Your Guide to First Time Home Buyer Grants in Maryland

- Justin McCurdy

- 6 days ago

- 15 min read

Stepping into your first home is a huge milestone, but staring down the barrel of a down payment can feel like a massive hurdle. That's where first time home buyer grants come into play. Think of them as a financial helping hand, a little boost designed to get you over the finish line from renting to owning.

These programs offer up gift money or even loans that are forgiven over time, all to slash your upfront costs and make that dream of homeownership feel much more real.

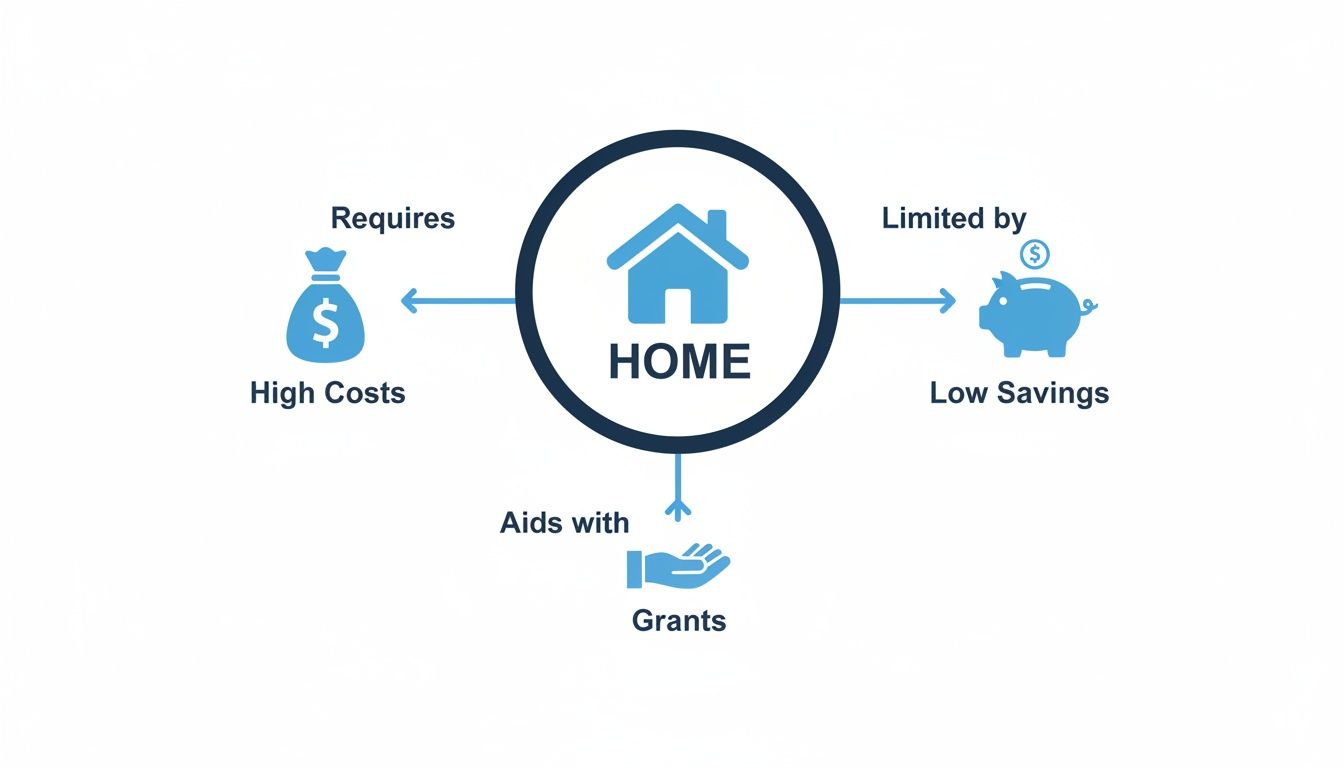

How Maryland Home Buyer Grants Make Homeownership Possible

So, you’ve been dreaming of picking out flooring and countertops for your very own space, but one look at your savings account makes it feel miles away. If that sounds familiar, you're definitely not alone.

The journey to owning a home almost always starts with one big question: "How am I ever going to save enough for a down payment?" Luckily, there are some incredible programs out there designed specifically to answer that question.

A Financial Bridge to Your New Front Door

First time home buyer grants are pretty much what they sound like: financial aid for people ready to own. These funds are there to help cover your down payment and closing costs, which are easily the biggest barriers for most new buyers.

And we're not talking about a small discount here. These programs can provide thousands of dollars, completely changing how much cash you need to bring to the closing table. For example, a $10,000 grant could cover a significant chunk of your down payment on a new townhome in White Marsh, Maryland, letting you keep your savings for furniture and moving costs.

This kind of support is more critical now than ever. In 2025, the number of assistance programs across the country hit a record high of 2,624, with the average buyer receiving about $18,000. This boom in aid is a direct response to the affordability crunch that's made it so tough for new buyers to get into the market. You can explore more details on nationwide first-time home buyer programs to see the bigger picture.

It's More Than Just Money—It's an Opportunity

Getting a hand with your down payment does a lot more than just lower your initial bill. It really opens up possibilities.

Buy Sooner: Why spend years trying to save up? With a grant, you can get into a home faster and start building your own equity right away.

Keep Your Savings: You won’t have to completely drain your emergency fund or other savings just to cover all the upfront expenses. Peace of mind is priceless.

Gain a Competitive Edge: In a tight market, coming in with your financing already secured—including grant funds—makes your offer that much stronger.

The whole process might seem a bit complicated from the outside, but with the right guidance, it's totally manageable. Understanding your options is the first step, and our comprehensive guide on how to buy your first home in Maryland can walk you through the entire journey. My team and I are here to connect you with trusted lender partners who are experts in these programs, making sure you get every single dollar you qualify for.

Understanding Your Financial Assistance Options

When you start digging into first-time home buyer grants, you’ll quickly realize "financial help" isn't a single thing. It's more like a buffet of options, and knowing what’s what is the key to picking the program that actually helps your bottom line.

Think of it this way: buying a house has some major financial hurdles, namely the down payment and closing costs. These assistance programs are designed to help you clear those hurdles. Some give you a boost, others build a ramp.

As you can see, these programs directly tackle the biggest financial barriers standing between you and the keys to your new home.

The Different Flavors of Financial Help

Let's break down the main types of assistance you'll encounter. They all aim to lower your upfront costs, but they get there in different ways.

To make it even clearer, here’s a quick comparison of the most common forms of financial aid for aspiring homeowners.

Types of Home Buyer Assistance at a Glance

Assistance Type | How It Works | Key Benefit |

|---|---|---|

Grants | Free money that you do not have to pay back. | No repayment required, ever. It’s a true gift. |

Forgivable Loans | A loan that is forgiven over time if you meet certain conditions (like living in the home). | Becomes a grant after you’ve stayed in the home for a set period (e.g., 5 years). |

Deferred Payment Loans | A zero-interest, no-monthly-payment loan that you repay when you sell or refinance. | Frees up cash flow now by pushing repayment into the future. |

Low-Interest Loans | A second, smaller loan with a very low interest rate to cover upfront costs. | More affordable than a standard loan, making initial costs manageable. |

Each of these tools can be powerful, but the right one depends on your personal financial picture and long-term plans.

Choosing the right assistance is one piece of the puzzle; pairing it with the right home loan is the other. For a deeper dive, check out our guide covering first-time buyer mortgage options to see all your financing choices.

Maryland-Specific Programs to Watch For

Here in Maryland, the Maryland Mortgage Program (MMP) is the go-to resource. It's a fantastic state-level program, and both of my trusted lender partners are absolute pros at navigating it. They can help you tap into assistance that usually comes in the form of forgivable or deferred payment loans.

But it gets even better.

My lender partner for the Trimble Meadows community has an exclusive loan program that’s a total game-changer. It's not just for first-timers, either—as long as you don't currently own a home or have your name on a deed or title, you're eligible.

So, what’s the deal? It’s a 100% conventional financing loan with no PMI (Private Mortgage Insurance). On top of that, the lender throws in an extra $12,000 to permanently buy down your interest rate below the going market rate.

You won't find this offer with any other home builders in the area. It’s available for new townhomes and single-family homes in our communities in White Marsh, Edgewood, and throughout Baltimore and Harford counties.

Combine this exclusive loan with our builder incentives for closing costs, and it’s genuinely possible to move into a brand-new home for $0 out of pocket. It’s the kind of opportunity that makes homeownership a reality much faster and more affordably than most people think is possible.

Maryland-Specific Programs You Should Know About

Alright, now that we've covered the basics, let's talk about what's available right here in our own backyard. Maryland has some seriously impressive programs that can give you a real edge, making it much easier to plant your roots in a great community like White Marsh or Edgewood.

The biggest name in the game is the Maryland Mortgage Program (MMP). This is the program you absolutely need to know about. It’s the state’s go-to for helping folks get into a home, and both of my lender partners are experts at navigating it for their clients.

The Power of the Maryland Mortgage Program

Think of the MMP less as a single loan and more like a whole toolkit. It's a suite of loan products that can be paired with down payment and closing cost assistance. This help often comes as a deferred, zero-interest loan—which is just as good as it sounds.

You don't make any monthly payments on it. You typically only pay it back when you sell the house or refinance your mortgage years down the road.

So, if you're looking at a home in Baltimore County or Harford County, the MMP could hand you thousands of dollars to cover those big upfront costs. That means you get to keep more of your own money for furniture, moving expenses, or just a healthy emergency fund. It’s a huge relief.

My trusted lenders are both approved to offer the Maryland Mortgage Program, and they’ll walk you through every single step. They make sure you get every penny of assistance you qualify for.

For a broader look at what’s out there, you can also explore other free grants in Maryland for individuals, including those for housing.

An Exclusive Loan That No Other Builder Can Offer

While the MMP is an incredible resource for many Marylanders, I've worked to connect my clients with something truly special. For my Trimble Meadows community, my lender partner offers a proprietary loan program that is an absolute game-changer.

This isn’t just another mortgage. It’s a 100% conventional financing loan with no PMI (Private Mortgage Insurance). Getting rid of PMI can save you a significant chunk of money on your monthly payment, every single month.

But that’s not all.

The lender also provides an additional $12,000 to permanently buy down your interest rate. This locks you into a rate that’s lower than what the market is offering, potentially saving you tens of thousands over the life of your loan.

This program is incredibly flexible, too. It’s open to both first-time buyers and people who have owned a home before. The only real catch is that you can’t currently own another property or have your name on a deed. You can use this loan to buy a brand-new townhome or single-family home in one of my communities.

The potential here is massive. When you combine this powerful loan with my current builder incentives (which can be put toward your closing costs), it’s possible to move into your new home for $0.

In a market where every dollar counts, this kind of program is a powerful tool. In fact, first-time home buyer grants are projected to help up to 1.6 million renters become homeowners in 2026 as the market shifts.

These Maryland-specific programs, especially this exclusive financing option, show how having the right connections can make the dream of owning a beautiful, customized home a very real and affordable possibility.

An Exclusive Loan Program That Changes Everything

While state programs like the Maryland Mortgage Program offer some fantastic support, I've worked hard to give my clients an advantage you just won't find anywhere else. Through a special partnership, the lender for our Trimble Meadows community provides an exclusive loan program that is an absolute game-changer for anyone looking to buy a new home. This isn't just another mortgage; it's a powerful financial tool designed to make homeownership dramatically more affordable.

Imagine getting approved for 100% conventional financing. That means you don't have to spend years scraping together a down payment. Right out of the gate, one of the biggest hurdles to buying a home is completely gone.

On top of that, this program comes with zero Private Mortgage Insurance (PMI). Normally, if you put down less than 20%, you’re stuck paying this extra monthly fee. Getting rid of PMI can save you a ton on your monthly payment, freeing up your budget for everything else life throws at you.

More Than Just No Down Payment

This is where this exclusive offer really starts to shine. The program also includes an additional $12,000 that comes directly from the lender. And no, this isn't a loan you have to pay back. These are funds used specifically to permanently buy down your interest rate.

This "rate buydown" locks you into a mortgage rate that's lower than what the market is offering—for the entire life of your loan. We're talking about a benefit that can save you tens of thousands of dollars over 30 years, paying you back month after month, year after year.

This exclusive loan program is not available through other home builders in the area. It is a unique opportunity we've secured for our clients, whether you're interested in a stylish townhome or a spacious single-family home.

Who Qualifies for This Amazing Opportunity?

One of the best things about this program is how flexible it is. It isn't limited to just first-time homebuyers. You can qualify even if you’ve owned a home before.

The main requirement is simple: you cannot currently own a home or have your name on a deed or title when you purchase. So, if you've been renting for a while after selling your last place, you’re a perfect candidate. This opens the door for so many buyers who might think they're shut out of special financing deals.

This program is really for anyone who is ready to own their next home now but wants a clear path forward without the usual financial roadblocks.

The Path to a $0 Move-In

Okay, let's put all the pieces together and see just how incredible this opportunity is. When we combine my builder incentives with this unique loan, you can create a truly powerful financial package.

Here’s the breakdown:

You get 100% financing, so you don't need a down payment.

The $12,000 from the lender buys down your interest rate, making your monthly payment lower.

You can then use my builder incentives to cover all of your closing costs.

When you stack these benefits, the result is stunning. You can move into a brand-new, customized home in a wonderful Maryland community like White Marsh or Edgewood for literally $0 out of pocket. It sounds almost too good to be true, I know. But it's a real strategy we use all the time to help our clients achieve their homeownership dreams. Let’s connect, and I can show you exactly how the numbers would work for you.

A Step-by-Step Guide to the Application Process

Looking at the application for a first-time home buyer grant can feel like you're staring at a mountain of paperwork. But really, it’s just a series of small, manageable steps. Once you break it down, the whole journey feels a lot less intimidating and way more exciting. Let's walk through it together.

Before you do anything else, you need to get pre-approved for a mortgage. This step is an absolute must. A pre-approval letter from a lender who knows the ins and outs of these programs (like my trusted partners) is your golden ticket—it tells you exactly what you can afford and signals to sellers that you mean business. If you're new to this, check out our simple guide on how to get pre-approved for a mortgage in Maryland.

Laying the Groundwork for Success

The secret to a stress-free application? Preparation. Getting your financial house in order before you even start filling out forms will make the entire process a breeze. Lenders need to see the full picture of your income, assets, and financial history.

So, grab a folder (digital or physical) and start collecting these key documents:

Proof of Income: Your most recent pay stubs, usually covering the last 30 days.

Tax Returns: The last two years of your federal tax returns, every single page.

Bank Statements: At least two or three months' worth of statements for any checking and savings accounts you have.

Identification: A clear copy of your driver’s license or another valid government-issued ID.

Having all this ready upfront will seriously speed things up and show your lender you're on top of your game.

Completing Key Requirements

Most grant programs, especially big ones like the Maryland Mortgage Program, have a couple of standard hoops you'll need to jump through. One of the most common is a homebuyer education course. Don't roll your eyes at this one! Think of it less as a chore and more as a crash course in homeownership that will genuinely help you. You'll learn everything from budgeting for repairs to understanding your mortgage.

These courses are designed to set you up for long-term success as a homeowner, ensuring you feel confident and prepared for the responsibilities ahead. Completing one is often a prerequisite for receiving grant funds.

The world of buyer assistance is always changing for the better. Down payment grants have become an absolute game-changer, with many programs allowing you to "stack" different types of aid to make your home purchase even more affordable. By late 2025, there were over 2,600 programs across the country, offering an average benefit of $18,000—a huge help for meeting that median down payment. Here in Maryland, that extra cash can be the difference-maker, freeing up funds to customize your new home’s finishes just the way you want.

After you've got your pre-approval and initial paperwork sorted, the real work of finding a home begins. This is where a comprehensive real estate due diligence checklist comes in handy to make sure you're not missing anything important.

And a final word of advice: once you're in the application process, hit the pause button on any big life changes. Don't go finance a new car, open a bunch of credit cards, or switch jobs. Any sudden financial shift can throw a wrench in your loan approval right at the finish line.

Your Dream Home Is Closer Than You Think

So, we've covered how first time home buyer grants and smart financing can seriously cut your upfront costs. That’s the practical stuff. Now, let’s get to the really exciting part—creating a home that feels like it was made just for you.

Imagine walking through your front door into a space that’s all you. You picked the rich hardwood floors for the living room. You chose the sleek quartz countertops that make your kitchen pop. You even selected the exact tile that gives your master bathroom that spa-like vibe. This isn't just some far-off dream; it's the experience I'm committed to bringing to life for every single client I work with.

See Your Vision Before We Build

One of the toughest parts of buying a new home is trying to visualize how all your choices will look together. A swatch of flooring and a cabinet sample can only tell you so much, right? That’s where I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life.

These tools let you play around and mix and match different options for:

Flooring: See how that light oak or dark walnut looks across your actual floor plan.

Cabinets: Instantly compare classic white shaker cabinets against modern, moody wood finishes.

Countertops: Drag and drop different granite and quartz patterns to see what pairs best with your cabinet choice.

Tile: Design the perfect kitchen backsplash or create the shower wall you’ve been pinning for years.

This whole process takes the anxiety and guesswork out of the equation. Instead of just hoping it all works out, you can be confident that the final result is exactly what you wanted. It turns what could be a stressful series of decisions into a genuinely fun and creative collaboration.

I’ve been doing this for 28 years, and I use that experience to guide you through every selection. My job is to make the journey smooth and exciting, from our very first chat to the day you get your keys. I’m here to combine these powerful financial tools with a truly personal home-buying experience.

Let's Make It Happen

The path to owning a brand-new, customized home in Maryland is a lot clearer and more affordable than most people realize. When you pair the right state programs with exclusive financing and a hands-on building process, your ideal home is suddenly well within reach.

I can help you explore beautiful new communities in White Marsh, Edgewood, and all across Baltimore County and Harford County. Let's sit down, look at your options, and start playing with these visual tools to design your future home together.

Ready to take that next step? Schedule a consultation with me today, and let's start turning your vision into a reality.

Frequently Asked Questions About Home Buyer Grants

Let's be honest, figuring out home buyer grants can feel like you're trying to solve a puzzle. It's totally normal to have questions. To clear things up and help you feel more confident, I've put together some straightforward answers to the questions I hear all the time from buyers right here in Maryland.

Do I Have to Be a 'First-Time' Buyer to Qualify?

This is probably the biggest myth out there, and the answer is a refreshing "no!" for many people.

Most programs, including the awesome Maryland Mortgage Program, have a pretty flexible definition of a "first-time home buyer." They often consider you one as long as you haven't owned your primary residence in the last three years.

Even better, our exclusive 100% financing loan program is open to repeat buyers, too. The only real catch is that you can’t own another property or have your name on a deed or title when you close on your new home. So, if you sold your last house a few years back and have been renting since, you're likely good to go.

Can I Combine a Grant with Other Incentives?

Yes, you absolutely can, and this is where the magic really happens. We call this "stacking," and it’s the secret to maximizing your savings. It’s totally possible to pair a state grant from the Maryland Mortgage Program with a builder incentive that helps cover your closing costs.

For example, when you work with our exclusive lender partner at Trimble Meadows, you can combine our builder incentives with his $12,000 rate buydown and 100% financing loan. This powerful combo is exactly how many of our buyers get the keys to their new home with literally $0 out of pocket. We'll sit down and figure out the best combination for you.

What Are the Typical Income and Credit Score Requirements?

The rules really change depending on the specific program. Most grants have income limits that are tied to your household size and the county you’re buying in, like Baltimore County or Harford County. This just ensures the funds are going to the people who need them most.

When it comes to credit, a solid score will definitely open up more options. While some government-backed loans have wiggle room, most grant programs and conventional loans are looking for a score of 640 or higher. Not sure where you land? Don't sweat it. Our lender partners are experts at looking at the whole picture and can give you clear guidance. You can also dive deeper into what credit score is needed for a mortgage in Maryland in our guide.

Can I Use Grant Money on a New Construction Home?

Yes! This is a fantastic strategy for making a brand-new, customized home feel much more attainable. The vast majority of first-time home buyer grants and assistance programs can be applied to new construction homes, including the beautiful, customizable townhomes and single-family homes we build.

You don't have to pick between getting financial help and getting the home you've been dreaming of. You can have both: a grant to ease the financial burden and a modern, beautiful home where you got to pick the finishes that fit your style.

While the builder I represent provides high-quality homes, I go a step further—offering my clients unique proprietary visualization tools, hands-on service, and access to visualizers that help you bring your dream space to life. Ready to see what’s possible in White Marsh, Edgewood, or other fantastic Maryland communities? Let’s talk. Visit https://www.customizeyourhome.com to schedule a consultation today.

Comments