Your Guide to Construction Financing Options in Maryland

- Justin McCurdy

- Dec 30, 2025

- 15 min read

So, you're dreaming of building a new home but the thought of navigating the financial side feels a bit like trying to read a map in a foreign language. You've come to the right place.

Think of a regular mortgage like buying a finished cake from the bakery. Construction financing is different—it's like getting a loan for the flour, sugar, and eggs, and then paying the baker as they complete each step. It’s a more involved process, often with higher interest rates and a few more moving parts.

What Exactly Is Construction Financing?

Unlike a traditional mortgage that hands you a lump sum for an existing house, a construction loan is designed to cover the costs of building a new home. These are almost always short-term loans. The bank doesn't just give your builder a big check; instead, they release the money in stages, known as draws, as major milestones are hit.

This makes sense when you think about it. With a resale home, the house itself is the bank's collateral. When you're building, there's no house yet! The lender funds the project piece by piece—from pouring the foundation to framing the walls and finally, adding the finishing touches.

The Big Difference For Homebuyers

For you, the homebuyer, this usually means a much more hands-on financial experience. While the home is under construction, you're typically on the hook for making interest-only payments on the funds that have been paid out to the builder. It's a normal part of the process, but let's be honest, it can add a lot of stress and financial pressure.

Here's the good news: when you build with us in communities like White Marsh or Edgewood, you don't have to worry about any of that. We handle the construction financing for you, which means you won't make a single interest payment while your new home is being built.

Our approach completely changes the game for your journey to homeownership. Instead of juggling a complicated construction loan, your only task is to line up a standard, permanent mortgage right when your brand-new home is ready for you to move in.

Why This Matters To You

Taking the construction loan off your plate gives you some serious advantages right from the start. You get to focus on the exciting parts of building a home without all the financial headaches.

Here's how it helps:

Financial Simplicity: You get to skip the entire complex application and management of a short-term, high-interest construction loan.

Reduced Stress: No need to watch over draw schedules or make interest payments on a home you can't even live in yet.

More Focus on Fun: Your energy can go exactly where it should be—on personalizing your space. You can enjoy picking out your flooring, countertops, and cabinets with my hands-on service and unique visualization tools.

While we take care of the construction loan, it's always smart to know all your options. Exploring alternative methods like seller financing in real estate can sometimes open up unique possibilities. Understanding the full picture helps you truly appreciate the simpler, more direct path we offer our homebuyers across Baltimore County and Harford County, Maryland.

Getting to Know Traditional Construction Loans

Alright, now that we've got the basics down, let's pull back the curtain on the most common ways people get a construction loan. It’s a bit like choosing between a direct flight or one with a layover—both get you there, but the journey is totally different. The two main paths are the “construction-to-permanent” loan and the “construction-only” loan.

Getting a handle on these is crucial, mostly because it throws a spotlight on just how much simpler our alternative is. When you build with us, we manage this whole complicated process for you. You don’t need either of these loans, which means you get to skip making interest payments on a house that isn't even finished yet.

The All-In-One Package: Construction-To-Permanent Loans

First up, we have the construction-to-permanent loan, which you’ll often hear called a "one-time close" loan. This is the crowd favorite because it rolls the financing for the build and your final mortgage into one neat package. You go through one application, one approval, and one closing. Simple enough, right?

Here’s how it plays out: once you’re approved, the loan has two distinct phases. While your home is being built, it acts as a construction loan, paying your builder in stages (called draws) as work gets done. During this time, you make interest-only payments. After the final nail is hammered and the home passes inspection, it automatically flips into a standard mortgage—no more paperwork, no more closing costs.

Imagine a family building in Harford County, Maryland. With a construction-to-permanent loan, they lock in their interest rate right at the start. That gives them some serious peace of mind, knowing their final mortgage payment won't suddenly shoot up by the time they get the keys. That predictability is a huge win.

The Two-Step Approach: Construction-Only Loans

The other route is the construction-only loan, and it’s as straightforward as its name. This is a short-term loan that just covers the cost of building your house. It’s usually set to last for the duration of the build, typically around 12 months.

During that year, you're on the hook for interest-only payments on the money the builder has used so far. But here’s the kicker: once the house is finished, the entire loan is due in full. That means you have to scramble to get a completely separate permanent mortgage to pay off the construction loan.

This "two-time close" process means two applications, two sets of underwriting, and yup, two sets of closing costs. While it might offer some flexibility if you’re betting on mortgage rates dropping, it’s a gamble. If rates go up, you could be stuck with a much higher payment than you planned for.

The biggest thing to remember? Both of these traditional loans require you to make payments while the house is still a work in progress. That’s a major financial burden that our clients in White Marsh, Edgewood, and across Baltimore County get to sidestep entirely. We take on that responsibility, so your first mortgage payment isn't due until your new home is 100% complete and ready for you to move in.

This doesn't just save you a boatload of money; it erases a massive source of stress from the equation. You can see all the steps involved in our guide on home construction loan requirements made simple. Even though we handle it for you, being in the know helps you appreciate the journey.

Ultimately, by managing the construction financing ourselves, we free you up to focus on the fun stuff—like using my unique visualization tools to design a home that’s perfectly you, without any of the financial headaches.

Government and Renovation Loan Programs

If the big, traditional construction loans seem a little intimidating—almost like they're built for professional developers—don't worry. Government-backed programs are the welcoming alternative, designed for everyday people. These aren't just obscure options; they're powerful ways to make building a new home a reality, especially here in our beautiful Maryland communities.

We're talking about programs from the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA). What makes them so great? They often come with some amazing perks, like much lower down payments and more flexible credit requirements. This makes them a perfect match for first-time homebuyers or families looking to settle down in the lovely suburban and rural parts of Harford County.

Unlocking Opportunities with Government Loans

Each of these government-backed construction loans has its own unique flavor, tailored to help a specific type of buyer. Think of them as leveling the playing field, opening the door to homeownership for more people.

Let's break down the most popular choices:

FHA Construction Loans: These are a huge hit with buyers who haven't saved up a massive down payment. You can often get into one with as little as 3.5% down.

VA Construction Loans: This is an incredible, hard-earned benefit for our service members, veterans, and their families. For most, you can build a brand-new home with zero down payment. It’s a complete game-changer for military families in places like Edgewood.

USDA Construction Loans: Dreaming of a home with a little more space, maybe in a qualifying rural or suburban spot? A USDA loan might be for you. Just like VA loans, they can offer 100% financing, meaning no down payment is needed.

These programs are fantastic, but they don't erase the normal hassles of a construction loan. You'd still be managing draw schedules and making interest-only payments while your home is under construction. It's a major financial responsibility, but it's one our clients get to skip entirely. We handle all the construction financing ourselves, so you can focus on the fun part—the creative journey.

Transforming a House with Renovation Loans

So, what happens when you find a house in the perfect Baltimore County neighborhood, but it’s, well, a fixer-upper? That's where renovation loans, especially the popular FHA 203(k) loan, shine.

An FHA 203(k) loan is a fantastic tool that lets you roll the purchase price of a home and the cost of its repairs into a single, convenient mortgage. It’s like getting one loan to both buy the house and fund the dream kitchen you've always wanted.

This is a really smart way to finance major upgrades without having to pay for it all out of pocket. Of course, you have to consider the current economic climate. The latest AIA Consensus Construction Forecast points out that high interest rates and material costs are making lenders a bit more cautious. You can get more details from the July 2025 construction forecast to see how the market is shifting.

While these government options are great, our process offers something even better: total peace of mind. When you build with us in White Marsh or our other Maryland communities, you get to bypass the entire construction loan phase. You won’t make a single interest payment while we build, because we’ve got it covered. I provide the hands-on service and proprietary visualization tools to bring your dream space to life, while you simply get ready for a standard, final mortgage at the end.

To get a better handle on how different mortgages work, take a look at our guide on home loan types explained for Maryland buyers. Understanding the basics really helps you appreciate just how simple and streamlined we make the path to your new home.

The Simple Path: How We Handle Construction Financing For You

Feeling a little overwhelmed by all those financing options? I get it. Draw schedules, interest-only payments, two-time closings... it’s enough to make anyone’s head spin.

So, let's just push all of that complexity aside for a moment. I want to talk about a much simpler, more direct path to building your new home.

When you build with us, you can completely skip the traditional construction loan process. That’s right—no applying, no managing multiple payments, no headaches. We take on the entire financial load for you, right from the start.

How We Make Financing Simple

Think of it this way: instead of you having to secure a loan to pay us to build your house, we use our own funds to build it for you. We're the ones dealing with the suppliers, paying the contractors, and handling the inspectors. We cover the costs as the foundation gets poured, the walls go up, and the roof goes on.

Your side of the financial equation is incredibly simple.

All you need to do is get approved for a standard, permanent mortgage—the same kind of loan you’d get for any existing house on the market. That loan doesn't even start until your beautiful new home is completely finished and you're ready to move in.

This means you won't make a single mortgage or interest payment while your home is under construction. All that anxiety about paying for a house you can't live in yet? Gone. You'll save thousands of dollars and avoid months of financial stress.

This straightforward approach is a core part of the experience for our clients building in communities across White Marsh, Edgewood, Baltimore County, and Harford County, Maryland.

The Real-World Perks of Our Approach

Letting us handle the financial heavy lifting does more than just cut down on paperwork. It genuinely changes the entire feel of your home-building journey for the better. It frees you up to focus your energy where it should be: on the fun and creative process of designing your dream home.

Here’s what that looks like in practice:

Massive Financial Savings: You avoid paying months of interest on a construction loan. On a typical build, these payments can easily add up to thousands of dollars—money you’ll never see again.

Zero Construction Risk: Unexpected delays? A sudden jump in material costs? That can be a nightmare with a traditional loan. Since we're fronting the costs, we absorb that risk, not you.

One Simple Closing: Forget the hassle of closing once on the loan and again on the house. You’ll have one single, easy closing for your final mortgage when the home is done, just as if you were buying a move-in-ready property.

More Energy for the Fun Stuff: Instead of worrying about loan draws and bank inspections, you can get lost in the creative details. That’s where the real magic happens!

Your Focus Stays on Personalization and Design

Because we’ve cleared the financial hurdles out of your way, your journey is all about bringing your vision to life. This is where I go a step further for my clients, offering unique visualization tools and a hands-on service you just won't find anywhere else.

While our team is busy managing the build, you'll be using our exclusive visualizers to:

Select the perfect flooring that captures your style.

Choose the countertops and cabinets for your dream kitchen.

Pick out the exact tile to make your bathroom feel like a personal spa.

This whole process is designed to be exciting, not exhausting. We believe customizing your home should be a creative adventure, not a financial puzzle. By taking the world of complex construction financing options off your plate, we put the focus back on you, helping you design a home that is a true reflection of your life.

Getting a Handle on Construction Loan Costs and Timelines

When you decide to handle the financing yourself, it's a whole different ballgame. You're not just looking at one single loan amount; you're stepping into a world of variable interest rates, inspection fees, draw schedules, and contingency funds. It can feel like juggling a dozen things at once.

Frankly, getting comfortable with all these moving parts is a must if you go the traditional route. It’s exactly this kind of financial stress and complexity that we've designed our process to help homebuyers in Maryland avoid completely.

What in the World is a Draw Schedule?

One of the biggest hurdles to understand is the draw schedule. Don't let the term intimidate you. Think of it as an allowance for your builder, paid out in stages based on their progress. The bank isn't just going to hand over a giant check for the full amount on day one.

Instead, they release funds—or "draws"—as specific milestones are hit. A really common schedule might look something like this:

Draw 1: After the foundation is poured and set.

Draw 2: Once the house is framed and the roof is on.

Draw 3: When windows, doors, and major systems like plumbing and electrical are installed.

Draw 4: After the drywall is up and interior finishing work starts.

Before cutting a check for each draw, the lender sends out an inspector to make sure the work is actually done and up to snuff. This is how they protect their investment, but it also creates a stop-and-go rhythm that can easily lead to delays if things aren't perfectly aligned.

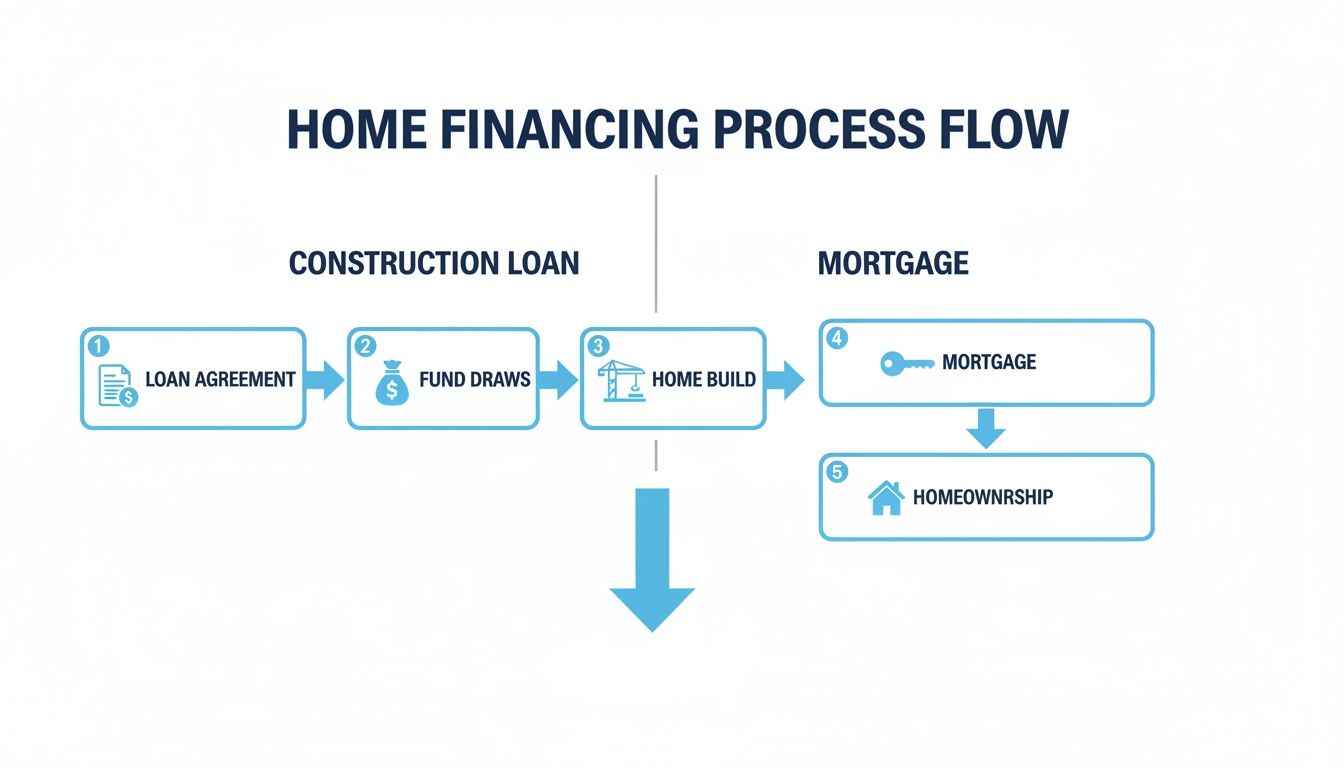

The diagram below really highlights the difference between this multi-step, traditional headache and the streamlined path our clients enjoy.

As you can see, our builder-financed model shields you from that entire complicated draw process. Your only job is to focus on getting a standard, simple mortgage right at the very end.

Juggling Timelines and Costs You Can’t Control

The construction industry is wrestling with some big challenges right now. Between ongoing supply chain hiccups and a major shortage of skilled workers, the entire North American construction sector is facing rising costs. On top of that, tariffs have driven the effective rate on construction goods to a 40-year high, which means the price of materials has shot up.

These aren't just abstract economic problems; they have a direct impact on your project's timeline and final cost. With a traditional construction loan, you're the one on the hook for those delays and budget overruns. It's yet another reason our builder-financed approach is such a game-changer—we take on that risk so you don't have to.

For our buyers in White Marsh, Edgewood, and all across Baltimore and Harford Counties, this means genuine peace of mind. You won't spend sleepless nights worrying that a sudden jump in lumber prices will stall your build and rack up more interest payments. To get a better sense of how it all comes together, take a look at our new home construction timeline explained.

We're firm believers that building your dream home should be an exciting, creative journey, not a nail-biting financial ordeal. By carrying the weight of the construction financing, we free you up to focus on the fun stuff—like using our visualization tools to pick the perfect flooring, cabinets, and countertops that will make your new house a home. If you do decide to tackle financing on your own, this ultimate guide to securing favorable bank loans is a great resource to have in your corner.

Bringing Your Vision to Life Without the Stress

While other homebuyers are getting bogged down in the nitty-gritty of draw schedules and interest-only payments, our clients are busy with the fun stuff—designing their dream space. We take the heavy lifting of construction financing completely off your shoulders so you can focus on what really matters.

This is where the real joy of building a new home kicks in. You get to dive headfirst into the creative process, making the hundreds of little choices that turn a house into your home.

Focus on What Truly Matters: Your Home

Our approach is pretty unique. We want your energy spent on personalization, not paperwork. While we handle all the complicated financial stuff behind the scenes, you get to work directly with me and my visualization tools to bring every idea to life.

We designed this process to be both fun and empowering. You’ll be able to:

Design Your Dream Kitchen: Pick out that perfect combination of countertops and cabinets you’ve been dreaming about.

Choose Your Flooring: Sort through tons of options to get the ideal look and feel for every single room.

Pick Your Perfect Tile: Create a spa-like bathroom retreat with finishes that really show off your personal style.

We manage the financial logistics so you can get lost in the creative journey. Our whole goal is to make customizing your home an exciting adventure, not a stressful ordeal.

The Powerful Benefits of Our Approach

When you choose to build with us in one of our Maryland communities—whether it's White Marsh, Edgewood, or anywhere across Baltimore and Harford County—you get some major advantages that simplify your life and protect your wallet.

Our model is built on a simple promise: we manage the financial stress so you can enjoy the creative process. This means you experience financial simplicity, reduced risk, and the freedom to design a home that is uniquely yours from the ground up.

Let's be real—economic factors can throw a lot of uncertainty into a home build. Just look at 2023, when skyrocketing borrowing costs caused a 7% drop in global investment for energy-efficient buildings. As material prices and tariffs keep climbing, our approach shields you from these wild market swings. If you're curious, you can dig into the findings in the latest Global Status Report.

By handling the financing ourselves, we make sure the project stays on track and on budget. This frees you up to concentrate on the details that make a house feel like home. It’s a bit like having a top-notch project manager steering the ship; if you want to understand why that role is so vital, check out our guide on what a general contractor is and why you need one. Let us take care of the heavy lifting while you get to the good part.

Got Questions About Construction Financing? We've Got Answers.

Jumping into the world of construction loans can feel a bit like learning a new language. It’s totally normal to have questions! Let's walk through some of the most common ones we hear every day. Hopefully, seeing the answers will make it crystal clear why our builder-financed approach is built to give you a much smoother, stress-free path to your new home.

Do I really need a bigger down payment for a construction loan?

With a traditional construction loan from a bank, the answer is almost always yes. Lenders see these as riskier projects, so they often ask for a hefty 20-25% down payment right at the start. For many people, that’s a huge financial roadblock.

This is exactly the hurdle our builder-financed model eliminates. You don't have to worry about that massive initial down payment. Instead, you just qualify for a standard mortgage—with a much more manageable down payment—once the house is nearly complete. It makes building a home a realistic option for so many more people.

What happens if construction costs go over budget?

This is a big one, and a major source of anxiety for most homebuyers. If you're managing a traditional loan, any unexpected cost overruns—think a sudden spike in lumber prices or unforeseen site issues—fall directly on you. That means you have to find the cash to cover the difference, which can be incredibly stressful.

When you build with us in our communities in White Marsh or Edgewood, we take on that risk. We manage the construction budget from start to finish. This shields you from those surprise cost increases, giving you financial peace of mind so you can actually enjoy the experience.

Our whole approach is built on a simple idea: we take the financial risk off your plate. We sweat the budget so you can focus on the fun stuff, like picking out the finishes that will make your house a home.

If the builder is handling the financing, do I lose control over personalizing my home?

Not at all! In fact, it's quite the opposite. Our process is specifically designed to separate the financial heavy lifting from your creative vision. While we're dealing with the complexities of the construction loan, you get to dive into the exciting design decisions.

I work one-on-one with my clients, offering a truly hands-on experience and access to our cool visualization tools. You'll get to choose everything from flooring and cabinets to countertops and tile, making sure your new home in Baltimore County or Harford County is a true reflection of your style.

How does the appraisal work for a brand-new home?

Getting an appraisal for a home that doesn't exist yet can be tricky. With a traditional loan, an appraiser has to determine the home's future value based on just a set of blueprints and plans. There's a lot of guesswork involved.

Our way is much simpler. Because we handle the construction phase, the appraisal for your final mortgage happens when the home is nearly finished. It's appraised just like any other newly built home, which is a far more reliable and straightforward process for everyone involved—especially the lender.

At Customize Your Home, we're convinced that building your dream home should be one of the most exciting experiences of your life, not a financial nightmare. By taking care of the construction financing ourselves, we clear the path for you to focus on what really matters: designing a home you'll love.

Ready to start creating without the stress? Learn more about our unique process and see what's possible at https://www.customizeyourhome.com.