closing. Keep your finances stable, and you'll set yourself up for a drama-free finish line.

About a week or so before closing, you'll get a document called the Closing Disclosure. Go over this thing line by line. It breaks down every single financial detail of your loan: the interest rate, your final monthly payment, and the total cash you need to bring to the table. This number includes your down payment balance plus all the closing costs. If you need a quick refresher on those, our friendly guide to understanding closing costs on a new home has you covered.

The Final Walkthrough and Getting Your Keys

Right before you head to the closing appointment—usually the day of or the day before—you'll do one last walkthrough of the house. This is your chance to make sure the home is in the same condition you agreed to buy it in and that any negotiated repairs have been completed.

And then, it’s the big day! You'll meet with your agent and someone from the title company to sign what feels like a mountain of paperwork. But once the last signature is down and the money has been officially transferred, it’s all over.

Congratulations, you're a homeowner! Now, go get your keys.

Answering Your Top Home Buying Questions

The road to owning a new home is exciting, but it's natural to have a lot of questions. Honestly, it's a huge step! To help clear things up, let's go through some of the most common things people ask when they're starting out.

How Long Does It Really Take to Get a House?

This is the big one, isn't it? The honest answer is... it depends. But a good ballpark figure for the entire process, from getting serious about your search to finally getting the keys, is around 3 to 6 months.

For a typical resale home, you're looking at two main stages:

The Hunt (1-2 months): This is all about pounding the pavement (or scrolling through listings), touring homes, finding "the one," and getting an offer accepted.

The Homestretch (30-60 days): Once your offer is in, the real paperwork begins. This is when the mortgage, appraisal, and inspections all happen.

Now, with a new construction home, the timeline feels a bit different. While the physical build takes time, the buying part is often much more straightforward. You get to skip the bidding wars and the stressful back-and-forth negotiations, which gives you a much clearer, more predictable path to closing day.

What Is a Builder's Representative?

You've probably heard of a real estate agent who helps people buy and sell existing homes. A builder’s representative—that's my role here—is a little different. We are specialists who live and breathe new construction.

Think of me as your dedicated guide for everything related to building your new home. I know the floor plans like the back of my hand, understand the construction process from the ground up, and can walk you through every personalization option available. My job is to make sure you have an expert in your corner from day one.

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life.

Are There Hidden Costs When Buying New?

We're all about being upfront and transparent, so you won't find any surprise "hidden" costs with us. That said, it's always smart to plan for more than just the sticker price of the house itself.

Here are the main things you should budget for:

Closing Costs: These usually run between 2% to 5% of your loan amount. They cover the necessary stuff like appraisal fees, title insurance, and loan origination fees.

Initial Deposit: This is your earnest money, which secures your homesite and officially kicks off the building process.

Personalized Upgrades: This is the fun part! We let buyers customize their homes by getting to pick their flooring, countertops, cabinets, tile, etc. Any choices you make beyond our high-quality standard features will be added to your total.

We give you a detailed cost breakdown right from the start, so you'll know exactly what to expect. Pro tip: I always recommend setting up a separate "new home fund" for the things you'll want right after moving in, like a comfy new sofa, blinds, or starting on that backyard oasis you've been dreaming of.

The Bottom Line: Planning for these extra items early on makes for a smooth, stress-free move. You can just focus on the exciting part—settling in and making your new house a home.

Why Choose a New Home in White Marsh, Maryland or Edgewood, Maryland?

We absolutely love building in White Marsh, Maryland, Edgewood, Maryland, and the fantastic communities across Baltimore County, Maryland and Harford County, Maryland. These areas offer a perfect mix of lifestyle, value, and convenience that’s tough to find anywhere else.

When you choose a new home here, you're not just buying a house; you're investing in a vibrant community. You get access to wonderful local parks, great schools, and all the shopping and dining you could ask for, all with an easy commute. While every market has its nuances, the core steps of buying a home are often similar; this practical guide to buying a home in Australia is a great resource that covers many of those universal principles.

Building new in these spots means you get a modern, energy-efficient home that you can customize to your heart's content—often for a price that's competitive with older homes in the area that might need a lot of work. It’s your chance to get the exact home you want, right where you want to be.

Buying a home is a huge adventure, but you don't have to go it alone. With Customize Your Home, you get a partner who is truly dedicated to bringing your vision to life. From our hands-on service and unique design tools to the final walk-through, we’re here to make the journey as smooth and enjoyable as possible.

Ready to start designing the home you've always wanted? Visit us online to learn more and see how we can build your future, together.

Comments