Benefits of Owning vs Renting: Your Friendly Guide to the Pros & Cons

- Justin McCurdy

- Dec 5, 2025

- 15 min read

So, you're at a classic crossroads: buy a home or keep renting? It's a massive decision with a lot to consider, so let's walk through it together. For many, renting is all about short-term flexibility and lower initial costs, which is perfect if you're not sure where you'll be in a few years. But when it comes to long-term wealth building and personal freedom, owning a home is hands-down the better move. Every mortgage payment you make is a direct investment in your own future, not your landlord's.

The Big Picture: Owning vs. Renting

Thinking about owning versus renting is so much more than just comparing a mortgage payment to a rent check. It’s really about what you want out of life—your financial goals, your lifestyle, and your future.

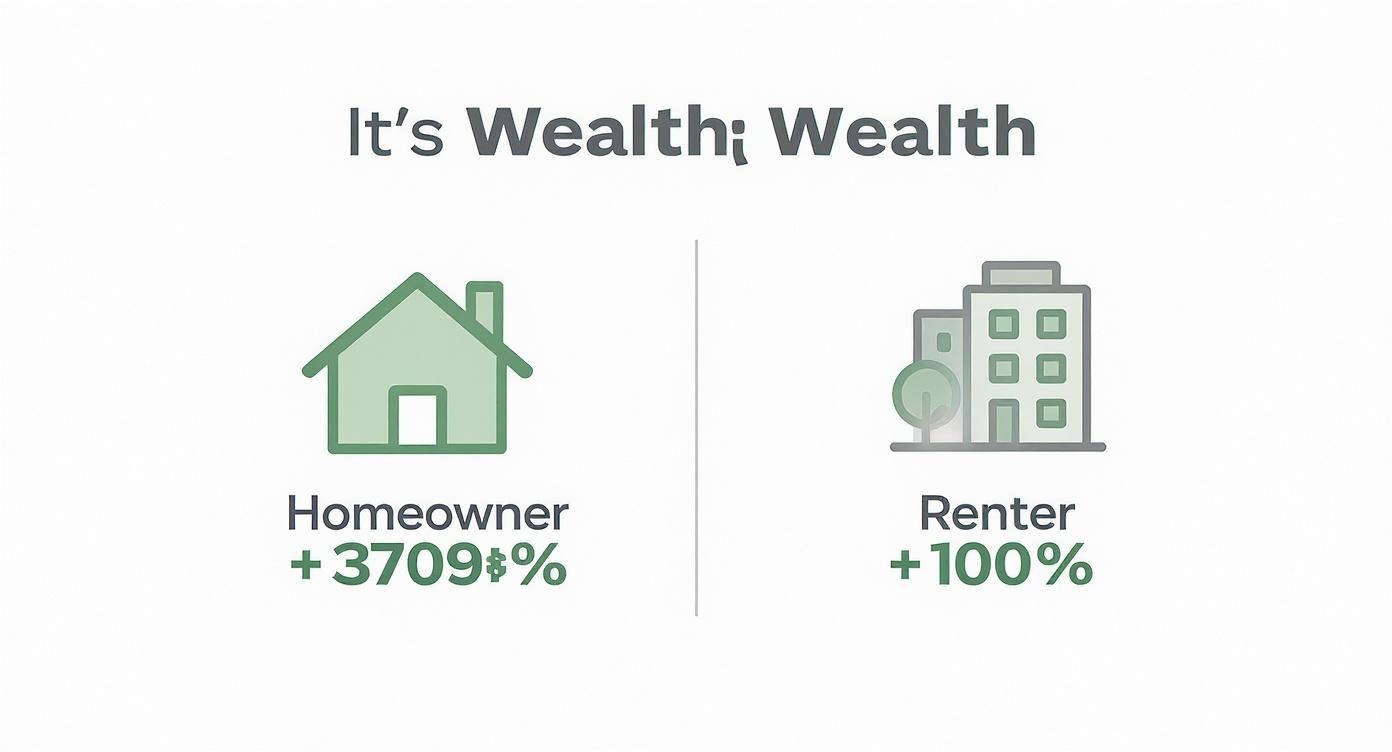

Renting might feel simpler at first, with fewer responsibilities knocking at your door. But owning a home is one of the most reliable ways to build real, lasting financial security. The numbers are pretty staggering: homeowners in the U.S. have a median household wealth that's over 3,709% higher than renters, a detail highlighted in this recent homeowner wealth study. That really puts the long-term power of ownership into perspective.

Of course, a lot of myths and outdated ideas can cloud the decision. Before you go any further, it’s worth separating fact from fiction. We actually put together a guide that tackles the biggest myths of buying a new home in Maryland to help clear things up.

Key Differences at a Glance: Owning vs. Renting

To make it even clearer, let's break down the main differences side-by-side. This table gives you a quick snapshot of what you gain and what you give up with each option.

Factor | Owning a Home | Renting a Home |

|---|---|---|

Financial Future | You build personal wealth and equity with every mortgage payment. | Your rent payments build your landlord's equity, not your own. |

Monthly Costs | A fixed-rate mortgage gives you predictable, stable payments. | Rent can—and almost always does—increase year after year. |

Personalization | You have complete freedom to paint, renovate, and truly make it yours. | Customization is very limited and requires landlord approval. |

Upfront Costs | Requires a down payment and closing costs to get started. | You'll need a security deposit plus the first and last month's rent. |

Long-Term Stability | Puts down roots in a community and offers a stable place to live. | Your lease can end, and the landlord might not renew. |

Repairs & Maintenance | You're responsible for all maintenance and repair costs. | The landlord is on the hook for handling most repairs. |

Looking at it this way, you can see the trade-offs. Owning means more responsibility, but it also means more control, stability, and a powerful financial asset. Renting offers convenience but at the cost of building your own wealth.

Let's Talk Real Costs: It's More Than Just the Monthly Payment

When you’re stuck in the owning vs. renting debate, it's so easy to get laser-focused on one number: the monthly payment. But comparing a mortgage to a rent check is like comparing apples to oranges—they’re just not the same thing. The real financial picture is much bigger, and both paths have their own unique expenses you need to be ready for.

Honestly, the numbers don't lie. A fixed-rate mortgage gives you something priceless: stability. Your main payment (the principal and interest) is locked in for the long haul, often 30 years. Rent? Not so much. Landlords almost always bump up the rent every year, and those small increases start to feel pretty big over time.

Predictability: Your Best Friend in Budgeting

When you own a home, especially a brand-new one, your biggest monthly expense is incredibly consistent. Sure, property taxes and insurance might wiggle a little bit year to year, but the core of your payment is set in stone. This makes it so much easier to plan your financial future without worrying about a sudden rent hike throwing a wrench in your budget.

For renters, it's a completely different ballgame. That great deal you got on rent is basically a moving target. Even a "small" 3-5% increase each year eats into your savings and makes it tougher to get ahead.

This chart really drives home how powerful homeownership is for building wealth over the long term.

The difference isn't just a rounding error—it's massive. It clearly shows why owning a home is one of the most reliable ways to build a secure financial future.

Unpacking the "Hidden" Costs

Both sides have expenses that don't show up on the glossy brochure. Getting a handle on these is key to making a truly fair comparison.

If You're a Homeowner:

Property Taxes: This is what you pay to your local government. It's usually rolled into your mortgage payment through an escrow account, so you don't have to think about it.

Homeowners Insurance: Protects your huge investment from disasters. Like taxes, this is typically part of your monthly mortgage payment.

Maintenance & Repairs: Things break. From a leaky sink to a furnace that gives up, you're the one on the hook. A smart move is to set aside 1-2% of your home's value each year just for this. With our new homes, you get warranties which will make your first years maintenance costs very low.

Closing Costs: These are the one-time fees for finalizing the sale. If you're wondering what they all are, take a look at our friendly guide to closing costs on a new home. We give amazing incentives, you can use this to have all of your closing costs paid in most cases and even move in for $0 in our communities.

If You're a Renter:

Security Deposit: Almost always one month's rent, and you have to fight to get it all back when you move out.

Application Fees: Many landlords charge these non-refundable fees just to see if you qualify.

Pet Fees: Got a dog or cat? Get ready for a non-refundable deposit plus a monthly "pet rent" in many places.

Renters Insurance: It’s way cheaper than homeowners insurance, but it's still an extra cost that only covers your stuff, not the building you live in.

A Quick Maryland Example

Let's ground this in reality. Say you're looking at two places in Harford County, Maryland. One is a new home with a mortgage of $2,500 a month. The other is a similar place for rent at $2,200 a month.

On the surface, renting looks $300 cheaper. But let's dig deeper.

The homeowner's $2,500 payment includes taxes and insurance, and a big chunk of it is actually paying down their loan and building equity. Plus, it's fixed for 30 years.

The renter's $2,200 is a 100% expense. If that rent goes up by just 4% a year, in five years they’ll be paying over $2,675 a month—more than the mortgage—and they won't have a single dollar of equity to show for it.

The Bottom Line: While a mortgage payment might seem higher upfront, a huge portion of it is an investment in yourself. Every rent payment you make is a 100% expense that goes directly into your landlord's pocket.

Nationally, the story can look different in the short term, especially with recent spikes in home prices and interest rates. Data shows the average monthly cost of owning is now around $3,069, while the average rent is $1,869. This gap definitely highlights the immediate cash savings of renting but completely glosses over the massive long-term financial upside of owning your own home.

How Home Equity Builds Your Financial Future

When you get down to the brass tacks of owning versus renting, home equity is the single biggest game-changer. It’s what separates a simple monthly expense from a powerful wealth-building tool. A rent check is gone the second you send it, but a mortgage payment is a direct investment in your own future.

So, what is it, really? Think of home equity as the slice of your home you truly own. It's the current market value of your property minus whatever you still owe on the mortgage. It’s almost like a forced savings account that you also get to live in.

How Your Equity Grows

This is where the magic happens. Your home equity doesn’t just sit there; it actively grows over time, usually in two ways at once. This one-two punch is something renters simply can't access.

Paying Down Your Mortgage: Every single month, a piece of your mortgage payment chips away at your loan's principal balance. That part of the payment isn't just covering interest—it’s directly boosting your ownership stake.

Market Appreciation: Homes, especially in sought-after areas like Baltimore County and Harford County, tend to go up in value over the years. As your home becomes worth more, your equity grows right along with it, often without you having to do a thing.

When you start to see your home as a financial asset, it helps to understand how to calculate your return on investment (ROI). This simple shift in perspective shows that homeownership is way more than a lifestyle choice; it’s a smart financial strategy.

A Real-World Baltimore County Example

Let's bring this down to earth. Say a family decides to buy a new home in White Marsh, Maryland, for $400,000. They make a $40,000 down payment and take out a $360,000 mortgage. The day they get the keys, their equity is $40,000.

Now, let's jump ahead five years:

Mortgage Paydown: They’ve been making steady payments, and their loan balance is now down to about $335,000.

Home Appreciation: The local market has been strong, and their home is now appraised at $450,000.

To figure out their new equity, you just do the math: $450,000 (current value) - $335,000 (what they owe) = $115,000 in equity. In only five years, they've more than doubled their initial investment and built a serious financial buffer.

That $115,000 isn't just a number on a spreadsheet. It's real, accessible wealth they can tap into for big life moments—paying for college, launching a small business, or just having a safety net for emergencies. All while living in a home they love.

The Renter's Reality

This is the financial engine that’s completely missing from the rental equation. When you write a check to your landlord for $2,200 a month, 100% of that cash is simply gone. You're covering their mortgage, paying for their maintenance, and building their wealth.

After five years of paying rent, the net worth you've built from your housing payments is a flat zero. You’ve made memories, sure, but you have no financial asset to show for all that money.

This is the fundamental truth of the debate. If you want to dig a little deeper, our guide on what home equity is and how it actually works breaks it all down. It’s the main reason homeownership remains a cornerstone of long-term financial security for so many people.

Making a House Feel Like Your Home

Let's be honest, one of the best parts of owning a home is the pure satisfaction of making a space completely and totally yours. When you're renting, you're just a guest in someone else's property. But when you own? That place becomes a canvas for your life, a true reflection of who you are.

Forget about getting a landlord's permission to paint a room or hang that heavy antique mirror. The freedom of homeownership means you can take on any project you can dream up, big or small, to match your style. It’s all about creating an environment that just works for you—whether that’s a quiet reading nook, a productive home office, or a kitchen built for entertaining friends.

The Renter's Personalization Puzzle

For renters, trying to personalize a space can feel like solving a puzzle with half the pieces missing. Every decision is filtered through the lease agreement, which is usually packed with strict rules meant to protect the landlord's investment, not to help you feel at home.

Renters run into all sorts of common roadblocks:

Painting: Most leases outright forbid painting. Even if it's allowed, you're almost always on the hook to paint it back to that original shade of beige before you move out.

Fixtures: Thinking of swapping out that dated light fixture or a leaky faucet? That's a definite no-go without getting special permission.

Gardening: If you're lucky enough to have a yard, you probably can't dig up a garden or make any real changes to the landscaping.

Wall Damage: Even hanging a few pictures can be a headache. Renters often have to look up creative strategies for hanging pictures without damaging walls just to add a bit of personality.

All these little restrictions really add up. It’s tough to create a space that feels like your own when every change is temporary and ultimately just improves someone else's property.

Designing Your Dream from the Start

This is where the real fun begins for my clients. Instead of just making do with someone else's old house, you get to call the shots on the design from day one. When you decide to buy a new home in a community like White Marsh or Edgewood, you're not just buying a property—you're an active partner in creating your home.

You get to choose the core elements that define your entire living space. Just imagine walking through the front door of a home where you personally picked out:

The warm, inviting flooring that runs under your feet.

The sleek, durable countertops in your dream kitchen.

The perfectly styled cabinets that fit your aesthetic.

The elegant tile that turns your bathroom into a private retreat.

These aren't just details; they're the choices that transform a building into your personal sanctuary. It's the huge difference between living in some generic box and living in a home crafted specifically for you.

The ability to customize isn't just a luxury; it's about building a home that actively supports and enhances your daily life. It’s about creating a space where every detail feels right because you chose it.

See It Before You Buy It

I know one of the biggest worries people have is trying to visualize how all their design choices will look together. A tiny sample square doesn't always tell the whole story. That’s why I go a step further—offering my clients unique proprietary visualization tools. We can see your design ideas come to life on a screen long before construction even starts.

You can mix and match different cabinet finishes with countertop styles to find that perfect pairing. Worried that a certain backsplash might clash with the floor? Our visualizers eliminate the guesswork. This hands-on service gives you the confidence to make bold, beautiful choices, ensuring your new home in Baltimore County or Harford County is exactly what you envisioned.

Flexibility vs. Stability: Which One Wins for You?

Life isn’t static, and your housing choice should reflect where you are right now. The whole rent-versus-own debate really boils down to a classic tug-of-war: the freedom to move versus the freedom to put down roots. There’s no single right answer here—it’s all about what fits your life and your future goals.

For a lot of people, the flexibility of renting is a massive perk. It’s hands-down the smarter play in certain situations. Let's say your job might move you across the country in the next year or two. Renting keeps you nimble, letting you pack up and go without the headache and hassle of selling a house.

Renting is also a brilliant strategy if you're just getting to know a new area. Maybe you’ve just landed in Maryland and are torn between the buzz of White Marsh and the quieter, family-oriented vibe of Harford County. Renting for a year gives you a chance to "test drive" different neighborhoods, figure out the commute, and get a real feel for the community before you commit to buying.

The Comfort of Putting Down Roots

On the flip side, there's the deep, grounding sense of stability that only comes with owning your home. This is about so much more than just a deed to a property; it's about building a life and becoming part of a community.

That stability brings a special kind of peace of mind. A fixed-rate mortgage means your housing costs are predictable, which eliminates the annual anxiety of wondering how much your rent is going to jump. It’s a solid foundation for your family.

Owning your home means creating a consistent world for your kids, with the same school and the same friends year after year. It’s about forging real connections with the neighbors you see at the local park and knowing that your space is truly, one hundred percent yours.

Figuring Out Your Priorities

In the end, this choice is a balancing act between short-term flexibility and long-term security. The right move really depends on your current life stage.

Renting probably makes more sense if:

You see a major life change on the horizon (like a job offer in another city).

You want to explore a neighborhood like Edgewood before making a long-term commitment.

Your savings or credit score need a little more time to get mortgage-ready.

Owning is likely the way to go if:

You plan on staying put for at least the next five years.

You're ready for the stability of a fixed monthly payment and a place to truly call your own.

You want to start building equity and create a powerful financial asset for your future.

And that feeling of security isn't just in your head. A global Ipsos survey found that 69% of homeowners are happy with their living situation, a stark contrast to just 47% of renters. The study also showed that homeowners feel more financially secure—only 37% stress about their mortgage, while nearly half (49%) of renters worry about paying their rent. You can explore more of the survey's insights about these housing trends to get the full picture.

So, You're Ready to Make a Move in Maryland?

It's one thing to weigh the pros and cons of owning versus renting, but it’s another to feel that spark and think, "This is for me." If you’re starting to picture yourself as a homeowner, that's the perfect place to start. Let's talk about how to turn that feeling into a real plan, right here in amazing Maryland communities like White Marsh, Edgewood, and across Baltimore and Harford Counties.

Taking that leap can feel huge, I get it. But breaking it down into smaller, manageable steps makes all the difference. The first move isn't touring homes—it's getting a solid handle on your budget. Knowing what you can comfortably afford is the key to a smooth, stress-free homebuying journey.

First, Let's Talk Money

Before you get lost in daydreams of kitchen islands and walk-in closets, it’s a good idea to get a clear, honest look at your financial situation. Doing this groundwork now will make your conversations with lenders so much easier down the road.

Here’s a quick checklist to get you started:

Know Your Credit Score: Your credit is a huge piece of the puzzle for lenders. You can pull free annual reports to see exactly where you stand and clean up any errors you might find.

Figure Out Your Debt-to-Income (DTI) Ratio: This is just a fancy way of saying lenders want to see how much of your monthly income is already spoken for. Add up your car loans, student debt, and credit card payments, then divide that total by your gross monthly income. That's your DTI.

Start Stashing Cash for a Down Payment: The old "you need 20% down" rule is mostly a myth these days. Many great loan options allow for as little as 3.5% down and even 0%, so every bit you can save now helps.

For a deeper dive, check out our guide on how to buy your first home in Maryland. It's packed with local insights to help you get ready.

Why Pre-Approval is Your Superpower

Once your finances are in focus, the next step is getting pre-approved for a mortgage. Honestly, this is a total game-changer. A pre-approval letter isn't just a piece of paper; it's proof to sellers that you're a serious, qualified buyer. It gives you a concrete budget to shop with and turns you from a casual browser into a real player.

This is where the fun really begins, and where I can help. I’m not just here to sell you a home—I’m here to offer real, hands-on guidance through these early stages. My job is to make this process feel exciting, not intimidating.

Ready to explore what’s out there? Let’s chat. I can connect you with lenders I trust and show you how my unique visualization tools can help you start designing the home you've always wanted. Together, we can make your dream of owning a new home in Maryland a reality.

Common Questions About Owning vs. Renting

The whole "buy or rent" debate can feel overwhelming. It's a huge financial decision, so of course, you've got questions. Let's break down some of the most common ones I hear all the time to help you get some clarity.

Is Renting Really Cheaper Than Buying Right Now?

It’s easy to look at a monthly rent payment and think it's the cheaper option, but that's really just a snapshot in time. With a fixed-rate mortgage, your principal and interest payment is locked in for the life of the loan—we're talking 15 or 30 years of predictability. Rent, on the other hand, almost always goes up.

The bigger picture, though, is what your money is actually doing. Every mortgage payment is a step toward owning your home outright, building your personal wealth through equity. Renting might feel lighter on the wallet this month, but owning is how you invest in your financial future.

How Much Do I Really Need for a Down Payment?

Forget the old myth that you need 20% down. That idea is thankfully a thing of the past for most people. There are so many fantastic loan programs out there designed to get people into homes without a massive pile of cash.

FHA Loans: These are a game-changer, often requiring as little as 3.5% down.

Conventional Loans: You'll find plenty of lenders offering great options for first-time buyers that only need 3-5% down and you can even get moved in for 0% in some of our communities if qualified.

Local Programs: Here in Maryland, we have some incredible state and local programs that can help out with both down payments and closing costs.

Your best first move is to have a conversation with a lender you trust. They can lay out all your options, and you’ll probably be surprised by what you can actually afford.

What if I Buy a Home and Need to Move Soon?

This is a really smart question, and the answer comes down to your timeline. If you have a strong feeling you might be relocating within the next one to three years, renting is often the more practical choice. The upfront costs of buying and the future costs of selling can eat into any gains you might make in such a short period.

However, if you see yourself staying put for five years or more, that’s usually enough time for the home’s value to grow. This gives you the chance to build solid equity, making it a sound financial move when you do decide to sell. And don't forget, you always have the option to become a landlord yourself and turn that home into an income-producing asset.

Ready to stop building your landlord's equity and start building your own? While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. Let’s explore how you can personalize a new home in White Marsh, Edgewood, or the surrounding Maryland communities. Visit me at customizeyourhome.com to get started.

Comments