What Is Home Equity and How Does It Actually Work

- Justin McCurdy

- Nov 17, 2025

- 16 min read

Think of home equity as the part of your house you actually own, free and clear. It’s the gap between what your home is worth on the market right now and what you still owe on your mortgage. It's your financial foothold in your property—an asset that builds up the longer you live there.

Your Home's Hidden Savings Account

It helps to think of your home as a kind of savings account. Every mortgage payment you make isn't just sending money to the bank; it’s like making a deposit. Part of it covers interest, sure, but a good chunk chips away at your loan balance, increasing your stake in the property. You're literally building wealth by just living your life.

And this isn't just pocket change. The total home equity held by homeowners in the United States recently soared to an incredible $35.8 trillion. That number shows just how much wealth is being built through real estate all across the country. As homes appreciate and owners pay down their loans, this massive collective savings account just keeps getting bigger. You can dig into the numbers yourself in the full real estate value report on Realtor.com.

Before we get into how it all works, let's break down the essential terms you'll need to know.

Quick Guide to Home Equity Key Terms

This simple table breaks down the core components of home equity. Understanding these three pieces is the foundation for everything else.

Term | Simple Definition | How It Affects Your Equity |

|---|---|---|

Market Value | The price your home could sell for today. | Higher market value means more potential equity. |

Mortgage Balance | The total amount you still owe the lender. | A lower mortgage balance directly increases your equity. |

Home Equity | The difference between your market value and mortgage balance. | This is your ownership stake—the financial asset you're building. |

With these basics down, let's look at exactly how that equity number goes up.

How This Savings Account Grows

So, how do you "deposit" more into this account? Your home equity builds in two main ways, and they often work together to boost your net worth.

Paying Down Your Mortgage: With every single payment, you reduce what you owe. That directly adds to the slice of the home that is 100% yours. For example, if you pay an extra $100 toward your principal this month, you've just increased your equity by $100. It's that direct.

Market Appreciation: This is the magic that happens when your home’s value goes up on its own. A hot real estate market, new neighborhood amenities, or high demand can all push your home’s value higher without you doing a thing.

The beauty of home equity is that it's an asset you can live in while it grows. It’s both a home and an investment, working for your financial future every single day.

Let’s put it in a real-world context. A family buying a new home in a growing community like White Marsh or Edgewood, Maryland, gets a double benefit. As they settle in and make their monthly payments, their equity climbs steadily. At the same time, if the area continues to attract new people and businesses, their home’s value could rise, accelerating their equity growth even more. This is what makes owning a home such a powerful tool for building a solid financial foundation.

How To Calculate Your Home Equity With Real Examples

Figuring out your home equity is surprisingly simple. You don't need a fancy calculator or a degree in finance—just one basic formula. Getting a handle on this is the first step to seeing how much of your home you truly own.

The Simple Formula: Current Market Value of Your Home - Remaining Mortgage Balance = Your Home Equity

That’s it. It’s the slice of the pie that belongs to you, not the bank. To make this crystal clear, let's walk through a few real-world scenarios right here in Maryland to see how it all works.

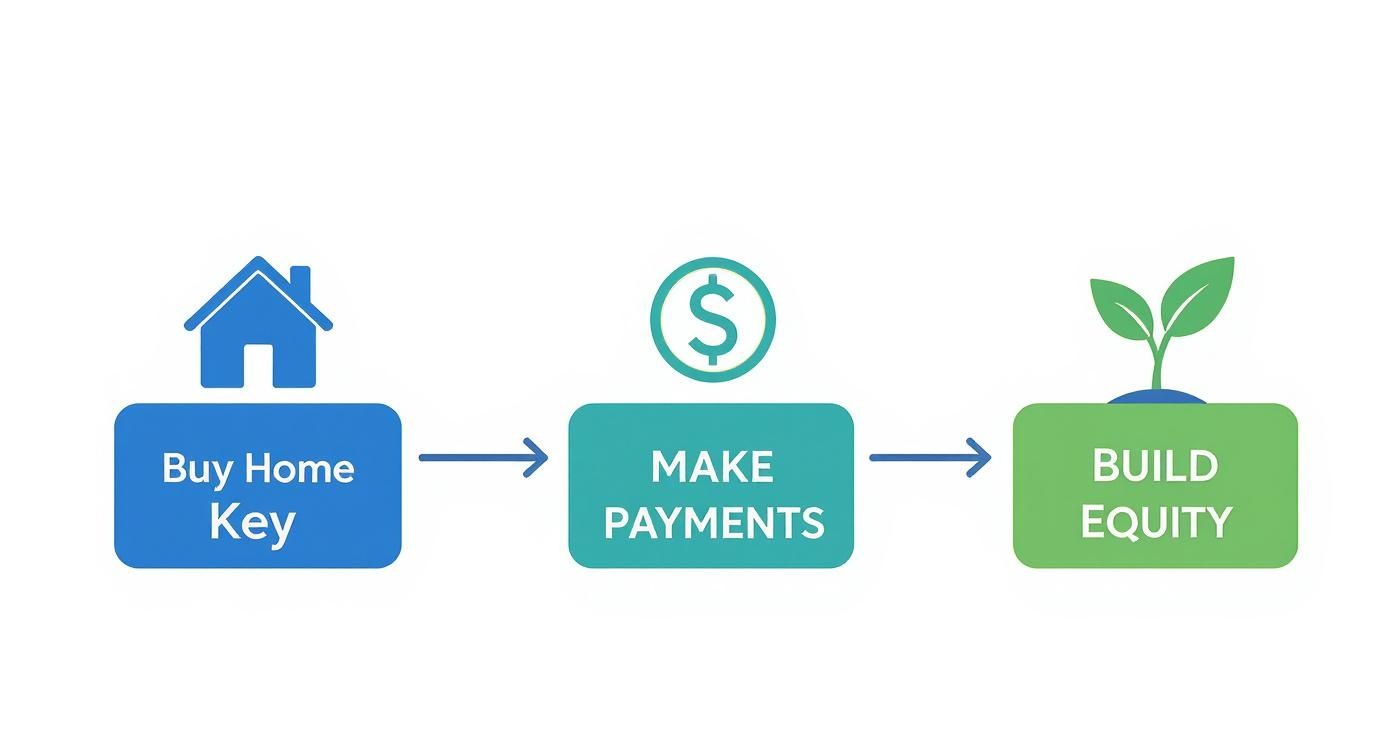

This simple timeline shows how your actions as a homeowner directly contribute to building this valuable asset over time.

As you can see, the process begins the day you buy your home and grows with every payment you make and every year that passes.

Example 1: The Brand-New Homeowner

Let’s imagine a family just bought a beautiful new home in Baltimore County, Maryland, for $450,000. They put down 10% ($45,000) and got a mortgage for the other $405,000.

On the day they get their keys, their equity looks like this:

Market Value: $450,000

Mortgage Balance: $405,000

Calculation: $450,000 - $405,000 = $45,000 in Home Equity

Right off the bat, their equity is equal to their down payment. This is their starting line—the foundation of the wealth they're about to build. But before you even get to this point, you have to know your budget. Check out our guide on how much house you can comfortably afford to get started on the right foot.

Example 2: The Homeowner After Five Years

Okay, let's jump ahead five years. A couple in Harford County, Maryland, bought their house for $400,000. They've been making their mortgage payments like clockwork and have chipped away at the loan, bringing their balance down to $360,000.

At the same time, the local market has been hot, and a new appraisal shows their home is now worth $475,000.

Here’s their new equity situation:

Market Value: $475,000

Mortgage Balance: $360,000

Calculation: $475,000 - $360,000 = $115,000 in Home Equity

They've built a whopping $75,000 in new equity just by paying their mortgage and letting the market do its thing. That’s the magic of time in real estate. To get a better sense of your own potential, this guide on how to calculate your home equity offers more great examples.

Example 3: The Smart Renovator

Now for a homeowner in Prince George's County who wants to take matters into their own hands. Their home is valued at $500,000, and they owe $300,000, which gives them a solid $200,000 in equity.

They decide to invest $25,000 in a kitchen renovation—we're talking new quartz countertops and high-end cabinets. After the dust settles, an appraiser determines their home's value has jumped to $540,000.

Let's do the math:

New Market Value: $540,000

Mortgage Balance: $300,000

Calculation: $540,000 - $300,000 = $240,000 in Home Equity

By strategically investing $25,000, they increased their home's value by $40,000, adding a net $15,000 straight to their equity. This is where customizing your home truly pays off. When you work with me, I provide access to proprietary visualization tools that help you see exactly how different flooring, tile, and countertop selections will look, ensuring you make choices that not only reflect your style but also maximize your investment.

Want to Build Home Equity Faster? Here's How.

Watching your home's value appreciate over time is great, but let's be honest—it's a waiting game. Why not take a more active role in your financial future? Building home equity at a faster clip isn't about some secret financial trick; it's about being intentional.

You really have two main levers to pull: chip away at your mortgage principal faster, or find smart ways to boost your home's market value.

Let's break down some real, practical ways to do just that.

Tackle Your Mortgage Principal

Think of every extra dollar you put toward your principal as a direct investment in your own wealth. It's you buying a bigger slice of your home back from the bank, and it saves you a ton in interest over the long haul.

Here are a few popular ways people do it:

Make One Extra Payment a Year: This is a classic for a reason—it works. Making just one extra mortgage payment annually can knock several years off a 30-year loan. You can either add a little extra to each month's payment or just make a single lump-sum payment when you get a bonus or tax refund.

Go Bi-Weekly: Instead of paying once a month, you make half a payment every two weeks. Because there are 26 two-week periods in a year, this adds up to 13 full monthly payments instead of the standard 12. Many lenders can set this up for you automatically.

Round It Up: This one is almost painless. If your payment is, say, $1,850, try rounding it up to an even $2,000. That extra $150 goes straight to work reducing your principal, and you'll be shocked at how much of a dent it makes over time.

The faster you pay down your mortgage, the sooner you stop "renting" money from the bank and start truly owning your home. That simple shift in mindset can change everything.

Boost Your Home's Value with Smart Upgrades

While paying down your loan is about shrinking the debt, this strategy is all about growing the asset. The right home improvements can deliver a fantastic return on investment, which directly translates into more equity. But—and this is a big but—not all renovations are created equal.

When you're renovating to build equity, it's critical to know how to maximize your bathroom remodel return on investment. The goal is to choose projects with broad appeal for future buyers.

The trick is to focus on timeless upgrades that improve both the look and function of your home, especially in high-impact areas like kitchens and bathrooms. In sought-after Maryland communities like White Marsh and Edgewood, a modern, thoughtfully designed home really stands out from the competition.

This is where customizing your home from the start gives you a massive advantage. When you get to choose your finishes from the very beginning, you’re not just creating a space you love; you’re embedding value right into the foundation. Picking durable, stylish flooring, high-quality countertops, and modern cabinets isn't just a design choice—it's a financial one.

As your partner, I offer more than just a house; I provide hands-on guidance and proprietary visualization tools to help you see it all come together. These resources empower you to make smart selections that create both a beautiful home and a powerful financial asset. Of course, building strong equity starts with a solid foundation—your down payment. Our guide on how to save for a down payment can help you get there.

Putting Your Home Equity to Work for You

So, you've been faithfully making those mortgage payments, and maybe your neighborhood has seen a nice bump in property values. You're likely sitting on a decent chunk of home equity. The big question is: what can you actually do with it? Think of it as a powerful financial tool you've built, one that you can tap into for other life goals.

Using your home's value isn't some niche strategy; it's becoming more and more common. The global home equity lending market was recently valued at $29.23 billion and is expected to hit $30.58 billion within a year. That trend just goes to show how many people are using their homes to fuel their financial journeys. You can see what's driving the demand for home equity loans worldwide for yourself.

Let's break down the three most popular ways homeowners put that hard-earned equity to work.

Home Equity Line of Credit (HELOC)

A HELOC is all about flexibility. The simplest way to think of it is like a credit card secured by your house. A lender gives you a credit limit based on your equity, and you can pull funds from it as needed during a specific "draw period."

The best part? You only pay interest on what you actually borrow, not the entire credit line. This makes it a fantastic fit for ongoing projects with unpredictable costs—like that kitchen remodel where you’re paying contractors in phases—or for recurring expenses like college tuition. A practical example: say you get a $50,000 HELOC for home repairs. If your new roof only costs $15,000, you only pay interest on that $15,000, leaving the rest available for future needs.

Home Equity Loan

If a HELOC is a credit card, a home equity loan is more like a classic personal loan. You get a single, lump-sum payment against your equity and pay it back with fixed monthly installments over a set term, usually somewhere between 5 to 15 years.

This route is perfect when you know exactly how much you need for a big, one-time expense. For example, if you have $30,000 in credit card debt, you could take out a $30,000 home equity loan, pay off all the cards at once, and then have one predictable monthly payment to manage, often at a much lower interest rate.

Key Takeaway: A HELOC gives you flexibility for ongoing or uncertain costs. A home equity loan provides the stability of a predictable payment for a specific, known expense.

Cash-Out Refinance

This one is a little different from the other two. With a cash-out refi, you replace your existing mortgage with a brand-new, larger one. The difference between what you owed on the old mortgage and the new loan amount is paid out to you in cash.

Let's say your home is worth $500,000, you still owe $300,000, and you refinance for a new $350,000 loan. You'd use the new loan to pay off the original $300,000 mortgage and walk away with $50,000 in cash. This can be a brilliant move if interest rates have fallen since you first bought your home, as you might snag a lower rate on your entire mortgage while also getting the cash you need.

Comparing Your Equity Options: HELOC vs Home Equity Loan vs Cash-Out Refinance

Choosing between a HELOC, a home equity loan, or a cash-out refinance really depends on your specific financial goals and circumstances. Each has its own structure, benefits, and ideal use cases. This table breaks down the key differences to help you see which one might be the best fit for you.

Feature | Home Equity Line of Credit (HELOC) | Home Equity Loan | Cash-Out Refinance |

|---|---|---|---|

How You Get Funds | Revolving credit line you can draw from as needed. | One-time, lump-sum payment. | A new, larger mortgage loan, with the difference paid to you in cash. |

Repayment Structure | Variable interest rate; often interest-only payments during the draw period. | Fixed interest rate with predictable monthly payments. | A new fixed or adjustable-rate mortgage payment for the entire loan amount. |

Best For | Ongoing projects, unexpected expenses, or when you need flexibility. | Large, one-time expenses with a known cost, like debt consolidation. | Accessing a large amount of cash, especially if you can lower your mortgage rate. |

Interest Rate | Typically variable, meaning it can change over time. | Typically fixed, so your payment stays the same. | Can be fixed or adjustable, depending on the new loan terms you choose. |

Ultimately, the right choice comes down to what you're trying to accomplish. A HELOC is great for flexibility, a home equity loan is perfect for predictability, and a cash-out refinance can be a smart move if the numbers (and interest rates) align. For a deeper dive into the world of lending, check out our guide on the different home loan types available to Maryland buyers.

No matter which path you're considering, always remember that you're borrowing against your most valuable asset. It's crucial to borrow responsibly and have a solid repayment plan in place. When used wisely, your home equity can be an incredibly powerful tool for reaching your dreams and strengthening your financial future.

Getting Real About the Risks and Rewards

Tapping into your home's equity can feel like unlocking a financial superpower. It’s a huge opportunity, but it’s also a decision that deserves some serious thought. This isn't just about getting cash; it’s about being smart with your biggest asset. So let's have an honest conversation about the good, the bad, and what you need to watch out for.

The biggest upside is obvious: financial flexibility. The equity you've worked so hard to build can be the launchpad for some of life's biggest milestones. You could fund a college education, wipe out high-interest credit card debt, or finally tackle that dream kitchen remodel you've been pinning for years. When you use it wisely, your home becomes more than just a place to live—it’s a powerful tool for achieving your goals.

Navigating the Potential Downsides

But let's be real—it’s not a risk-free move. When you borrow against your equity, your home is on the line. It's the collateral, and that’s the most important thing to wrap your head around.

The Bottom Line: If you take out a home equity loan or HELOC and can't make the payments, the lender has the right to foreclose. I'm not saying this to scare you, but to make sure you understand the stakes. Always borrow within your budget and have a rock-solid plan for paying it back.

The other major risk is something you can't control: the housing market. It has a mind of its own.

When Property Values Fluctuate

While real estate has been on a tear for a while, markets don't always go up. If home values in your neighborhood take a nosedive, you could end up with negative equity. That’s the industry term for being "underwater," meaning you owe more on your loans than your house is actually worth.

Being underwater can trap you. It makes selling or refinancing incredibly difficult without taking a big financial hit. And as we've seen lately, this isn't just a theoretical problem.

Even with homeowners sitting on record levels of equity, the market took a slight turn recently. According to recent home equity trends on Cotality.com, the average U.S. homeowner saw their equity dip by about $9,200 over the last year. They still hold an impressive average of $307,000, but here's the kicker: the number of homes with negative equity jumped by 18%, affecting 1.15 million households. It just goes to show how quickly things can change.

Making smart choices from day one is the best way to protect yourself. To get started on the right foot, check out our guide on 7 First-Time Home Buyer Mistakes to Avoid in 2025.

At the end of the day, being fully aware of both the amazing potential and the real-world risks is what allows you to make decisions you can feel good about. It's about protecting your family and your financial future.

Ready to Build Your Future?

So, where do we go from here? You've seen how home equity works—it's not just a number on a spreadsheet, but a real, tangible asset you can grow and use. The smartest homeowners I know don't just buy a house; they make deliberate choices from day one to build value and create a strong financial foundation.

This is where a different way of thinking about home buying comes into play. It’s less about finding a pre-built house and more about creating a home that’s a perfect fit for you and a smart long-term investment.

A Different Kind of Home-Buying Experience

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. We get there by focusing on the details that make a huge difference.

Instead of trying to imagine what your future home might look like, you can use my unique visualization tools to see it all come together. These tools let you play designer and bring your dream space to life long before construction even begins.

See It Before You Commit: Wondering how that dark flooring looks with light cabinets? Or if that bold tile choice works? You can explore different flooring, countertops, cabinet styles, and tiles in real-time.

Decide with Confidence: Visualizing the finished product means no regrets. You can be sure every selection flows together to create a home that feels cohesive and looks incredible.

Invest in What Matters: This process isn't just fun—it’s smart. It helps you choose finishes that you’ll personally love and that will also catch the eye of future buyers, giving your home’s value and your equity a direct boost.

This is all about making sure you’re making informed, value-adding decisions from the get-go.

Building Equity in the Places You Want to Live

This thoughtful approach is a game-changer, especially in the growing communities I work in. Whether you’re setting down roots in White Marsh, Edgewood, or anywhere across Baltimore County, Harford County, or Prince George's County, a personalized home simply stands out from the crowd.

In these sought-after Maryland spots, a home that nails that blend of modern style and lasting quality is a fantastic investment. By hand-picking your finishes, you aren't just making a house your own—you're strategically building an asset that will support you and your family for years to come.

Imagine walking into your brand-new home, and every single detail—from the kitchen backsplash to the bathroom floor—is exactly what you chose. That’s not just a nice thought. It’s a powerful step toward building a life you love and a financial future you can bank on.

My role is to be more than just a builder’s rep; I'm here to be your partner. I'll give you the tools, share what I know, and guide you through making choices that are right for your lifestyle and your financial goals. Your home should be your sanctuary and a cornerstone of your wealth.

If you’re ready to see how we can build a home that’s perfectly tuned to your life and your financial future, let's talk. We can start your journey with the confidence that comes from making a smart, equity-focused investment from the very beginning.

Your Home Equity Questions, Answered

Let's be honest—home equity can feel a little abstract at first. To help clear things up, here are some straightforward answers to the questions I get asked all the time.

How Long Until I Have a Good Amount of Equity?

You actually start building equity the moment you make your first mortgage payment. But building a significant chunk that you can really work with? That usually takes a few years. It’s a marathon, not a sprint, fueled by two things: chipping away at your mortgage principal and the home's value going up over time.

For instance, someone buying a home in Baltimore County could see some pretty solid equity growth in just 3-5 years, thanks to a combination of their regular payments and a healthy market. And here's a pro tip: making smart, personalized design choices from the start—like picking timeless hardwood floors or quality kitchen countertops—gives you an immediate leg up on value from day one.

Is It Possible to Lose Home Equity?

Yes, unfortunately, it is. Your equity isn't set in stone; it's directly tied to what your home is worth on the open market. If the local real estate market hits a rough patch and home values dip, your equity will shrink right along with it.

This is exactly why thinking of homeownership as a long-term game is so important. Markets go up and down, but historically, real estate trends upward over the long haul. It’s also a good reminder not to get too carried away with borrowing against your home’s value.

Think of it this way: Building equity is like climbing a hill. Sometimes the path flattens out or even dips a bit, but the overall journey is upward. The trick is to just keep making your payments and not overload yourself with risk.

What's the Difference Between "Appraisal" and "Market Value"?

This is a fantastic question because people often use these terms as if they mean the same thing, but there's a key difference.

Market Value is simply what a ready and willing buyer will pay for your house. It’s the real-world price, shaped by supply and demand, recent sales in your neighborhood, and even a little bit of emotion.

An Appraisal is a formal, data-driven opinion of your home's value put together by a licensed professional. Lenders always require one before a sale or refinance to make sure the loan they’re giving you is backed by a property of equal value.

While the two numbers are usually very close, the appraisal is the official valuation needed for any financial transaction.

How Do Customizations Impact My Equity?

Smart, thoughtful customizations can give your home's value—and your equity—a serious boost. Things like upgrading to a gourmet kitchen, adding a spa-like master bath, or installing durable, beautiful flooring almost always pay off. The secret is to pick upgrades that have wide appeal but still feel perfect for you.

When I work with clients, I give them access to special visualization tools to see exactly how different countertops, cabinets, and tiles will look in their new space. This kind of hands-on guidance helps you make confident choices that not only create a home you'll absolutely love but also build instant value right from the start.

Feeling a little more clear on how home equity works? When you’re ready to build a home that's a smart investment from the ground up, Customize Your Home is here to guide you. I provide the tools and personal support to help you design a beautiful home in communities across Maryland that fits your life and your financial future.

Comments