Your Guide To Buying Your First Home In Maryland

- Justin McCurdy

- Jan 31

- 15 min read

So, you're thinking about buying your first home. It's a huge milestone, but it doesn't have to be overwhelming. Let's be honest, the whole process can feel like a mystery, but once you break it down, it's totally manageable.

This guide is here to walk you through it, step by step, with a friendly tone and lots of practical examples. We'll turn that "Where do I even start?" feeling into a confident plan of action.

Your Homeownership Journey Starts Here

Welcome! Getting the keys to your first home is one of the most exciting things you'll ever do. It might seem like there are a million moving parts, but we're going to tackle them one at a time.

Think of this as a conversation with a friend who’s been through it all. We’ll cover everything from getting your finances sorted out for a loan, to the big decision between a brand-new build and an older home, and all the way to what actually happens on closing day.

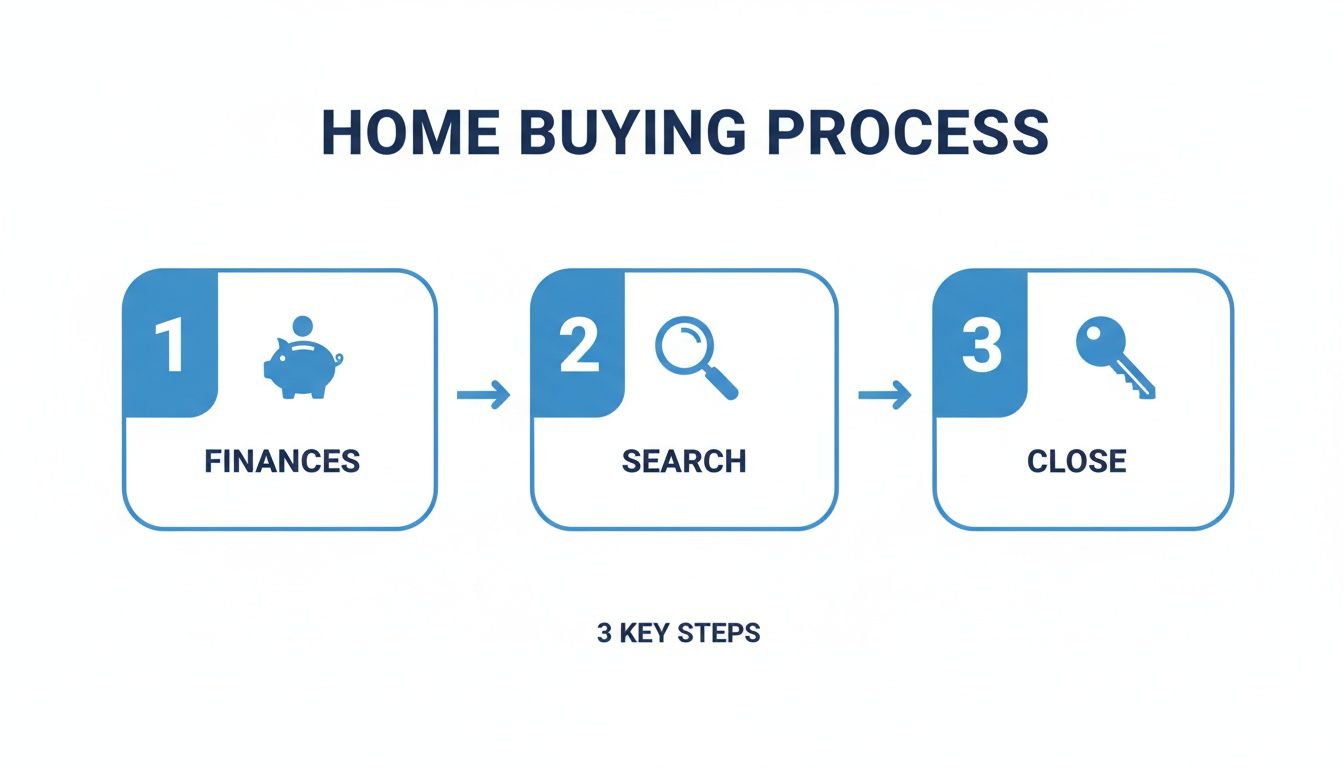

At its core, the journey to homeownership really comes down to three big phases.

As you can see, getting your financial ducks in a row is the absolute first step. That solid foundation makes the house hunt so much smoother and sets you up for a successful closing.

Creating Your Personalized Home

One of the first major forks in the road is deciding what kind of home you want. While resale homes have their own appeal, choosing a new construction home gives you a blank canvas to create a space that’s 100% you, right from the get-go.

Instead of inheriting someone else's design choices (and potential weekend projects), you get to be the one calling the shots. Imagine picking out your own flooring, kitchen countertops, cabinets, and tile. For example, instead of living with dated floral wallpaper, you get to choose the perfect paint color for your living room before you even move in. That's the real magic of building new—you skip the immediate renovation costs and move into a home that already feels like your own.

Choosing new construction isn't just about buying a house; it's about crafting a home that perfectly reflects your lifestyle and personality right from the start.

This guide is especially geared toward anyone looking to put down roots here in Maryland. Whether you're eyeing the bustling neighborhoods of White Marsh, the easy-living vibe of Edgewood, or other great spots in Baltimore County and Harford County, we’ve got the local insights you need.

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. For a more detailed look at the local process, check out our guide on a friendly step-by-step home buying Maryland guide.

Preparing Your Finances For A Mortgage

Before you even think about picking out kitchen cabinets or arguing over paint swatches, the first real step to buying a home is getting your financial house in order. Think of it like pouring the foundation for your new house—everything else in this journey depends on it being solid.

This isn't just about saving up a pile of cash. It's about positioning yourself as a great candidate for a mortgage, turning that vague "someday" dream into a real, actionable plan for "soon." Let's get into what you need to focus on to get yourself ready.

Why Your Credit Score Is A Big Deal

Your credit score is basically your financial reputation boiled down to a single number. Lenders look at it to get a quick read on how you've handled debt in the past. A great score can unlock a lower interest rate, which might not sound like much, but it can literally save you tens of thousands of dollars over the 30-year life of your loan. For instance, a 1% lower interest rate on a $400,000 loan could save you over $200 per month.

Don't panic if your score isn't perfect. A lot of loan programs are actually built for first-time buyers who have good—but not flawless—credit. The important thing is to know your number and start taking steps to make it better.

Here are a few simple ways to give your score a boost:

Pay every bill on time. Seriously, this is the biggest piece of the puzzle. Setting up automatic payments is a great way to avoid accidental late fees.

Lower your credit card balances. Try to keep your usage below 30% of your total available credit. If your credit limit is $10,000, aim to keep your balance under $3,000.

Scan your credit report for mistakes. You can get free copies from the big credit bureaus and challenge anything that looks wrong.

The Down Payment Demystified

The down payment often feels like the biggest mountain to climb. How much do you really need? You’ve probably heard the old "you need 20% down" rule, but for most people buying their first home, that's simply not true anymore.

Saving is definitely a major focus for new buyers. According to the National Association of Realtors' 2025 Profile of Home Buyers and Sellers, the median down payment for first-timers was 10%—the highest it’s been since 1989. On a home with an average list price of $432,600, that’s a $43,260 down payment. It's a hefty sum that leads many buyers to look into builder incentives and new construction to make the numbers work. You can dig into more of these trends in their full 2025 home buyer profile.

Understanding Your Loan Options

Not all mortgages are built the same. There are different types of loans designed for different financial situations, and it pays to know which one might be right for you.

Here's a quick comparison of the most popular mortgage options to help you understand which might be the best fit for your financial situation.

Common Loan Types For First-Time Buyers

Loan Type | Typical Minimum Down Payment | Best For | Key Consideration |

|---|---|---|---|

Conventional | 0% in Trimble Meadows (if qualified), 3% - 5% | Borrowers with strong credit and stable income. | You'll likely need Private Mortgage Insurance (PMI) if you put down less than 20%. No PMI for the exclusive 100% program in Trimble Meadows. |

FHA Loan | 3.5% | Buyers with lower credit scores or smaller savings for a down payment. | Requires mortgage insurance for the life of the loan (unless you refinance). |

VA Loan | 0% | Eligible veterans, active-duty service members, and surviving spouses. | This is a fantastic benefit earned through service, with no PMI required. |

Ultimately, choosing a loan is a personal decision, but understanding these basic differences is a great first step. Your lender will be able to guide you toward the perfect fit.

Getting pre-approved for a mortgage is like having a golden ticket. It proves to sellers you’re a serious buyer and gives you a concrete budget, so you can shop for a home with total confidence.

Beyond The Down Payment

Your down payment is the big one, but it's not the only check you'll be writing. Budgeting for these other costs from the get-go will save you a lot of stress down the road.

Make sure you've got some cash set aside for:

Closing Costs: These are all the fees for the services needed to finalize the sale, and they typically add up to 2% to 5% of the home's price. In both communities, our current incentives will likely pay all closing costs if you elect to apply them towards this (you must use our preferred lender and title company partner to get these.

Property Taxes & Home Insurance: Lenders require you to have insurance, and taxes are just part of owning a home. These are usually rolled into your monthly mortgage payment.

Moving Expenses: Don't forget about the cost of actually getting all your stuff from your old place to your new one!

One of the key numbers lenders will scrutinize is your debt-to-income ratio. We've got a great resource that explains what debt-to-income ratio is and why it matters for homebuyers that you'll definitely want to check out.

New Construction vs. Resale Homes

One of the first big forks in the road for any homebuyer is deciding between a brand-new home and one that’s been lived in. It’s a classic debate: the charm and mature landscaping of a resale home versus the squeaky-clean, modern appeal of new construction. They're two completely different routes to getting the keys to your own place.

A resale home definitely has its allure. You're buying into an established neighborhood, complete with big trees and a certain character that’s hard to build from scratch. But sometimes, that charm can mask some pretty big headaches. It’s easy to fall for a 30-year-old house and not realize the furnace is on its last leg or the roof is one bad storm away from needing a full replacement.

The True Cost of a Resale Home

When you buy an older home, the price you see on the listing is really just a starting point. You’re not just buying the four walls; you’re also inheriting every bit of wear and tear from the previous owners. This is where a lot of first-time buyers get a rude awakening.

You have to look at a resale home and immediately start factoring in the cost of future renovations. For example, knowing the average cost of a kitchen remodel is a game-changer for your budget. That charming-but-dated kitchen could easily tack on an extra $25,000 to your real cost, turning your "bargain" into a never-ending, budget-draining project.

Here are a few of the common "gotchas" with resale homes:

Big-Ticket Replacements: An aging HVAC system, water heater, or roof can fail without warning. Suddenly, you're facing an emergency repair bill for thousands of dollars you hadn't planned for.

Outdated Guts: Older electrical and plumbing systems often can't handle our modern gadgets and appliances. Bringing them up to code can be a surprisingly expensive job.

Energy Hogs: Think drafty old windows, barely-there insulation, and ancient appliances. All of this adds up to sky-high utility bills every single month.

The Blank Canvas of a New Build

Okay, now let's flip the script and talk about new construction. Buying a new home is like being handed a perfectly blank canvas. Everything is fresh, untouched, and built to the latest safety and energy standards. There are no weird mysteries hiding behind the drywall or ugly popcorn ceilings you’ll have to spend your weekends scraping off.

Honestly, the biggest win is moving into a home that’s truly yours from the get-go, without having to live in a dusty, chaotic construction zone. You get to be the one making all the fun decisions that show off your style.

With new construction, you aren't just buying a house; you're creating a home. You skip the compromises and step into a space designed specifically for you.

You get to pick the things that matter most. Imagine walking into your kitchen for the first time and seeing the exact quartz countertops and shaker cabinets you spent weeks dreaming about. Or feeling the perfect luxury vinyl plank flooring under your feet—the one you chose because you knew it would look amazing with your sofa.

My Approach to Personalization

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. You can virtually mix and match different flooring, cabinet colors, and countertop materials to see how it all flows together. It completely takes the guesswork out of designing your home, so you can be confident you'll love the final product.

That's a level of personalization you just can't get with a resale home unless you're ready for a massive, wallet-draining overhaul. In communities all over White Marsh, Edgewood, and greater Baltimore County and Harford County, we help buyers build a home that's a perfect fit for their life, right from the very beginning.

At the end of the day, the choice is all about your priorities. Are you drawn to the character of an older home and ready to tackle the projects that come with it? Or do you crave the peace of mind, energy savings, and total customization that only a brand-new home can offer? For most first-time buyers, starting fresh is the most exciting and rewarding path.

Personalizing Your New Construction Home

This is where buying your first home gets really fun. When you choose new construction over a resale property, you're not just moving into a house; you’re stepping into a space that you had a hand in creating from the ground up.

Forget having to live with someone else's questionable taste in avocado-green bathroom tile or decades-old shag carpet. Building new means you get to be the designer. It's all about making your home a true reflection of your personality and how you actually live.

Making Your Selections

This is the part everyone looks forward to—visiting the design center. You'll get to pick out all the finishes that turn a basic floor plan into your personal sanctuary. I'm right there with you, guiding you through every choice to make sure the final look is cohesive and exactly what you envisioned.

Here are just a few of the key areas you'll get to put your stamp on:

Kitchen Finishes: Are you dreaming of sleek, modern quartz countertops or the timeless, classic appeal of granite? You’ll also choose the cabinet styles and colors that define the heart of your home.

Flooring Throughout: From durable, stylish hardwood in the main living areas to plush, cozy carpeting in the bedrooms, you decide what goes underfoot in every single room.

Bathroom Design: This is your chance to create a mini spa-like retreat. Pick out your favorite tile for the shower walls and floors, select the perfect vanities, and choose the fixtures that complete the look.

Bringing Your Vision To Life

It’s one thing to see a small tile sample, but it can be really tough to picture how it will look next to your cabinet choice across an entire kitchen. This is where a little bit of tech makes a huge difference in the home-buying journey.

I offer my clients unique proprietary visualization tools that completely take the guesswork out of the design process. You can see a realistic preview of your choices before construction even starts, giving you total confidence in every decision.

Want to see how different hardwood finishes look in your future living room? Or maybe you want to play around with backsplash patterns for the kitchen? These tools let you experiment with combinations and see exactly how your dream space will come together. No more hoping for the best—you'll know you love it.

Designing For Your Lifestyle

True personalization goes way beyond just colors and materials. It's about making your home work for you.

Think about how you live day-to-day. If you love to entertain, maybe a large kitchen island where guests can gather is a must-have. If you work from home, we can make sure your office has the right flooring and lighting to be a truly productive space. For more ideas on this, check out our guide to customizing your home.

In communities all over White Marsh, Edgewood, and greater Baltimore County and Harford County, we help first-time buyers create homes that are a perfect fit. This ability to customize is precisely why so many people find building a new home is the most rewarding path to homeownership.

From Final Walk-Through To Moving Day

You’ve signed off on the designs, watched your home take shape, and the day you’ve been dreaming about is finally within reach! This final stretch is all about tying up the loose ends, making sure every detail is perfect, and officially getting those keys in your hand. It's the home stretch before you can finally kick back on your new sofa and soak it all in.

The All-Important Final Walk-Through

Think of the final walk-through as your last look-over before the house is officially yours. This is your chance to walk through the completed home with me to confirm that everything is exactly how you pictured it. Now is not the time to be shy! We want you to be completely, 100% happy with the finished product.

Together, we’ll keep an eye out for any minor imperfections that need a quick touch-up, like a tiny paint scuff on the wall or a cabinet door that doesn’t close quite right. These little items get added to what we in the industry call a "punch list." For example, we'll flip every switch to make sure the light fixtures you chose are working perfectly. To get a better handle on this part of the process, it helps to understand what a punch list is and how it ensures a perfect home finish.

Understanding Closing Day

Closing day is the official finish line. It's the big meeting where you'll sign a stack of final paperwork, the funds will be transferred, and the property legally becomes yours. At the very end of it all, you'll be handed the keys to your brand-new home!

A key part of closing is paying the closing costs. These are simply the fees for all the various services required to finalize the home purchase.

They typically include things like:

Lender Fees: What the bank charges for processing and approving your loan.

Title Insurance: This protects both you and the lender from any weird, unforeseen claims on the property's title down the road.

Recording Fees: The cost to have the county officially record you as the new owner.

In most cases, you can expect these costs to be somewhere between 2% to 5% of your home's total purchase price. Don't worry, we'll give you a detailed breakdown well ahead of time so you know exactly what to expect. No surprises.

The Peace of Mind of a Home Warranty

Honestly, one of the biggest perks of buying a brand-new home is the warranty. With a resale home, you're often inheriting someone else's potential problems. But with new construction, your home is protected from day one. It's a massive safety net that brings incredible peace of mind.

A new home warranty is your assurance that the quality and craftsmanship of your home are built to last. It covers workmanship, materials, and major systems, protecting your investment for years to come.

This means if an issue pops up with the plumbing, electrical systems, or even the structural components, you’re covered. It’s a huge weight off your shoulders, letting you settle in and just enjoy your new space without stressing about sudden, expensive repair bills.

Your Smooth Move-In Checklist

With the keys finally in your hand, it’s time for the very last step: moving in! A little bit of planning here goes a long way in making the whole process feel easy and exciting, not overwhelming.

As you get ready for the big day, checking out some tips for a smooth move as a first-time homeowner can be a game-changer. Start scheduling your utilities, booking movers, and packing up those boxes a little early. That way, you can focus on the pure excitement of starting this amazing new chapter in your beautiful Maryland home, whether it’s in White Marsh, Edgewood, or another one of our fantastic communities.

Your Maryland Home Buying Questions Answered

We get it—buying your first home is a huge step, and it’s totally normal to have a million questions swirling around in your head. It can feel like you’re trying to learn a whole new language overnight.

That's why we've put together answers to some of the most common questions we hear from first-time home buyers right here in Maryland. Our goal is to cut through the noise and give you the straightforward info you need to feel confident and make smart moves in the local market.

FAQ For Maryland First-Time Home Buyers

Here’s a quick rundown of what new buyers often ask when looking for homes in places like Baltimore County and Harford County.

Question | Answer |

|---|---|

What are the biggest mistakes first-time home buyers make? | Jumping the gun and house hunting before getting pre-approved is a big one—it often leads to disappointment. Another is underestimating the true cost of owning a home, which goes way beyond the mortgage to include taxes, insurance, and upkeep. With resale homes, skipping the inspection is a massive gamble. The equivalent for new construction? Rushing the final walk-through. You really need to take your time and make sure every detail is perfect. |

Are there special programs for first-time buyers in Maryland? | You bet! The Maryland Mortgage Program (MMP) is fantastic and offers several options for down payment and closing cost assistance. These programs exist specifically to give first-time buyers a leg up. We always tell people to find a lender who really knows the ins and outs of these state-specific programs to see what you qualify for. |

How long does the home buying process take? | If you’re buying an existing home, you can typically expect it to take anywhere from 30 to 90 days from pre-approval to closing day. The biggest variable is always the house hunt itself. For a new construction home that you're customizing, the timeline is naturally longer to account for the build. Your builder will walk you through a clear schedule right from the start so you always know what’s happening. |

Why should I consider buying a new home in White Marsh or Harford County? | Honestly, these areas offer an incredible lifestyle. You get the comfort of the suburbs with super easy access to Baltimore and major commuter routes. You’ll find you get more space for your money compared to the city, plus great schools and communities full of parks and shopping. Building a new home here means you get a modern, energy-efficient space designed by you, in a location that’s perfect for both families and professionals. |

Think of this as your starting point. Every home buying journey is a little different, but knowing the basics can make a world of difference.

Everyday Home Living Tips

Okay, so once you’ve got the keys in your hand, the real fun begins: turning that house into your home. It’s not just about the big stuff. The little, everyday habits are what make home life feel less chaotic and a lot more enjoyable.

Here are a few practical tips to get you started on the right foot:

Create a Seasonal Maintenance Checklist: Don't wait for things to go wrong. In the spring, get your HVAC tuned up and clear out the gutters. Come fall, check for drafts around the windows and have the furnace inspected. A simple checklist can save you from a major headache (and a major bill) down the road.

Set Up a "Home Central" Spot: Pick one little area—a kitchen drawer, a basket by the door—for all the essential stuff. We’re talking keys, wallets, mail, and phone chargers. This tiny bit of organization is a lifesaver on those frantic mornings when you're already running late.

Master a Few Go-To Recipes: Seriously, nothing makes a house feel like home faster than the smell of something delicious cooking. Learn 3 to 5 simple meals you can whip up without much thought. It solves the "what's for dinner?" dilemma and makes you look like a pro when friends drop by unexpectedly.

Owning a home isn’t just about paying the mortgage; it’s about creating a space that’s comfortable, functional, and genuinely brings you joy. A little bit of planning makes all the difference.

These small routines are what transform a property into your personal sanctuary. By keeping an eye on both the big picture of homeownership and the tiny details of daily life, you’re setting yourself up for years of happiness.

Ready to explore a home that’s uniquely yours? While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. We let buyers customize their homes by getting to pick their flooring, countertops, cabinets, tile, and more.

Let’s start the conversation about building your future in White Marsh, Edgewood, or another great Maryland community. Visit our website to learn more about how we can help.

Comments